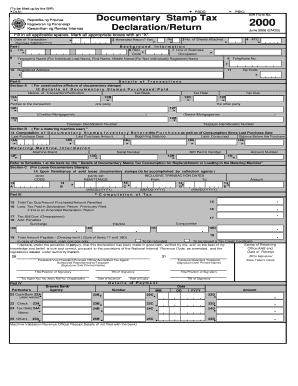

Bir Form June Excel

What is the Bir Form June Excel

The Bir Form June Excel is a specific tax form used in the United States for reporting various financial activities. It is essential for individuals and businesses to accurately report their income and expenses. This form is particularly important for self-employed individuals, freelancers, and small business owners who need to comply with tax regulations. The June version of the form may include updates or changes relevant to that tax year, ensuring that users are following the latest guidelines set forth by the IRS.

Steps to complete the Bir Form June Excel

Completing the Bir Form June Excel involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, receipts, and any previous tax forms. Next, open the Excel file and input your data into the designated fields. Be sure to follow the instructions provided within the form for each section, as this will help prevent errors. After entering your information, review the form carefully for any discrepancies. Finally, save your completed form and prepare it for submission.

Legal use of the Bir Form June Excel

The legal use of the Bir Form June Excel is governed by IRS regulations, which stipulate that all tax forms must be filled out accurately and submitted on time. This form serves as a formal declaration of your financial activities and must be completed in accordance with federal and state laws. Using this form correctly ensures that you maintain compliance and avoid potential penalties. It is advisable to keep a copy of the completed form for your records, as it may be required for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Bir Form June Excel are crucial for taxpayers to adhere to in order to avoid penalties. Typically, the deadline for submitting this form aligns with the general tax filing deadline, which is usually April fifteenth of each year. However, if you are self-employed or have specific circumstances, you may qualify for an extension. It is important to stay informed about any changes to these dates, as they can vary from year to year based on IRS announcements.

Required Documents

Before filling out the Bir Form June Excel, it is essential to gather all required documents. These typically include your income statements, such as W-2s or 1099s, receipts for deductible expenses, and any previous tax returns. Having these documents on hand will facilitate the completion of the form and ensure that all financial data is accurately reported. Additionally, if you are claiming specific deductions or credits, you may need to provide supporting documentation to validate your claims.

Examples of using the Bir Form June Excel

Examples of using the Bir Form June Excel can provide clarity on how to apply the form in various scenarios. For instance, a self-employed graphic designer may use this form to report their earnings and expenses related to client projects. Similarly, a small business owner might utilize the form to account for operational costs and income from sales. Understanding these examples can help users see the practical applications of the form and ensure they are reporting their financial activities accurately.

Quick guide on how to complete bir form 2000 june 2006 excel

Effortlessly Prepare Bir Form June Excel on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Manage Bir Form June Excel on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

The Easiest Way to Modify and eSign Bir Form June Excel Effortlessly

- Locate Bir Form June Excel and click on Get Form to begin.

- Utilize our provided tools to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to finalize your changes.

- Select how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Bir Form June Excel to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bir form 2000 june 2006 excel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2000 ot form, and how can it be used with airSlate SignNow?

The 2000 ot form is a specific document used for various organizational purposes, including overtime requests. With airSlate SignNow, businesses can easily create, send, and eSign this form, ensuring a streamlined process for managing employee documentation and improving overall efficiency.

-

Is there a cost associated with using airSlate SignNow for the 2000 ot form?

Yes, there is a pricing structure associated with airSlate SignNow that varies based on your chosen plan. However, it remains a cost-effective solution for managing forms like the 2000 ot form, ensuring you can integrate eSigning into your business processes without breaking the bank.

-

What features does airSlate SignNow offer for managing the 2000 ot form?

airSlate SignNow provides numerous features for the 2000 ot form, including customizable templates, secure electronic signatures, and collaboration tools. These features help streamline the process and ensure that all necessary stakeholders can easily access and sign the document.

-

How can airSlate SignNow help in speeding up the approval process for the 2000 ot form?

By utilizing airSlate SignNow, businesses can eliminate the delays associated with traditional forms of document signing. The 2000 ot form can be sent directly to approvers electronically, allowing for immediate reviews and approvals, thus saving time and keeping the process moving efficiently.

-

Are there integration options for using airSlate SignNow with the 2000 ot form?

Yes, airSlate SignNow integrates seamlessly with a variety of platforms, such as CRM systems, project management tools, and cloud storage services. This means you can easily manage your 2000 ot form alongside other business applications, enhancing workflow efficiency.

-

What benefits does airSlate SignNow provide for businesses using the 2000 ot form?

The primary benefits of using airSlate SignNow for the 2000 ot form include reduced paperwork, improved accuracy, and faster turnaround times. Furthermore, it ensures compliance and security for sensitive documents, providing peace of mind to businesses and their employees.

-

Can I track the status of the 2000 ot form sent through airSlate SignNow?

Absolutely, airSlate SignNow offers tracking capabilities that allow you to monitor the status of your 2000 ot form at every stage of the signing process. This feature keeps you informed about who has signed, who still needs to sign, and ensures accountability in the document management workflow.

Get more for Bir Form June Excel

Find out other Bir Form June Excel

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online