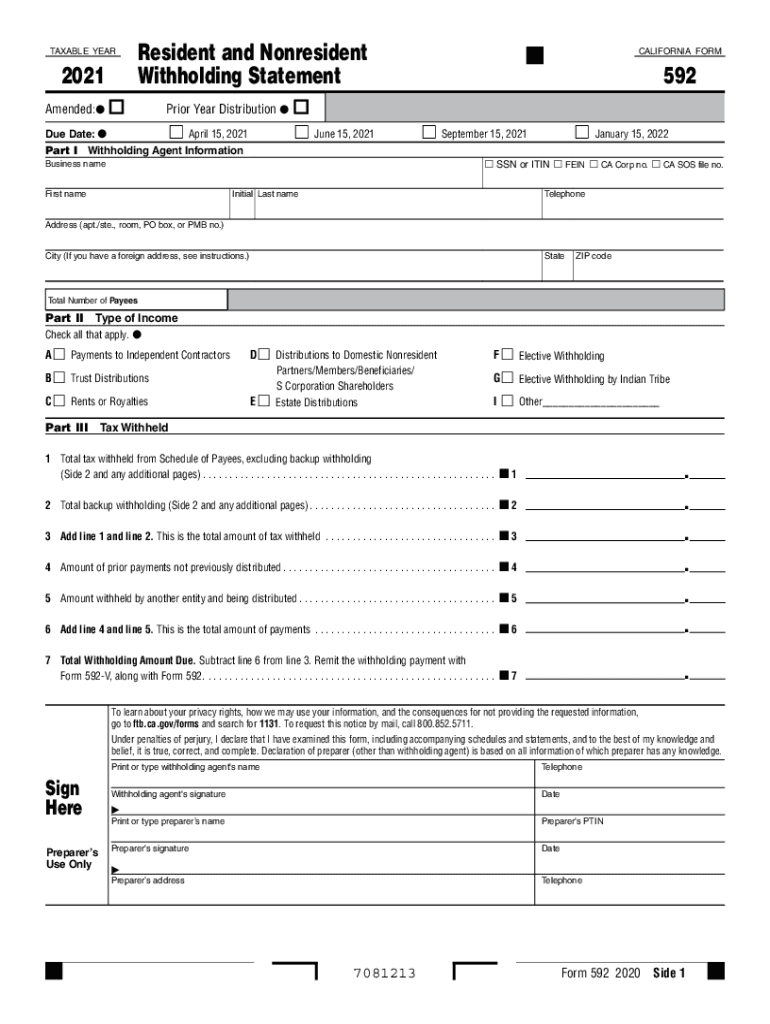

2021 Form 592 Resident and Nonresident Withholding Statement 2021, Form 592, Resident and Nonresident Withholding Statement 2021

What is the Form 592 B California?

The Form 592 B California, officially known as the Resident and Nonresident Withholding Statement, is a crucial document used by the California Franchise Tax Board. This form is primarily designed for reporting withholding tax on payments made to nonresidents and certain residents. It is essential for ensuring compliance with California tax laws, particularly for businesses and individuals who make payments that are subject to withholding. The form captures vital information regarding the payee, the amount withheld, and the nature of the payment, thereby facilitating accurate tax reporting and remittance.

Steps to Complete the Form 592 B California

Completing the Form 592 B California requires careful attention to detail. Here are the essential steps to follow:

- Gather necessary information, including the payee's name, address, and taxpayer identification number.

- Determine the type of payment being made and the corresponding withholding rate.

- Fill out the form accurately, ensuring all fields are completed, including the total amount paid and the amount withheld.

- Review the form for accuracy before submission to avoid penalties or delays.

- Submit the completed form to the California Franchise Tax Board by the designated deadline.

Key Elements of the Form 592 B California

The Form 592 B includes several key elements that are important for proper completion and compliance:

- Payee Information: This section requires the name, address, and taxpayer identification number of the payee.

- Payment Details: Specify the type of payment and the total amount paid to the payee.

- Withholding Amount: Clearly indicate the amount withheld from the payment, which is essential for tax reporting.

- Signature: The form must be signed by the person responsible for the payment, confirming the accuracy of the information provided.

Legal Use of the Form 592 B California

The legal use of the Form 592 B California is paramount for compliance with state tax regulations. It serves as a formal declaration of the withholding amounts and ensures that the California Franchise Tax Board receives accurate information regarding tax liabilities. Failure to properly complete and submit this form can result in penalties, interest, and potential audits. Therefore, understanding the legal implications and requirements of the form is essential for all parties involved in transactions that require withholding.

Filing Deadlines for the Form 592 B California

Timely filing of the Form 592 B is crucial to avoid penalties. The form must be submitted to the California Franchise Tax Board by specific deadlines, which typically align with the payment dates. It is important to keep track of these deadlines to ensure compliance and prevent any issues related to late submissions. Regular updates from the California Franchise Tax Board can provide the most current deadline information.

Obtaining the Form 592 B California

The Form 592 B California can be obtained directly from the California Franchise Tax Board's official website. It is available for download in a printable format, making it easy for users to access and complete. Additionally, many tax software programs include this form, allowing for electronic completion and filing, which can streamline the process and enhance accuracy.

Quick guide on how to complete 2021 form 592 resident and nonresident withholding statement 2021 form 592 resident and nonresident withholding statement

Complete 2021 Form 592 Resident And Nonresident Withholding Statement 2021, Form 592, Resident And Nonresident Withholding Statement seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Handle 2021 Form 592 Resident And Nonresident Withholding Statement 2021, Form 592, Resident And Nonresident Withholding Statement on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign 2021 Form 592 Resident And Nonresident Withholding Statement 2021, Form 592, Resident And Nonresident Withholding Statement effortlessly

- Locate 2021 Form 592 Resident And Nonresident Withholding Statement 2021, Form 592, Resident And Nonresident Withholding Statement and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, via email, SMS, or an invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign 2021 Form 592 Resident And Nonresident Withholding Statement 2021, Form 592, Resident And Nonresident Withholding Statement while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 592 resident and nonresident withholding statement 2021 form 592 resident and nonresident withholding statement

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 592 resident and nonresident withholding statement 2021 form 592 resident and nonresident withholding statement

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is Form 592 B California?

Form 592 B California is a tax form used for reporting California source income paid to non-resident individuals and entities. It's essential for businesses to understand this form to comply with California tax regulations and avoid penalties.

-

How does airSlate SignNow help with Form 592 B California?

airSlate SignNow simplifies the process of creating, sending, and signing documents like Form 592 B California. Our user-friendly platform allows businesses to efficiently manage their tax documentation while ensuring compliance with California laws.

-

Is there a cost associated with using airSlate SignNow for Form 592 B California?

Yes, airSlate SignNow offers tiered pricing plans to accommodate various business needs when managing documents such as Form 592 B California. Our solutions aim to be cost-effective to ensure all users can afford comprehensive document management.

-

What features does airSlate SignNow offer for managing Form 592 B California?

airSlate SignNow provides features like customizable templates, secure eSignatures, and document tracking to help manage your Form 592 B California efficiently. These tools streamline the entire signing process, saving your team valuable time and resources.

-

Are there integrations available for airSlate SignNow that support Form 592 B California?

Yes, airSlate SignNow integrates seamlessly with various platforms, allowing businesses to easily manage Form 592 B California alongside their existing workflows. Whether you're using CRM systems, cloud storage, or other software, our integrations enhance your document collaboration.

-

Can airSlate SignNow assist with multiple Form 592 B California submissions?

Absolutely! airSlate SignNow is designed to handle bulk submissions, making it ideal for businesses that need to submit multiple Form 592 B California documents at once. Our platform ensures that all documents are securely stored and easily accessible.

-

What benefits does using airSlate SignNow provide for completing Form 592 B California?

Using airSlate SignNow to complete Form 592 B California offers numerous benefits, including reduced paperwork, increased efficiency, and enhanced security. Our digital solution ensures that your forms are processed faster and with greater accuracy.

Get more for 2021 Form 592 Resident And Nonresident Withholding Statement 2021, Form 592, Resident And Nonresident Withholding Statement

- Wa sublease form

- Letter landlord rent template 497429677 form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable washington form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration 497429679 form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497429680 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement washington form

- Notice rent increase 497429682 form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants washington form

Find out other 2021 Form 592 Resident And Nonresident Withholding Statement 2021, Form 592, Resident And Nonresident Withholding Statement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile

- Sign Wisconsin LLC Operating Agreement Mobile

- Can I Sign Wyoming LLC Operating Agreement

- Sign Hawaii Rental Invoice Template Simple

- Sign California Commercial Lease Agreement Template Free

- Sign New Jersey Rental Invoice Template Online