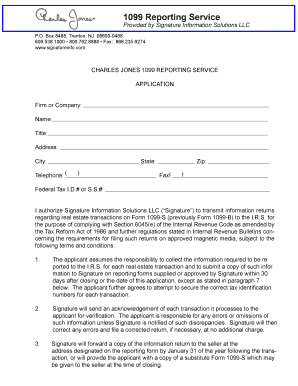

Charles Jones 1099 S Reporting Form

What is the Charles Jones 1099 S Reporting Form

The Charles Jones 1099 S Reporting Form is a tax document used in the United States to report income from real estate transactions. This form is essential for individuals and businesses involved in the sale or exchange of real estate, as it provides the IRS with necessary information regarding the proceeds from such transactions. The form captures details such as the seller's information, the buyer's information, and the gross proceeds from the sale, ensuring compliance with federal tax regulations.

How to use the Charles Jones 1099 S Reporting Form

Using the Charles Jones 1099 S Reporting Form involves several steps to ensure accurate reporting of real estate transactions. First, gather all relevant information, including the seller's and buyer's names, addresses, and taxpayer identification numbers. Next, accurately fill out the form, ensuring that all fields are completed correctly. After completing the form, it should be submitted to the IRS and a copy provided to the seller. It is important to keep a copy for your records as well.

Steps to complete the Charles Jones 1099 S Reporting Form

Completing the Charles Jones 1099 S Reporting Form requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source or download it in PDF format.

- Enter the seller's name, address, and taxpayer identification number.

- Provide the buyer's information, including their name and address.

- Input the gross proceeds from the sale of the property.

- Check all entries for accuracy before submission.

Legal use of the Charles Jones 1099 S Reporting Form

The legal use of the Charles Jones 1099 S Reporting Form is governed by IRS regulations. It must be filed accurately and on time to avoid potential penalties. The form serves as a formal declaration of income from real estate transactions, and failure to report this income can result in audits or fines. Using electronic signature solutions can enhance the legal standing of the completed form, ensuring that it meets compliance standards.

Filing Deadlines / Important Dates

Filing deadlines for the Charles Jones 1099 S Reporting Form are crucial for compliance. Generally, the form must be submitted to the IRS by the end of February if filed on paper, or by the end of March if filed electronically. Additionally, copies must be provided to the seller by the same deadlines. Keeping track of these dates helps avoid penalties and ensures timely reporting of real estate transactions.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Charles Jones 1099 S Reporting Form. These guidelines outline the necessary information required, the correct filing procedures, and the importance of accuracy in reporting. It is essential to familiarize yourself with these guidelines to ensure compliance and avoid any issues with the IRS.

Quick guide on how to complete charles jones 1099 s reporting form

Finish Charles Jones 1099 S Reporting Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Charles Jones 1099 S Reporting Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to edit and eSign Charles Jones 1099 S Reporting Form without hassle

- Obtain Charles Jones 1099 S Reporting Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant portions of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Charles Jones 1099 S Reporting Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the charles jones 1099 s reporting form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a charles jones 1099 pdf?

A charles jones 1099 pdf is a tax form used to report various types of income other than wages, salaries, and tips. This document is essential for independent contractors and freelancers who receive payments from clients. Accessing a charles jones 1099 pdf is straightforward with airSlate SignNow's electronic signing tools.

-

How can I create a charles jones 1099 pdf using airSlate SignNow?

Creating a charles jones 1099 pdf with airSlate SignNow is simple. Users can easily fill out the required fields in the document template, ensuring all necessary information is included. After completing the form, you can eSign it, making it ready for distribution.

-

What are the pricing options for using airSlate SignNow to manage charles jones 1099 pdf forms?

airSlate SignNow offers various pricing plans to accommodate different business sizes and needs. With affordable pricing, users can efficiently manage their charles jones 1099 pdf forms without breaking the bank. Plans often include features tailored for document management and eSigning.

-

Can I integrate airSlate SignNow with other tools to manage charles jones 1099 pdf documents?

Yes, airSlate SignNow supports integrations with various platforms, including CRM and accounting software. This flexibility allows users to streamline the handling of charles jones 1099 pdf documents directly within their existing workflows. Look for seamless integrations to enhance productivity.

-

What are the benefits of using airSlate SignNow to process charles jones 1099 pdf forms?

Using airSlate SignNow for charles jones 1099 pdf processing offers numerous advantages, including time savings and increased efficiency. The platform simplifies the eSignature and document dispatch process, ensuring that your forms are completed accurately and quickly. This can signNowly reduce the administrative burden on your team.

-

Is it safe to eSign a charles jones 1099 pdf with airSlate SignNow?

Absolutely. airSlate SignNow employs top-notch security measures to protect your charles jones 1099 pdf documents. With robust encryption and compliance with industry standards, you can trust that your sensitive information is safeguarded throughout the signing process.

-

Can I store my charles jones 1099 pdf files in airSlate SignNow?

Yes, airSlate SignNow provides secure cloud storage for all your charles jones 1099 pdf files. This feature allows you to easily access, organize, and retrieve your documents whenever needed. The intuitive interface makes managing your files simple and efficient.

Get more for Charles Jones 1099 S Reporting Form

- Fluid intake tracking form for doc

- Moneynetworkpaycardwm form

- Work search activity log examples form

- Dsd 27 form

- Bird strike reporting form international civil aviation icao

- Tr 570 form pdf

- Conditional waiver and release on final payment form

- Testing and inspection report form no 0446 city of london

Find out other Charles Jones 1099 S Reporting Form

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract