Form 592 Resident and Nonresident Withholding Statement , Form 592, Resident and Nonresident Withholding Statement 2022

Understanding Form 592: Resident and Nonresident Withholding Statement

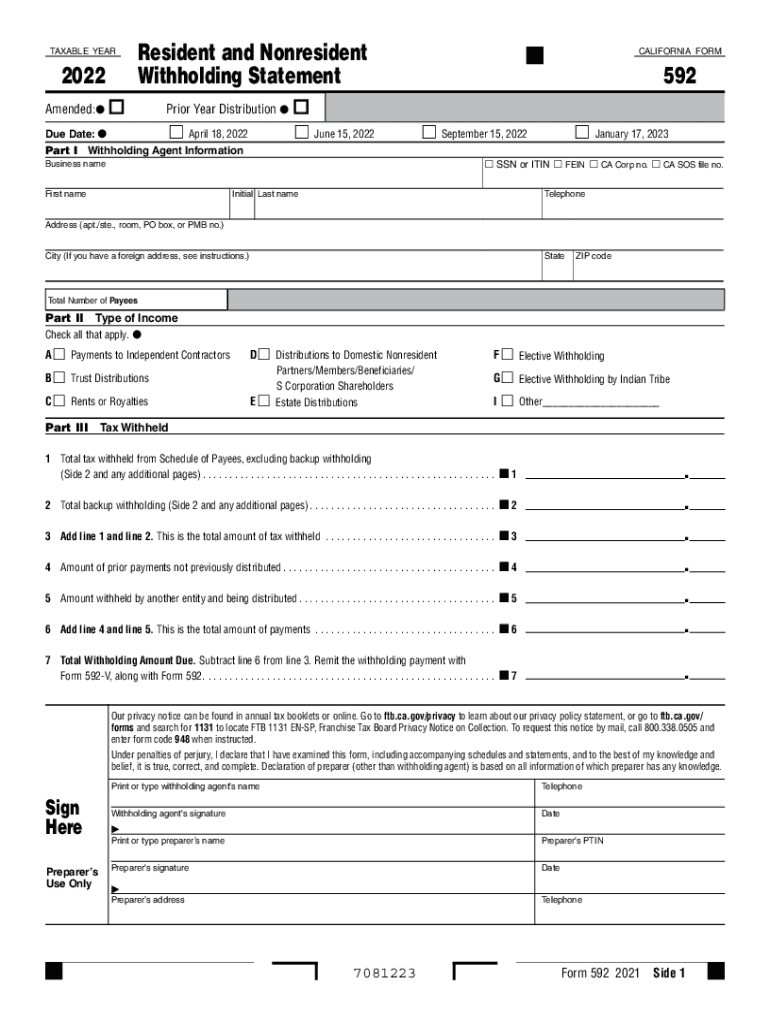

The Form 592 is a crucial document used in California for reporting withholding on income paid to nonresidents. This form is essential for ensuring compliance with state tax laws and is required by the California Franchise Tax Board. It serves as a withholding statement for both residents and nonresidents, detailing the amounts withheld from payments made to individuals or entities that do not reside in California. Understanding its purpose and requirements is vital for accurate tax reporting and to avoid potential penalties.

Steps to Complete Form 592

Completing Form 592 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, such as the recipient's name, address, and taxpayer identification number. Next, accurately report the amounts withheld from payments made during the tax year. It is important to follow the specific instructions provided on the form to avoid errors. After filling out the form, review it carefully for any discrepancies before submission. Ensure that all signatures are obtained where required to validate the document.

Obtaining Form 592

Form 592 can be obtained directly from the California Franchise Tax Board's website or through authorized tax preparation software. It is available in a printable format, allowing taxpayers to complete it manually if preferred. For those who opt for electronic filing, many tax software programs include the form within their offerings, making it easier to fill out and submit electronically. Ensuring you have the most current version of the form is essential for compliance.

Key Elements of Form 592

Form 592 includes several key elements that are crucial for accurate reporting. These elements consist of the payer's information, the recipient's details, and the total amount withheld. Additionally, the form requires specific codes that indicate the type of income being reported. Understanding these elements helps ensure that the form is filled out correctly, which is essential for both the payer and the recipient to maintain compliance with California tax laws.

Legal Use of Form 592

The legal use of Form 592 is governed by California tax regulations. It is essential for ensuring that withholding taxes are reported accurately and timely. The form must be submitted to the Franchise Tax Board, along with any required payments, to fulfill tax obligations. Failure to use this form correctly can result in penalties and interest on unpaid taxes. Therefore, understanding the legal implications of Form 592 is critical for both individuals and businesses operating in California.

Filing Deadlines for Form 592

Timely filing of Form 592 is crucial to avoid penalties. The form must be submitted by the last day of the month following the end of the quarter in which the withholding occurred. For example, if withholding occurred in the first quarter, the form is due by April 30. It is important to keep track of these deadlines to ensure compliance and avoid any unnecessary fines or interest charges. Marking these dates on a calendar can help ensure timely submission.

Quick guide on how to complete 2022 form 592 resident and nonresident withholding statement 2022 form 592 resident and nonresident withholding statement

Effortlessly prepare Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed forms, allowing you to access the right format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven workflow today.

The simplest way to modify and electronically sign Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement with ease

- Obtain Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or black out sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or downloading it to your computer.

Put an end to lost or misplaced documents, tiresome form searches, and errors that require new printed copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 592 resident and nonresident withholding statement 2022 form 592 resident and nonresident withholding statement

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 592 resident and nonresident withholding statement 2022 form 592 resident and nonresident withholding statement

The best way to make an e-signature for a PDF document online

The best way to make an e-signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

How to make an e-signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is Form 592 and why do I need it?

Form 592 is a California tax form used to report income paid to non-residents. If your business engages with non-residents, completing Form 592 is essential to ensure compliance with state tax regulations. Using airSlate SignNow simplifies the eSigning and submission process for Form 592, making it efficient for businesses to manage their filing obligations.

-

How does airSlate SignNow help with completing Form 592?

airSlate SignNow provides user-friendly tools that allow you to fill out Form 592 electronically. The platform features templates and guided workflow processes that ensure all necessary fields are completed accurately. This can signNowly reduce errors and save time compared to traditional paper methods.

-

Is there a cost associated with using airSlate SignNow to manage Form 592?

Yes, airSlate SignNow offers various pricing plans that cater to different user needs. These plans are designed to be affordable while providing robust features to manage Form 592 and other documents. With competitive pricing, businesses can efficiently handle their eSigning needs without breaking the bank.

-

Can I integrate airSlate SignNow with other software for processing Form 592?

Absolutely! airSlate SignNow integrates seamlessly with many popular applications and platforms such as Google Drive, Dropbox, and CRM systems. This allows for easy access to Form 592 and other necessary documents, streamlining your workflow and enhancing productivity.

-

What are the benefits of using airSlate SignNow for Form 592?

Using airSlate SignNow for Form 592 offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security for sensitive information. Additionally, the platform enables easy tracking of document statuses and provides audit trails, giving you peace of mind during tax season. Overall, it makes the filing process much more manageable and organized.

-

How secure is my data when using airSlate SignNow for Form 592?

Data security is a top priority at airSlate SignNow. The platform implements advanced encryption protocols and complies with industry standards to protect your information while processing Form 592. You can trust that your sensitive data remains confidential and secure throughout the signing process.

-

Can I access Form 592 on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage Form 592 on-the-go. Whether you are using a smartphone or tablet, you can easily access, complete, and eSign your documents anytime, anywhere. This flexibility is ideal for busy professionals who need to stay productive while away from their desks.

Get more for Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement

- Letter attorney representation form

- Letter on behalf of client regarding attempt by lessee to terminate lease agreement louisiana form

- Louisiana district attorney 497308888 form

- Letter to bank advising of attorney representation and bankruptcy filing louisiana form

- Letter hearing appeal form

- Louisiana demand 497308891 form

- Opposing counsel form

- Farrell s operation manual farrell s kickboxing handbook form

Find out other Form 592 Resident And Nonresident Withholding Statement , Form 592, Resident And Nonresident Withholding Statement

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple