W9 Puerto Rico Form

What is the W-9 Puerto Rico

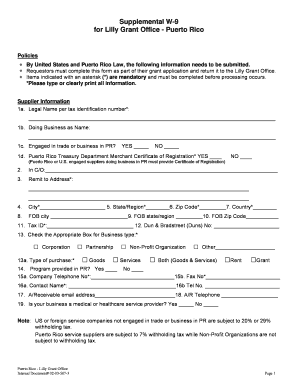

The W-9 Puerto Rico is a tax form used by individuals and businesses to provide their taxpayer identification information to entities that are required to report certain types of income to the IRS. This form is essential for ensuring accurate tax reporting and compliance with U.S. tax laws. It is primarily used by freelancers, contractors, and other self-employed individuals who receive payments from businesses. The W-9 form helps the payer to correctly report payments made to the IRS and to the payee, ensuring that the appropriate taxes are withheld, if necessary.

Steps to Complete the W-9 Puerto Rico

Completing the W-9 Puerto Rico involves several straightforward steps. First, provide your name as it appears on your tax return. Next, indicate your business name if applicable. You will then need to select your federal tax classification, such as individual, corporation, or partnership. After that, enter your address, including city, state, and ZIP code. The next step is to provide your taxpayer identification number (TIN), which can be your Social Security number or Employer Identification Number (EIN). Finally, sign and date the form to certify that the information provided is accurate.

Legal Use of the W-9 Puerto Rico

The W-9 Puerto Rico is legally binding once it is completed and signed. It serves as a declaration of your taxpayer status and provides the necessary information for the payer to report income to the IRS. The form must be used in compliance with IRS guidelines, ensuring that all information is accurate and up-to-date. Failure to provide a correct W-9 can result in backup withholding, where the payer is required to withhold a percentage of your payments for tax purposes. Therefore, it is crucial to ensure that the form is filled out correctly and submitted to the appropriate parties.

How to Obtain the W-9 Puerto Rico

The W-9 Puerto Rico can be obtained from the IRS website or through various tax preparation software. It is available as a downloadable PDF that can be printed and filled out manually. Additionally, many businesses provide their contractors with a copy of the form to complete as part of their onboarding process. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Form Submission Methods

The completed W-9 Puerto Rico can be submitted in several ways, depending on the requirements of the requesting entity. Common submission methods include:

- Online submission via secure portals provided by the payer.

- Emailing a scanned copy of the signed form.

- Mailing a physical copy to the address specified by the requester.

Each method has its own security considerations, so it is advisable to choose the one that best protects your personal information.

Key Elements of the W-9 Puerto Rico

Understanding the key elements of the W-9 Puerto Rico is essential for accurate completion. The form includes:

- Name and business name (if applicable).

- Federal tax classification.

- Address details.

- Taxpayer Identification Number (TIN).

- Signature and date.

Each of these elements plays a critical role in ensuring that the form is valid and can be used for tax reporting purposes.

Quick guide on how to complete w9 puerto rico

Complete W9 Puerto Rico effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the features necessary to create, modify, and eSign your documents quickly and without hindrance. Manage W9 Puerto Rico on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest method to alter and eSign W9 Puerto Rico without any difficulty

- Locate W9 Puerto Rico and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow manages your document management needs in just a few clicks from a device of your choice. Alter and eSign W9 Puerto Rico and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w9 puerto rico

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the w9 formulario puerto rico and why is it important?

The w9 formulario puerto rico is a tax form used by individuals and businesses to provide their taxpayer identification number to the IRS. It's essential for proper reporting of income and fulfilling tax obligations. This form helps ensure compliance with U.S. tax laws, making it a critical document for anyone engaged in business transactions in Puerto Rico.

-

How can airSlate SignNow simplify completing the w9 formulario puerto rico?

airSlate SignNow provides an easy-to-use platform that allows users to fill out and sign the w9 formulario puerto rico electronically. This streamlines the process, ensuring accuracy and saving time compared to traditional paper methods. With customizable templates, businesses can quickly access and send the form to clients or contractors.

-

What are the pricing options for using airSlate SignNow for the w9 formulario puerto rico?

airSlate SignNow offers flexible pricing plans, ensuring that businesses of all sizes can utilize its features for the w9 formulario puerto rico. Pricing is competitive and varies based on the plan chosen, which includes options for individuals and larger teams. This cost-effective solution helps save money while ensuring compliance and efficiency.

-

Does airSlate SignNow allow integration with other platforms when managing the w9 formulario puerto rico?

Yes, airSlate SignNow seamlessly integrates with various business applications to enhance the management of the w9 formulario puerto rico. Whether you use CRM software or project management tools, you can incorporate eSigning into your workflow. This integration helps keep your processes smooth and efficient.

-

What security measures does airSlate SignNow have for the w9 formulario puerto rico?

airSlate SignNow prioritizes the security of your data, especially for sensitive documents like the w9 formulario puerto rico. The platform employs advanced encryption and security protocols to protect your information during transmission and storage. This ensures that your documents remain safe and accessible only to authorized users.

-

Can I track the status of the w9 formulario puerto rico once sent through airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of the w9 formulario puerto rico after you send it. You will receive notifications regarding when the document is viewed, signed, and completed, making it easier to manage your paperwork effectively.

-

Are there any benefits to using airSlate SignNow for the w9 formulario puerto rico compared to traditional methods?

Using airSlate SignNow for the w9 formulario puerto rico offers several benefits, including increased efficiency, reduced turnaround time, and enhanced accuracy. Unlike traditional paper methods, the electronic process eliminates the need for printing and scanning, allowing for a seamless experience. Additionally, it helps businesses maintain a digital record of their forms.

Get more for W9 Puerto Rico

- Neolog nrp form

- Lisa madigans complaint forms

- D claration des douanes us customs and border protection cbp form

- Ultrasound cpt codes form

- It handbuch fr fachinformatiker pdf download kostenlos

- Science form 1 exercise with answers

- Fiche didentification personnelle form

- Vanderbilt teacher assessment form

Find out other W9 Puerto Rico

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement