Rabobank Fatca Email Form 2014-2026

What is the Rabobank Fatca Email Form

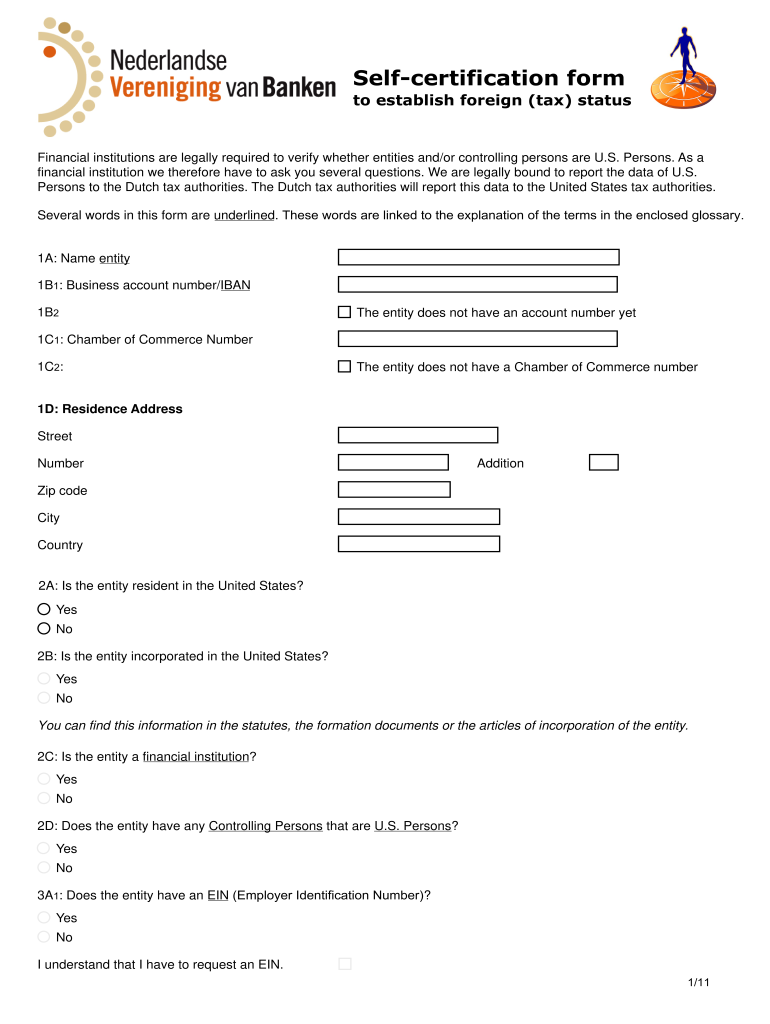

The Rabobank FATCA email form is a document used by U.S. taxpayers to report their foreign financial accounts and comply with the Foreign Account Tax Compliance Act (FATCA). This form is essential for individuals and entities with accounts at Rabobank, ensuring they meet U.S. tax obligations. By completing this form, account holders provide necessary information to the Internal Revenue Service (IRS) regarding their foreign assets, helping to prevent tax evasion and promote transparency in international banking.

Steps to complete the Rabobank Fatca Email Form

Completing the Rabobank FATCA email form involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant financial information, including account numbers and balances. Next, fill out the form with your personal details, such as your name, address, and taxpayer identification number. It is crucial to review the completed form for any errors or omissions before submitting it. Finally, send the form electronically through Rabobank’s secure email system, ensuring that you receive confirmation of submission for your records.

Legal use of the Rabobank Fatca Email Form

The legal use of the Rabobank FATCA email form is governed by U.S. tax laws and regulations. This form must be filled out accurately and submitted on time to avoid penalties. Under U.S. law, failing to report foreign financial accounts can lead to significant fines and legal repercussions. Therefore, it is important to understand the legal implications of the information provided in the form, as well as the requirements set forth by the IRS regarding foreign account reporting.

Required Documents

To complete the Rabobank FATCA email form, certain documents are necessary. These include your Social Security number or Individual Taxpayer Identification Number, bank statements from your foreign accounts, and any relevant tax documents that detail your income and assets. Having these documents on hand will facilitate the completion of the form and ensure that all information is accurate and comprehensive.

Form Submission Methods

The Rabobank FATCA email form can be submitted electronically, which is the preferred method for efficiency and security. Rabobank provides a secure email platform for submitting the form, ensuring that your personal information is protected. Alternatively, if electronic submission is not possible, you may also opt to print the form and send it via traditional mail. However, electronic submission is recommended to expedite processing and confirmation.

Penalties for Non-Compliance

Non-compliance with FATCA requirements can result in severe penalties. U.S. taxpayers who fail to report their foreign financial accounts may face fines that can range from $10,000 to $50,000, depending on the circumstances. Additionally, willful neglect can lead to even harsher penalties, including criminal charges. It is essential to understand these consequences and ensure timely and accurate filing of the Rabobank FATCA email form to avoid such repercussions.

Quick guide on how to complete rabobank fatca email form

Discover how to effortlessly navigate the Rabobank Fatca Email Form completion with this simple guide

eFiling and signNowing online documents is becoming more popular and the preferred choice for numerous clients. It offers numerous benefits compared to conventional printed documents, such as convenience, time savings, enhanced precision, and security.

Utilizing tools like airSlate SignNow, you can find, modify, signNow, enhance, and transmit your Rabobank Fatca Email Form without getting caught up in endless printing and scanning. Follow this concise guide to get going and finalize your document.

Follow these instructions to obtain and complete Rabobank Fatca Email Form

- Begin by clicking the Get Form button to access your document in our editor.

- Pay attention to the green marker on the left indicating required fields so you don’t miss them.

- Utilize our advanced tools to annotate, edit, approve, secure, and enhance your document.

- Protect your file or convert it into a fillable form using the features available in the right panel.

- Review the document and look for mistakes or inconsistencies.

- Click DONE to complete the editing process.

- Rename your document or keep it as it is.

- Select the storage service where you want to save your document, send it via USPS, or click the Download Now button to download your file.

If Rabobank Fatca Email Form isn’t what you were searching for, you can explore our extensive library of pre-imported forms that you can complete with ease. Visit our platform now!

Create this form in 5 minutes or less

FAQs

-

I have created a registration form in HTML. When someone fills it out, how do I get the filled out form sent to my email?

Are you assuming that the browser will send the email? That is not the way it is typically done. You include in your registration form a and use PHP or whatever on the server to send the email. In PHP it is PHP: mail - Manual But if you are already on the server it seems illogical to send an email. Just register the user immediately.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

Create this form in 5 minutes!

How to create an eSignature for the rabobank fatca email form

How to create an electronic signature for your Rabobank Fatca Email Form online

How to make an electronic signature for the Rabobank Fatca Email Form in Google Chrome

How to make an electronic signature for signing the Rabobank Fatca Email Form in Gmail

How to generate an eSignature for the Rabobank Fatca Email Form right from your smart phone

How to generate an eSignature for the Rabobank Fatca Email Form on iOS devices

How to make an eSignature for the Rabobank Fatca Email Form on Android OS

People also ask

-

What is the Rabobank Fatca Email Form?

The Rabobank Fatca Email Form is a specialized digital form designed for Rabobank clients to comply with FATCA regulations. It allows users to submit necessary information securely and efficiently, ensuring compliance with international tax laws. By using the Rabobank Fatca Email Form, clients can streamline their reporting processes.

-

How does the Rabobank Fatca Email Form work?

The Rabobank Fatca Email Form works by allowing users to fill out the required fields electronically and submit them via email. This process eliminates the need for paper forms, making it faster and more convenient. With airSlate SignNow, you can eSign the Rabobank Fatca Email Form directly, ensuring that all documents are legally binding and secure.

-

Is there a cost associated with using the Rabobank Fatca Email Form?

Using the Rabobank Fatca Email Form through airSlate SignNow is cost-effective, with flexible pricing plans tailored to fit various business needs. You can choose a plan that suits your volume of documents and feature requirements. Additionally, airSlate SignNow often offers free trials, allowing you to test the service before committing.

-

What features does the Rabobank Fatca Email Form include?

The Rabobank Fatca Email Form includes features such as eSigning, document tracking, and secure cloud storage. Users can customize the form to collect specific information and utilize templates for repeated use. Additionally, airSlate SignNow offers integrations with other business applications to enhance workflow efficiency.

-

How can the Rabobank Fatca Email Form benefit my business?

The Rabobank Fatca Email Form benefits your business by simplifying the compliance process, reducing paperwork, and ensuring timely submissions. By digitizing your forms, you enhance efficiency, save time, and reduce the risk of errors. This ultimately leads to better resource allocation and improved customer satisfaction.

-

Can I integrate the Rabobank Fatca Email Form with other software?

Yes, the Rabobank Fatca Email Form can be integrated with various software solutions through airSlate SignNow's API. This allows for seamless data transfer between platforms, enhancing your workflow and improving overall efficiency. Integrations with CRM systems and other business tools ensure that your compliance processes are streamlined.

-

Is the Rabobank Fatca Email Form secure?

Absolutely, the Rabobank Fatca Email Form is designed with security in mind. airSlate SignNow employs advanced encryption methods to protect your data during transmission and storage. This ensures that sensitive information submitted through the Rabobank Fatca Email Form remains confidential and secure.

Get more for Rabobank Fatca Email Form

Find out other Rabobank Fatca Email Form

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template