Ohio Mason Return Form 2016

What is the Ohio Mason Return Form

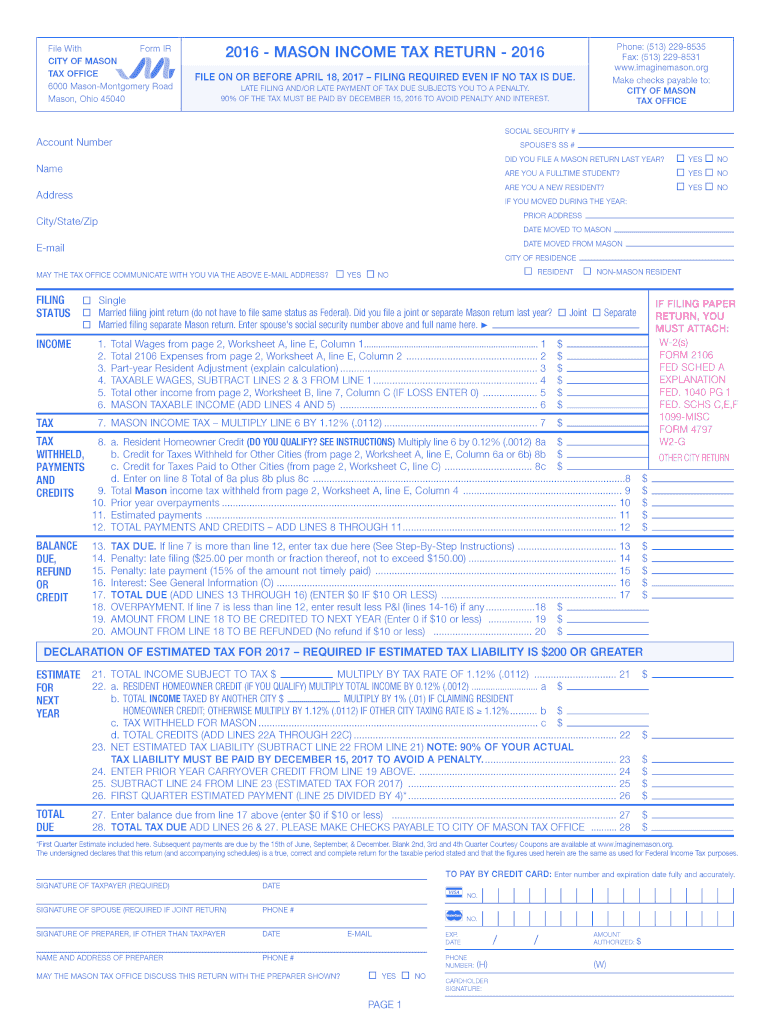

The Ohio Mason Return Form is a tax document specifically designed for individuals and businesses operating as masonry contractors in Ohio. This form is essential for reporting income and expenses related to masonry work. It ensures compliance with state tax regulations and helps in accurately calculating the tax owed. The form captures vital information, including gross receipts, deductions, and any applicable credits, making it a critical component of the tax filing process for masonry professionals.

How to use the Ohio Mason Return Form

Using the Ohio Mason Return Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial records, including income statements and expense receipts. Next, download or access the form online. Fill in the required fields with accurate data, ensuring all calculations are correct. After completing the form, review it for any errors before signing. Finally, submit the form electronically or by mail, depending on your preference and the guidelines provided by the Ohio Department of Taxation.

Steps to complete the Ohio Mason Return Form

Completing the Ohio Mason Return Form requires attention to detail. Follow these steps:

- Collect all relevant financial documents, such as income statements and expense reports.

- Access the Ohio Mason Return Form from a reliable source.

- Fill in your personal and business information accurately in the designated fields.

- Report your gross receipts from masonry work.

- List any deductions you are eligible for, such as business expenses.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Ohio Mason Return Form

The Ohio Mason Return Form serves as a legally binding document when submitted to the state tax authority. It is essential that the information provided is truthful and accurate, as any discrepancies may lead to penalties or legal consequences. The form must be filled out in compliance with Ohio state tax laws, ensuring that all reported income and deductions adhere to the guidelines set forth by the Ohio Department of Taxation. Proper use of this form not only fulfills legal obligations but also supports the integrity of the tax system.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio Mason Return Form are crucial to avoid penalties. Typically, the form must be submitted by the due date for state income tax returns, which is usually April 15 for most taxpayers. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these dates, as well as any specific deadlines related to extensions or amendments.

Form Submission Methods (Online / Mail / In-Person)

The Ohio Mason Return Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically through the Ohio Department of Taxation's online portal, which offers a streamlined process.

- Mail: The completed form can be printed and mailed to the designated address provided in the filing instructions.

- In-Person: Some may choose to submit the form in person at local tax offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete ohio mason return 2016 form

Your assistance manual on how to prepare your Ohio Mason Return Form

If you’re wondering how to generate and dispatch your Ohio Mason Return Form, here are some brief instructions on how to simplify the tax filing process.

To get started, you just need to set up your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is an extremely intuitive and powerful document solution that enables you to modify, generate, and finalize your tax documents with ease. With its editor, you can alternate between text, check boxes, and eSignatures and return to amend answers as necessary. Enhance your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Ohio Mason Return Form in just minutes:

- Create your account and start working on PDFs within moments.

- Utilize our catalog to locate any IRS tax form; browse through versions and schedules.

- Press Get form to access your Ohio Mason Return Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to file your taxes electronically with airSlate SignNow. Please be aware that paper submissions can increase errors and delay refunds. Of course, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct ohio mason return 2016 form

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

What is the official website to fill out the GST return form?

https://www.gst.gov.in/

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How should I fill this contract form "Signed this... day of..., 2016"?

I agree that you need to have the document translated to your native language or read to you by an interpreter.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

Create this form in 5 minutes!

How to create an eSignature for the ohio mason return 2016 form

How to make an eSignature for the Ohio Mason Return 2016 Form online

How to make an electronic signature for your Ohio Mason Return 2016 Form in Google Chrome

How to create an eSignature for signing the Ohio Mason Return 2016 Form in Gmail

How to generate an eSignature for the Ohio Mason Return 2016 Form straight from your mobile device

How to make an electronic signature for the Ohio Mason Return 2016 Form on iOS

How to make an electronic signature for the Ohio Mason Return 2016 Form on Android devices

People also ask

-

What is the Ohio Mason Return Form and how can I use it?

The Ohio Mason Return Form is a specific document used for reporting and submitting various business-related information in Ohio. With airSlate SignNow, you can easily create, send, and eSign your Ohio Mason Return Form, streamlining your submission process and ensuring compliance.

-

How much does it cost to use airSlate SignNow for the Ohio Mason Return Form?

airSlate SignNow offers competitive pricing plans that cater to different business sizes and needs. You can choose a plan that fits your budget while efficiently managing your Ohio Mason Return Form and other documents without incurring hidden fees.

-

What features does airSlate SignNow provide for handling the Ohio Mason Return Form?

airSlate SignNow offers a range of features for managing the Ohio Mason Return Form, including customizable templates, secure eSigning, and document tracking. These features enhance your workflow and ensure your submissions are completed accurately and on time.

-

Can I integrate airSlate SignNow with other applications for processing the Ohio Mason Return Form?

Yes, airSlate SignNow supports integration with various applications, allowing you to seamlessly manage your Ohio Mason Return Form alongside other business tools. This integration helps streamline your processes and enhances collaboration across your organization.

-

How does airSlate SignNow ensure the security of my Ohio Mason Return Form?

Security is a priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your Ohio Mason Return Form and other sensitive documents, ensuring that your information remains confidential and safe from unauthorized access.

-

Is it easy to eSign the Ohio Mason Return Form using airSlate SignNow?

Absolutely! airSlate SignNow simplifies the eSigning process for your Ohio Mason Return Form. With just a few clicks, you can sign documents electronically, making it easy to manage your submissions without the hassle of printing or scanning.

-

Can I access my Ohio Mason Return Form on mobile devices?

Yes, airSlate SignNow is compatible with mobile devices, allowing you to access your Ohio Mason Return Form anytime, anywhere. This flexibility ensures you can manage your documents on the go, making it easier to stay organized and responsive.

Get more for Ohio Mason Return Form

- Fort valley printable application form 5447158

- Problem solving and computing lesson 3 answer key form

- Vehicle disclaimer form

- Computer security a hands on approach pdf form

- T77f form

- Partnership dissolution agreement form

- Pdf ncti enrollment application form

- Rtgsneft mandate authorisation form illustrative format mazagondock gov

Find out other Ohio Mason Return Form

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy