ABL 901C SC Department of Revenue 2023

What is the ABL 901C SC Department of Revenue?

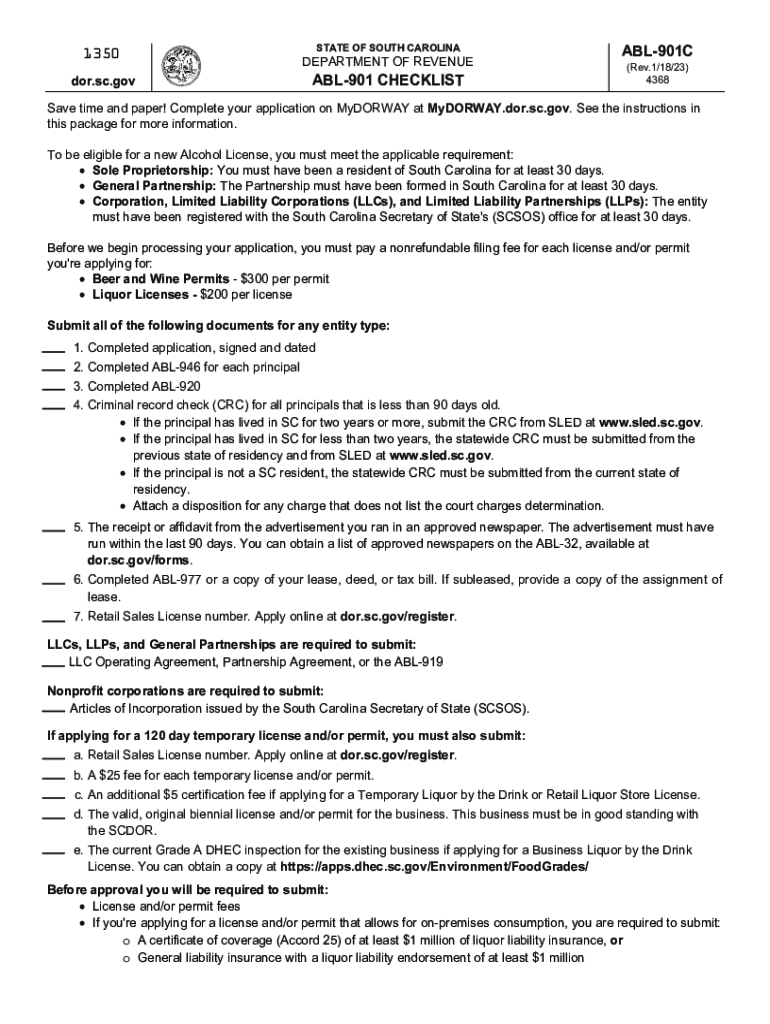

The ABL 901C is a form used by the South Carolina Department of Revenue for the application and renewal of an Alcoholic Beverage License. This license is essential for businesses involved in the sale of alcoholic beverages, ensuring compliance with state regulations. The ABL 901C form collects necessary information about the applicant, including business details and ownership structure, to assess eligibility for the license.

Steps to Complete the ABL 901C SC Department of Revenue

Completing the ABL 901C form involves several key steps:

- Gather required information about your business, including its name, address, and ownership details.

- Provide personal information for all owners and partners, including Social Security numbers and addresses.

- Detail the type of alcoholic beverages you intend to sell and the specific license type you are applying for.

- Review the form for accuracy and completeness before submission.

Legal Use of the ABL 901C SC Department of Revenue

The ABL 901C form is legally binding and must be filled out truthfully. Misrepresentation or failure to disclose relevant information can lead to penalties, including denial of the application or revocation of the license. It is crucial to understand the legal implications of the information provided on the form, as it serves as a formal request for permission to operate within the alcoholic beverage industry in South Carolina.

Required Documents for the ABL 901C SC Department of Revenue

When submitting the ABL 901C form, you must include several supporting documents:

- Proof of identity for all owners, such as a driver’s license or passport.

- Business formation documents, like articles of incorporation or partnership agreements.

- Background checks for all owners, which may include criminal history reports.

- Any additional documentation required by the South Carolina Department of Revenue.

Eligibility Criteria for the ABL 901C SC Department of Revenue

To qualify for an Alcoholic Beverage License through the ABL 901C form, applicants must meet specific eligibility criteria:

- Applicants must be at least twenty-one years old.

- All owners must have a clean criminal record, particularly concerning alcohol-related offenses.

- Businesses must comply with zoning laws and regulations in their locality.

- Applicants must demonstrate financial stability and the ability to operate a business legally.

Form Submission Methods for the ABL 901C SC Department of Revenue

The ABL 901C can be submitted through various methods:

- Online submission via the South Carolina Department of Revenue's official website.

- Mailing the completed form along with required documents to the designated address.

- In-person submission at a local Department of Revenue office for immediate processing.

Quick guide on how to complete abl 901c sc department of revenue

Prepare ABL 901C SC Department Of Revenue seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage ABL 901C SC Department Of Revenue on any platform with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to edit and eSign ABL 901C SC Department Of Revenue effortlessly

- Locate ABL 901C SC Department Of Revenue and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Edit and eSign ABL 901C SC Department Of Revenue to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct abl 901c sc department of revenue

Create this form in 5 minutes!

How to create an eSignature for the abl 901c sc department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is abl 901?

Abl 901 is a powerful digital signing solution offered by airSlate SignNow. It provides users with a seamless way to electronically sign documents, ensuring compliance and security. With abl 901, businesses can streamline their signing processes and reduce turnaround time.

-

How does abl 901 enhance document workflow?

Abl 901 enhances document workflow by enabling users to send, sign, and manage documents efficiently. It offers real-time tracking and notifications, allowing teams to stay updated on document status. This improves collaboration and ensures that no critical steps are overlooked.

-

What are the pricing options for abl 901?

AirSlate SignNow offers competitive pricing plans for abl 901, catering to various business needs. Pricing typically starts with a basic plan suitable for small teams and scales up to more comprehensive solutions for larger organizations. It's best to check the website for the most current pricing details.

-

What features does abl 901 include?

Abl 901 includes a range of features such as template creation, automated workflows, and secure storage. Additionally, it supports multiple document formats and provides options for customized branding. These features help businesses create a professional and efficient signing experience.

-

How does abl 901 ensure document security?

Abl 901 ensures document security through advanced encryption and authentication mechanisms. It complies with industry standards for electronic signatures, providing an audit trail for all transactions. This guarantees that your documents are safe and legally binding.

-

Can abl 901 integrate with other tools?

Yes, abl 901 integrates seamlessly with various business tools and applications, enhancing workflow efficiency. Popular integrations include CRM systems, cloud storage services, and other productivity software. This flexibility allows businesses to leverage their existing tools alongside abl 901.

-

What are the benefits of using abl 901 for eSigning?

Using abl 901 for eSigning offers numerous benefits, including time savings and improved accuracy. It eliminates the need for printing, scanning, and mailing physical documents. This results in faster processing times and helps businesses reduce operational costs.

Get more for ABL 901C SC Department Of Revenue

Find out other ABL 901C SC Department Of Revenue

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors