Form 31 Myanmar

What is the Form 31 Myanmar

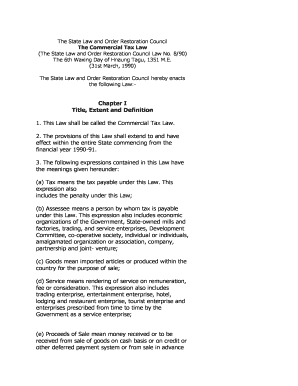

The Form 31 Myanmar is a commercial tax form used for various taxation purposes within Myanmar. This form is essential for businesses operating in the country, as it helps in reporting their tax obligations accurately. The form provides a structured way for taxpayers to disclose their income and calculate the taxes owed to the government. Understanding the specifics of this form is crucial for compliance with Myanmar's tax regulations.

How to use the Form 31 Myanmar

Using the Form 31 Myanmar involves several key steps. First, ensure that you have the correct version of the form, which can be downloaded from official government sources. Next, gather all necessary financial documentation, including income statements and expense records. Complete the form by accurately entering your financial details, ensuring that all calculations are correct. Once filled out, the form must be submitted to the appropriate tax authority, either online or via mail, depending on the regulations in place.

Steps to complete the Form 31 Myanmar

Completing the Form 31 Myanmar requires careful attention to detail. Follow these steps:

- Download the form: Obtain the latest version of the Form 31 from official sources.

- Gather documentation: Collect all relevant financial records, including income and expenses.

- Fill out the form: Input your financial information accurately, ensuring all sections are completed.

- Review calculations: Double-check all figures to avoid errors that could lead to penalties.

- Submit the form: Send the completed form to the tax authority through the designated method.

Legal use of the Form 31 Myanmar

The legal use of the Form 31 Myanmar is governed by the tax laws of Myanmar. It is crucial for businesses to complete and submit this form accurately to avoid legal repercussions. Failure to comply with the requirements can result in fines, penalties, or other legal actions. It is advisable for taxpayers to consult with a tax professional to ensure that they meet all legal obligations related to the form.

Key elements of the Form 31 Myanmar

Key elements of the Form 31 Myanmar include:

- Taxpayer Information: Basic details about the business, such as name, address, and tax identification number.

- Income Reporting: Sections dedicated to reporting various sources of income.

- Expense Deductions: Areas to list allowable business expenses that can reduce taxable income.

- Tax Calculation: A section for calculating the total tax liability based on reported income and deductions.

Form Submission Methods

The Form 31 Myanmar can be submitted through multiple methods, ensuring accessibility for all taxpayers. Options typically include:

- Online Submission: Many tax authorities offer online platforms for submitting forms electronically.

- Mail Submission: Taxpayers can also print and mail the completed form to the appropriate tax office.

- In-Person Submission: Some individuals may prefer to deliver the form directly to a tax office for personal assistance.

Quick guide on how to complete form 31 myanmar

Effortlessly prepare Form 31 Myanmar on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly and without hassle. Manage Form 31 Myanmar on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

How to edit and eSign Form 31 Myanmar with ease

- Obtain Form 31 Myanmar and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your adjustments.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form 31 Myanmar to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 31 myanmar

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 31 Myanmar and how does it work?

Form 31 Myanmar is an essential document used for various administrative processes within Myanmar. With airSlate SignNow, you can easily create, send, and eSign Form 31 Myanmar, ensuring a streamlined workflow. The platform simplifies document management, making it accessible for both individuals and businesses.

-

How can airSlate SignNow help with the completion of Form 31 Myanmar?

airSlate SignNow offers robust features that make completing Form 31 Myanmar straightforward. Users can fill out the form digitally, add eSignatures, and store documents securely. This reduces the hassle of paperwork and improves efficiency in processing important transactions.

-

What are the pricing options for using airSlate SignNow for Form 31 Myanmar?

airSlate SignNow offers flexible pricing plans suited for businesses of all sizes. You can choose from monthly or annual subscriptions, which include features tailored for handling Form 31 Myanmar efficiently. Visit our pricing page to find the plan that best meets your needs.

-

Can I integrate airSlate SignNow with other applications for managing Form 31 Myanmar?

Yes, airSlate SignNow provides seamless integrations with various applications you may already use. This includes tools for project management, customer relationship management (CRM), and accounting software, allowing you to manage Form 31 Myanmar alongside your other workflows effortlessly.

-

What benefits does airSlate SignNow offer for eSigning Form 31 Myanmar?

Using airSlate SignNow to eSign Form 31 Myanmar brings numerous benefits, such as enhanced security, faster turnaround times, and a more eco-friendly process. You can complete necessary signatures in minutes, eliminating the delays often associated with traditional signing methods.

-

Is airSlate SignNow secure for handling sensitive Form 31 Myanmar documents?

Absolutely! airSlate SignNow prioritizes the security of your data, employing industry-leading encryption and compliance measures. This ensures that your Form 31 Myanmar and any other sensitive documents remain safe and confidential throughout the signing and storage process.

-

What features does airSlate SignNow provide for tracking Form 31 Myanmar submissions?

airSlate SignNow includes comprehensive tracking features that allow users to monitor the status of each Form 31 Myanmar submission. You can receive notifications when documents are viewed, signed, or completed, providing transparency and helping you stay organized.

Get more for Form 31 Myanmar

Find out other Form 31 Myanmar

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample