OH Form IR Mason 2022

What is the OH Form IR Mason

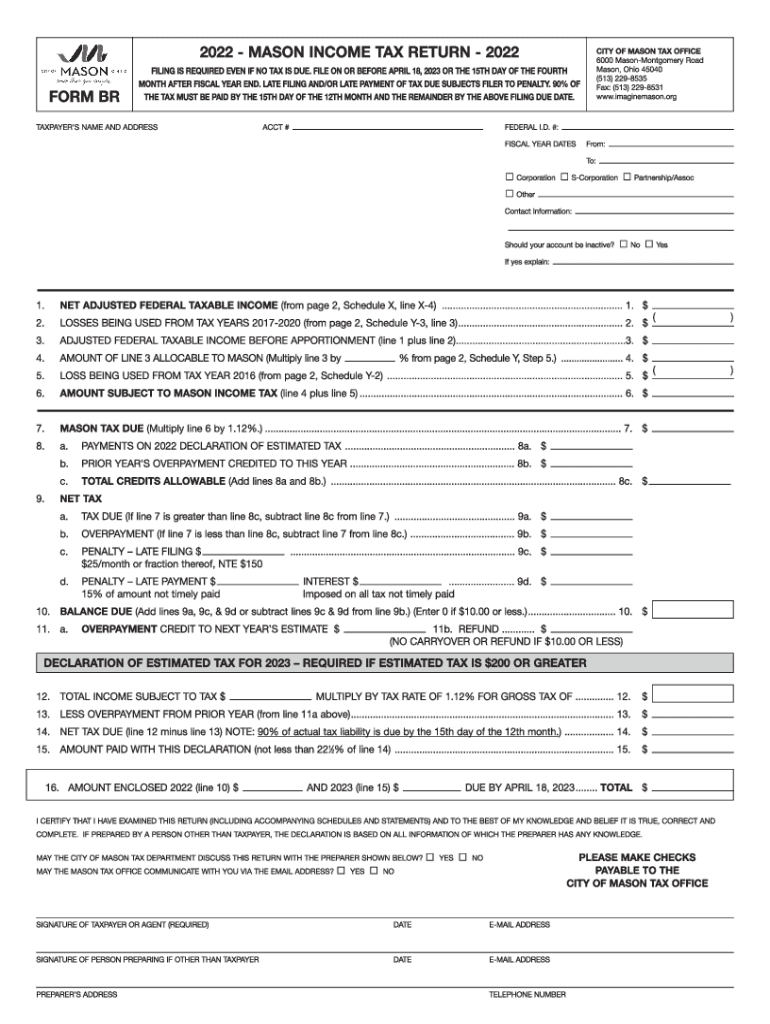

The OH Form IR Mason is a tax form specifically designed for residents of Mason, Ohio, to report their income for tax purposes. This form is essential for individuals and businesses to accurately declare their earnings and calculate their tax liabilities. It is part of the local income tax system and must be filed annually to ensure compliance with city regulations.

How to use the OH Form IR Mason

Using the OH Form IR Mason involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, accurately fill out the form, ensuring that all income sources are reported. After completing the form, review it for accuracy before submitting it to the appropriate city tax authority. Utilizing electronic tools can streamline this process and enhance accuracy.

Steps to complete the OH Form IR Mason

Completing the OH Form IR Mason requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant income documents, such as W-2 forms and 1099 statements.

- Enter your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring accuracy in your calculations.

- Deduct any applicable credits or adjustments to determine your taxable income.

- Calculate the total tax owed based on the city's tax rates.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Filing deadlines for the OH Form IR Mason are crucial for compliance. Typically, the form must be submitted by April 15 of each year for the previous tax year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Staying informed about these dates helps avoid penalties and ensures timely processing of your tax return.

Required Documents

To complete the OH Form IR Mason, several documents are necessary. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Previous year's tax return for reference

Having these documents on hand will facilitate a smoother filing process and help ensure accuracy.

Penalties for Non-Compliance

Failing to file the OH Form IR Mason by the deadline can result in significant penalties. Common consequences include late fees, interest on unpaid taxes, and potential legal action. It is essential to file on time and ensure all information is accurate to avoid these repercussions. Understanding the importance of compliance can help taxpayers maintain good standing with local tax authorities.

Quick guide on how to complete oh form ir mason 627571675

Complete OH Form IR Mason seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle OH Form IR Mason on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related processes today.

How to alter and electronically sign OH Form IR Mason with ease

- Find OH Form IR Mason and then click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to confirm your changes.

- Select how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device of your choosing. Alter and electronically sign OH Form IR Mason to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oh form ir mason 627571675

Create this form in 5 minutes!

How to create an eSignature for the oh form ir mason 627571675

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mason income and how does it relate to airSlate SignNow?

Mason income refers to the steady revenue generated by businesses using efficient tools like airSlate SignNow. By streamlining document workflows and eSigning processes, companies can enhance their productivity and ultimately increase their mason income.

-

How does airSlate SignNow help improve mason income?

airSlate SignNow helps businesses improve mason income by automating document management and reducing turnaround times. This efficiency allows users to close deals faster and devote more time to revenue-generating activities.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans to cater to different business needs, ensuring a cost-effective solution for improving mason income. Plans vary based on features and the number of users, allowing businesses to choose the best fit for their budget.

-

What features does airSlate SignNow provide to boost mason income?

Key features of airSlate SignNow include customizable templates, real-time tracking, and advanced security options. By utilizing these features, businesses can optimize their document signing processes, leading to increased efficiency and higher mason income.

-

Can airSlate SignNow integrate with other software to enhance mason income?

Yes, airSlate SignNow offers seamless integrations with popular business applications such as CRM systems and productivity tools. These integrations enhance collaboration and workflow, ultimately leading to improved operations and increased mason income.

-

Is airSlate SignNow secure enough to handle sensitive documents affecting mason income?

Absolutely, airSlate SignNow complies with strict security standards, ensuring that sensitive documents are protected. This level of security instills confidence in users, allowing them to focus on enhancing their mason income without worry.

-

What are the benefits of using airSlate SignNow for my business?

By using airSlate SignNow, businesses enjoy faster document processing, easier collaboration, and enhanced customer satisfaction. These benefits contribute directly to driving up mason income and improving overall business performance.

Get more for OH Form IR Mason

- Petition to contest a cdl office of the ilsosgov form

- Adult application coastal carolina council form

- Hearing request to contest delinquent child support payment suspension court order form

- Parenting plan 0218 form

- Carruth compliance consulting home page form

- Statistical abstract of north carolina taxes 2010 form

- Provisional permit application forms office of the professions

- Consent agreement restraining order ohio form

Find out other OH Form IR Mason

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online