592 Form 2017

What is the 592 Form

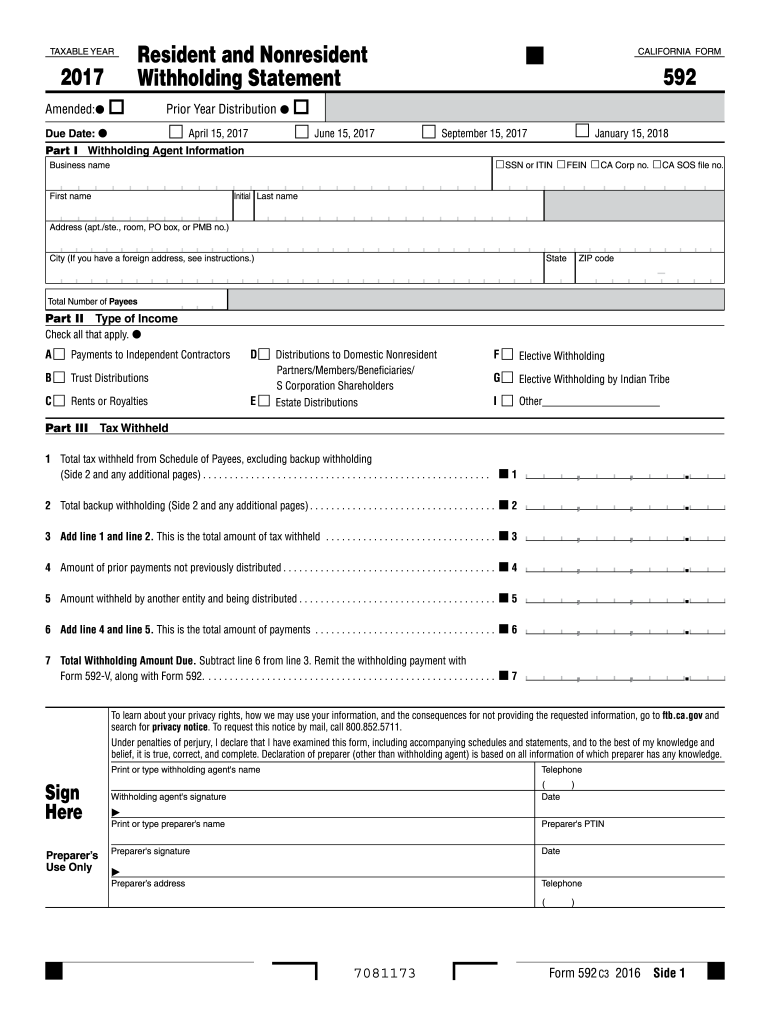

The 592 Form is a tax document used in the United States for reporting California source income paid to non-residents. It is essential for ensuring compliance with state tax laws and is required for withholding tax purposes. The form helps to report the amount of income that is subject to California withholding tax and provides necessary information to the California Franchise Tax Board.

How to use the 592 Form

To use the 592 Form, individuals or businesses must accurately fill out the required fields, which include details about the payee, the amount of income paid, and the withholding tax amount. Once completed, the form must be submitted to the California Franchise Tax Board along with any required payments. It is crucial to ensure that all information is correct to avoid penalties or issues with tax compliance.

Steps to complete the 592 Form

Completing the 592 Form involves several clear steps:

- Gather necessary information, including the payee's name, address, and taxpayer identification number.

- Determine the total amount of California source income paid to the non-resident.

- Calculate the withholding tax amount based on the income reported.

- Fill in the form accurately, ensuring all fields are completed.

- Review the form for accuracy before submission.

- Submit the form along with any required payment to the California Franchise Tax Board.

Legal use of the 592 Form

The 592 Form is legally mandated for businesses and individuals who pay California source income to non-residents. It ensures compliance with California tax laws and helps facilitate the proper withholding of taxes. Failure to use the form correctly can result in penalties, including fines and interest on unpaid taxes. Therefore, it is essential to understand the legal implications of using the 592 Form.

Filing Deadlines / Important Dates

Filing deadlines for the 592 Form are crucial for compliance. Typically, the form must be submitted by the last day of the month following the end of the quarter in which the payments were made. For example, if payments were made in the first quarter, the form would be due by April 30. It is important to stay informed about any changes to these deadlines to avoid late filing penalties.

Form Submission Methods

The 592 Form can be submitted through various methods, including online submission via the California Franchise Tax Board's website, mailing a paper copy, or delivering it in person. Online submission is often the most efficient method, allowing for quicker processing and confirmation of receipt. Regardless of the method chosen, it is essential to keep a copy of the submitted form for personal records.

Quick guide on how to complete 592 2017 form

Your assistance manual on how to prepare your 592 Form

If you’re looking to understand how to complete and submit your 592 Form, here are some straightforward recommendations to streamline tax filing.

To start, all you need to do is register for your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is a highly intuitive and robust document solution that enables you to modify, create, and finish your tax paperwork effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and revisit to amend any information as necessary. Simplify your tax management through advanced PDF editing, eSigning, and convenient sharing.

Follow the instructions below to complete your 592 Form within minutes:

- Create your account and begin working on PDFs in a matter of minutes.

- Browse our directory to locate any IRS tax form; explore various versions and schedules.

- Click Get form to access your 592 Form in our editor.

- Fill in the necessary fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and rectify any errors.

- Save your changes, print your copy, send it to your designated recipient, and download it to your device.

Make use of this guide to submit your taxes electronically using airSlate SignNow. Keep in mind that filing via paper might lead to increased return errors and delays in reimbursements. Naturally, before e-filing your taxes, consult the IRS website for filing regulations in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct 592 2017 form

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

Create this form in 5 minutes!

How to create an eSignature for the 592 2017 form

How to generate an eSignature for your 592 2017 Form online

How to create an eSignature for your 592 2017 Form in Chrome

How to create an eSignature for signing the 592 2017 Form in Gmail

How to generate an eSignature for the 592 2017 Form right from your smart phone

How to make an electronic signature for the 592 2017 Form on iOS

How to generate an electronic signature for the 592 2017 Form on Android devices

People also ask

-

What is the 592 Form and how can airSlate SignNow help with it?

The 592 Form is a document used for reporting California source income paid to non-residents. With airSlate SignNow, you can easily create, send, and eSign your 592 Form online, streamlining your tax reporting process and ensuring compliance with state regulations.

-

Is using airSlate SignNow for the 592 Form secure?

Yes, airSlate SignNow prioritizes your security. When filling out the 592 Form, all data is encrypted and securely stored, ensuring that your sensitive information remains protected against unauthorized access.

-

Can I integrate airSlate SignNow with other software for managing the 592 Form?

Absolutely! airSlate SignNow offers seamless integrations with popular software tools such as Salesforce, Google Drive, and Dropbox. This means you can easily manage your 592 Form alongside other important documents and workflows.

-

What are the pricing options for using airSlate SignNow for the 592 Form?

airSlate SignNow offers flexible pricing plans to suit different needs, starting from a free trial to affordable monthly subscriptions. This allows you to choose the best plan that enables you to efficiently manage your 592 Form and other documents.

-

Can I customize the 592 Form using airSlate SignNow?

Yes, airSlate SignNow allows you to customize the 592 Form to fit your specific requirements. You can add your branding, adjust fields, and include any necessary instructions to ensure your form meets your business needs.

-

How does airSlate SignNow simplify the signing process for the 592 Form?

airSlate SignNow simplifies the signing process for the 592 Form by allowing you to send it electronically to signers via email. Signers can easily eSign the document from any device, making it a hassle-free experience for everyone involved.

-

Can I track the status of my 592 Form with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your 592 Form. You can monitor when the document is viewed, signed, and completed, ensuring you stay updated on its progress at all times.

Get more for 592 Form

- Medical records release ivinson memorial hospital ivinsonhospital form

- Ohio public works commission five year capital improvement form

- Candidates statement of surplus elections in canada form

- Db2 gp form

- Form pppr 11 application for property order justicegovtnz justice govt

- General affidavit ministry of justice justice govt form

- Pppr form

- San pablo cd form

Find out other 592 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors