Form 592 Resident and Nonresident Withholding Statement , Form 592, Resident and Nonresident Withholding Statement 2023-2026

Understanding the Form 592 Resident And Nonresident Withholding Statement

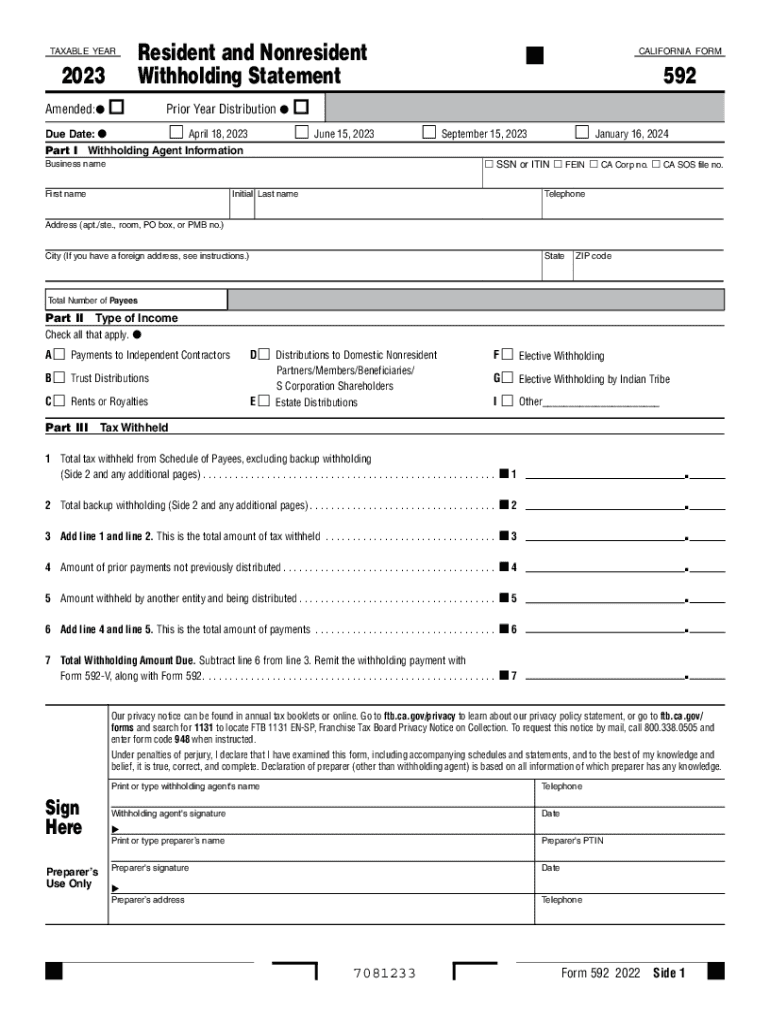

The Form 592, officially known as the Resident and Nonresident Withholding Statement, is a crucial document for those involved in real estate transactions or other business activities in California. This form is used to report and remit withholding taxes on payments made to nonresidents, ensuring compliance with California state tax regulations. The Franchise Tax Board (FTB) requires this form to accurately track tax obligations and facilitate proper tax collection from nonresident entities or individuals.

Steps to Complete the Form 592

Completing the Form 592 involves several key steps to ensure accuracy and compliance with California state tax laws. Here is a streamlined process for filling out the form:

- Gather necessary information, including the recipient's name, address, and taxpayer identification number.

- Determine the amount of payment subject to withholding and the applicable withholding rate.

- Fill out the required sections of the form, including the withholding agent's details and the payment information.

- Calculate the total withholding amount and ensure all figures are accurate.

- Sign and date the form to certify its accuracy before submission.

Legal Use of the Form 592

The Form 592 serves as a legal document that ensures compliance with California tax laws regarding withholding from nonresidents. It is essential for businesses and individuals making payments subject to withholding to use this form correctly. Failure to submit the Form 592 can result in penalties and interest for both the payer and the payee, emphasizing the importance of understanding its legal implications.

Filing Deadlines and Important Dates

Timely submission of the Form 592 is critical to avoid penalties. The form must be filed with the Franchise Tax Board by specific deadlines based on the payment date. Typically, the form is due on the 15th day of the month following the payment. For example, if a payment is made in January, the form must be submitted by February 15. It is advisable to keep track of these deadlines to ensure compliance and avoid unnecessary fines.

Obtaining the Form 592

The Form 592 can be easily obtained from the California Franchise Tax Board's official website. It is available in a downloadable PDF format, which can be filled out electronically or printed for manual completion. Additionally, many tax preparation software programs include the Form 592, allowing users to complete and file it directly through their platforms.

Key Elements of the Form 592

Understanding the key elements of the Form 592 is essential for accurate completion. The form includes sections for the withholding agent's information, the payee's details, and the payment amounts. It also requires the calculation of withholding amounts based on the applicable rates for residents and nonresidents. Each section must be filled out carefully to ensure that all necessary information is provided for proper tax compliance.

Quick guide on how to complete 2023 form 592 resident and nonresident withholding statement 2023 form 592 resident and nonresident withholding statement

Effortlessly prepare Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement on any device

The management of online documents has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement on any platform with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to modify and electronically sign Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement easily

- Locate Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement and click Get Form to begin.

- Use the tools available to complete your form.

- Highlight important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2023 form 592 resident and nonresident withholding statement 2023 form 592 resident and nonresident withholding statement

Create this form in 5 minutes!

How to create an eSignature for the 2023 form 592 resident and nonresident withholding statement 2023 form 592 resident and nonresident withholding statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California state tax and who needs to pay it?

California state tax is a tax imposed on the income earned by individuals and businesses within the state. Anyone who resides or has a business in California is required to pay state taxes. Understanding California state tax is crucial for compliance and to avoid any penalties.

-

How can airSlate SignNow help with California state tax documentation?

airSlate SignNow simplifies the process of managing documents related to California state tax. Our platform allows you to efficiently prepare, send, and eSign important tax documents, ensuring they are processed quickly and securely. This can save you time and reduce the stress associated with tax filing.

-

What are the pricing options for airSlate SignNow related to tax documentation?

airSlate SignNow offers a variety of pricing plans designed to meet different business needs, including those involved with California state tax documentation. Our plans are cost-effective, providing essential features for businesses of all sizes. You can choose the plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer that are relevant for handling California state tax forms?

airSlate SignNow includes features such as customizable templates and collaboration tools specifically designed for managing California state tax forms. Additionally, our eSignature capability ensures that all signatures are legally binding and compliant, making tax submissions seamless and secure.

-

Are there any integrations available with airSlate SignNow for California state tax solutions?

Yes, airSlate SignNow integrates with various accounting and tax software solutions to streamline the handling of California state tax. This enables users to manage their tax documents and submissions efficiently within their existing workflow. Our integrations ensure you have all the tools needed for effective tax compliance.

-

Can airSlate SignNow assist with tracking California state tax submissions?

Absolutely! airSlate SignNow provides features that allow you to track the status of your important California state tax submissions. You can receive real-time notifications and updates on document completions, ensuring you stay informed and organized throughout the tax filing process.

-

What benefits does using airSlate SignNow provide for California businesses in tax management?

Using airSlate SignNow for tax management can bring signNow benefits to California businesses, including time savings and improved accuracy. Our platform allows you to easily eSign and send tax documents, reducing the risk of errors. This efficiency helps you focus more on growing your business rather than getting bogged down in paperwork.

Get more for Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement

Find out other Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement