MO MO 1040A Form 2022

What is the Missouri MO 1040A Form

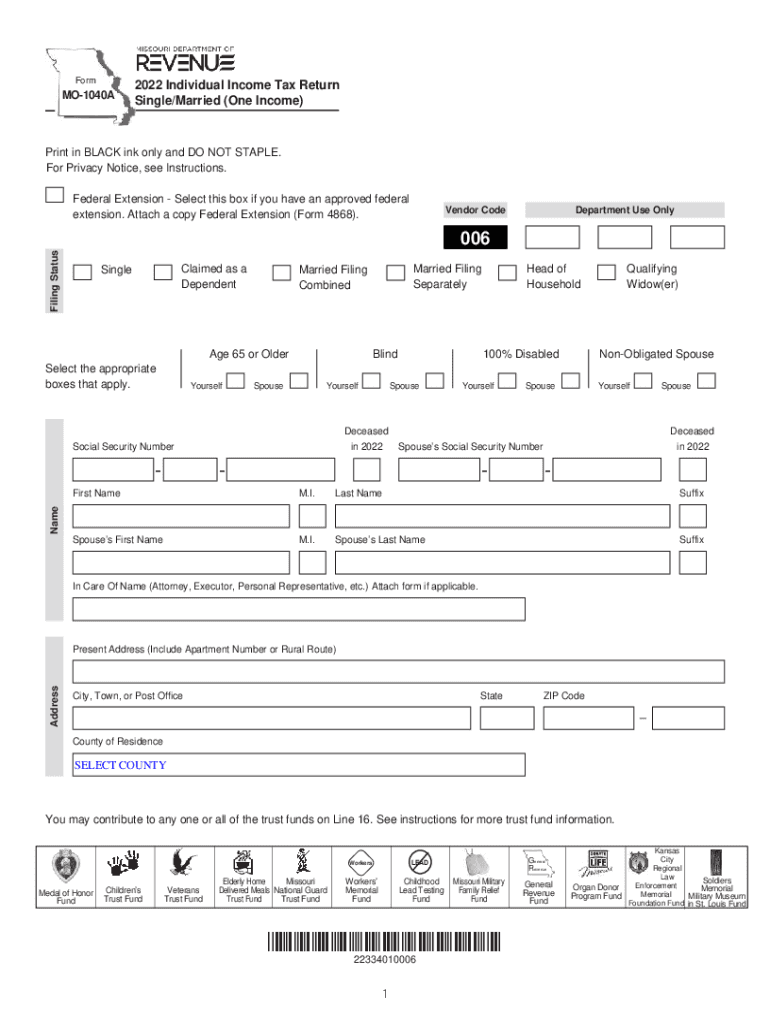

The Missouri MO 1040A Form is a state income tax return specifically designed for individual taxpayers in Missouri. This form allows residents to report their income, calculate their tax liability, and claim any applicable credits or deductions. The MO 1040A is tailored for single filers, making it easier for individuals with straightforward tax situations to complete their returns efficiently. It is essential for ensuring compliance with state tax laws and for receiving any potential refunds owed to the taxpayer.

How to use the Missouri MO 1040A Form

To effectively use the Missouri MO 1040A Form, taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Once the relevant information is collected, individuals can fill out the form by entering their personal details, income amounts, and any deductions or credits they qualify for. It is crucial to follow the instructions provided with the form to ensure accurate completion. After filling out the form, taxpayers can submit it electronically or via mail, depending on their preference.

Steps to complete the Missouri MO 1040A Form

Completing the Missouri MO 1040A Form involves several key steps:

- Gather all relevant income documents, such as W-2 forms and 1099s.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring all figures match your documents.

- Claim any deductions or credits applicable to your situation, such as standard deductions or tax credits.

- Review the completed form for accuracy and ensure all sections are filled out correctly.

- Submit the form electronically through a secure platform or mail it to the appropriate state tax office.

Legal use of the Missouri MO 1040A Form

The Missouri MO 1040A Form is legally binding once it has been signed and submitted. To ensure the form is recognized as valid, it must be completed in accordance with Missouri state tax laws. This includes providing accurate information and adhering to filing deadlines. Using a reliable electronic signature solution can enhance the legal validity of the submission by providing a secure method for signing the document, thereby ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Taxpayers should be aware of critical deadlines associated with the Missouri MO 1040A Form. Typically, the filing deadline aligns with the federal tax deadline, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be mindful of any extensions they may file for, which can provide additional time to submit their returns. Staying informed about these dates is essential to avoid penalties and ensure timely processing of refunds.

Required Documents

To complete the Missouri MO 1040A Form, several documents are necessary. Taxpayers should have the following on hand:

- W-2 forms from employers to report wages.

- 1099 forms for any freelance or contract work.

- Documentation for any other sources of income, such as interest or dividends.

- Records of deductible expenses, such as medical expenses or charitable contributions.

- Any previous tax returns for reference.

Form Submission Methods

The Missouri MO 1040A Form can be submitted through various methods. Taxpayers have the option to file electronically using secure online platforms, which often provide immediate confirmation of receipt. Alternatively, individuals may choose to print the completed form and mail it to the appropriate state tax office. In-person submissions may also be possible at designated tax offices, allowing for direct interaction with tax professionals if needed.

Quick guide on how to complete mo mo 1040a form 627248215

Effortlessly Prepare MO MO 1040A Form on Any Device

Digital document management has gained signNow traction among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without complications. Manage MO MO 1040A Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest method to edit and eSign MO MO 1040A Form with ease

- Find MO MO 1040A Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or obscure sensitive information using the specific tools that airSlate SignNow provides for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate concerns about lost or mislocated files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign MO MO 1040A Form while guaranteeing exceptional communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo mo 1040a form 627248215

Create this form in 5 minutes!

How to create an eSignature for the mo mo 1040a form 627248215

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri MO 1040A single form fillable?

The Missouri MO 1040A single form fillable is a convenient online form designed for residents to report their state income taxes efficiently. This fillable form allows taxpayers to easily enter their information and submit it electronically, ensuring a smooth filing experience.

-

How do I fill out the Missouri MO 1040A single form fillable?

Filling out the Missouri MO 1040A single form fillable involves accessing the form through our platform and entering your personal, income, and deduction information. The easy interface guides you through each step, ensuring you complete the form accurately and efficiently.

-

Is there a cost associated with using the Missouri MO 1040A single form fillable?

Using the Missouri MO 1040A single form fillable is cost-effective and designed to save users time and money. While basic form access is free, additional features may incur a small fee, ensuring you only pay for the options you need.

-

What features does the Missouri MO 1040A single form fillable offer?

The Missouri MO 1040A single form fillable offers features such as automatic calculations, error-checking, and electronic submission capabilities. These features enhance the user experience and ensure that you file correctly and on time.

-

Why should I choose the Missouri MO 1040A single form fillable over paper forms?

Choosing the Missouri MO 1040A single form fillable over traditional paper forms provides numerous benefits like convenience, speed, and reducing the risk of errors. With real-time verification and electronic filing, you can ensure your tax return is accurate and submitted without delays.

-

Can the Missouri MO 1040A single form fillable be integrated with other software?

Yes, the Missouri MO 1040A single form fillable can be seamlessly integrated with various tax preparation and accounting software. This integration allows for easy data transfer and helps streamline your overall tax filing process.

-

How secure is the Missouri MO 1040A single form fillable?

The Missouri MO 1040A single form fillable is built with robust security measures to protect your personal information. Our platform employs encryption technology to ensure that your data is safe during transmission and storage.

Get more for MO MO 1040A Form

- Nfpa 130 pdf download form

- 20 rs bond paper pdf download form

- Alamance county concealed carry permit form

- Cat pedigree certificate template form

- Exhibit cover sheet template form

- Air assault packing list form

- Bulletin no 2643 15 los angeles unified school district form

- Rtl application login north carolina medical board form

Find out other MO MO 1040A Form

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free