How to File Dayton City Taxes 2022

Steps to complete the Ohio City tax return form

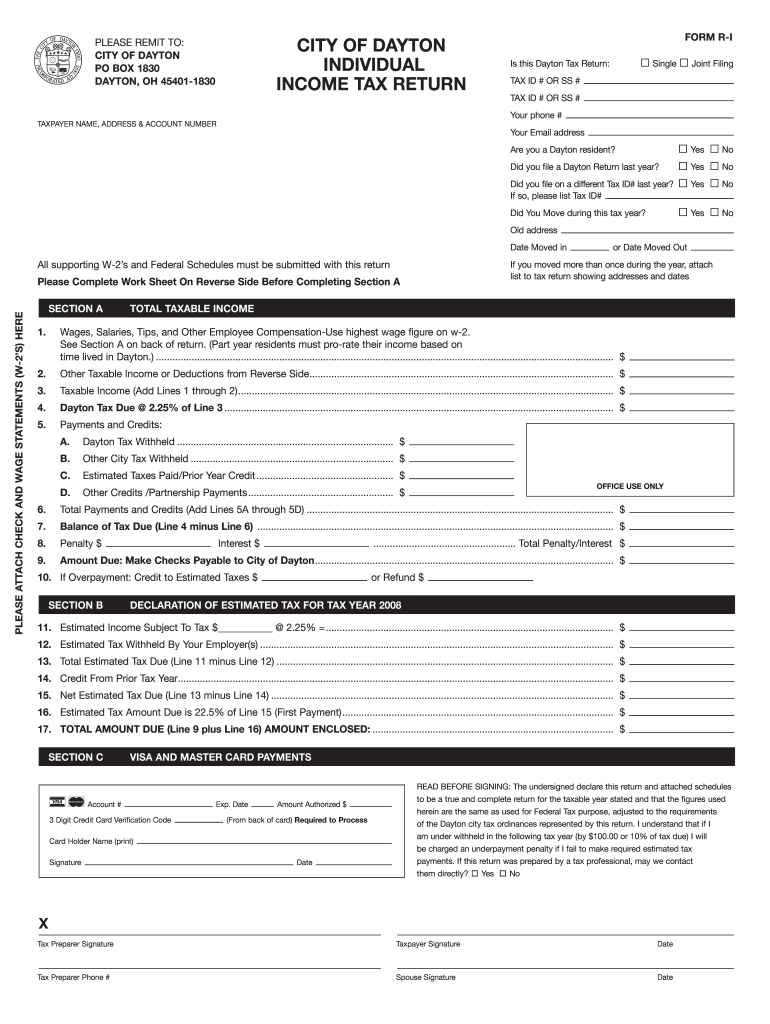

Filing your Ohio City tax return involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including your W-2 forms, 1099 forms, and any other relevant income statements. Next, determine the appropriate Ohio City tax return form for your situation, which may vary depending on your residency status and income type.

Once you have the correct form, carefully fill it out, ensuring that all information is accurate and complete. Pay special attention to your income, deductions, and credits, as these will affect your overall tax liability. After completing the form, review it thoroughly to catch any potential errors before submission.

Finally, submit your completed Ohio City tax return form either electronically or via mail, depending on your preference and the submission options available. Ensure you keep a copy of your submitted form and any supporting documents for your records.

Required documents for the Ohio City tax return

When preparing to file your Ohio City tax return, it is essential to have all required documents on hand. These typically include:

- W-2 forms: These forms report your annual wages and the taxes withheld by your employer.

- 1099 forms: If you are self-employed or received other income, you will need these forms to report that income.

- Proof of deductions: Gather documentation for any deductions you plan to claim, such as receipts for business expenses or charitable contributions.

- Previous year’s tax return: Having your prior year’s return can help you ensure you are consistent with your reporting and may provide useful information for your current filing.

Having these documents ready will streamline the process and help ensure you complete your Ohio City tax return accurately.

Form submission methods for the Ohio City tax return

There are several methods available for submitting your Ohio City tax return form, allowing you to choose the option that best suits your needs. You can file your return electronically through authorized e-filing services, which offer a quick and efficient way to submit your information. This method often allows for faster processing and may expedite any potential refunds.

If you prefer to file by mail, ensure you send your completed Ohio City tax return form to the correct address designated for tax submissions. It is advisable to use a secure mailing method, such as certified mail, to confirm that your return has been delivered.

In-person submissions may also be available at designated tax offices, providing an opportunity to ask questions and receive assistance if needed. Regardless of the method you choose, be mindful of filing deadlines to avoid penalties.

Legal use of the Ohio City tax return form

The Ohio City tax return form is legally binding, provided it is completed and submitted according to the relevant tax laws and regulations. To ensure your form is legally valid, it is important to follow the prescribed guidelines for filling it out, including accurate reporting of income and proper documentation of deductions and credits.

Electronic submissions are also recognized as legally valid, as long as they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Using a reliable e-signature service can help ensure that your electronic submission meets all legal requirements.

Penalties for non-compliance with the Ohio City tax return

Failing to file your Ohio City tax return on time or submitting inaccurate information can result in various penalties. Common consequences include:

- Late filing penalties: If you do not file your return by the deadline, you may incur a penalty based on the amount of tax owed.

- Accuracy-related penalties: Providing incorrect information on your tax return can lead to additional penalties, especially if the inaccuracies result in underpayment of taxes.

- Interest charges: Unpaid taxes may accrue interest until they are paid in full, increasing the total amount owed.

To avoid these penalties, it is crucial to file your Ohio City tax return accurately and on time.

Eligibility criteria for the Ohio City tax return

Eligibility for filing the Ohio City tax return depends on several factors, including your residency status and income level. Generally, residents of Ohio City who earn income above a certain threshold are required to file a tax return. This includes individuals who are employed, self-employed, or receive income from other sources.

Additionally, non-residents who earn income within Ohio City may also be required to file a return. It is important to review specific eligibility criteria based on your individual circumstances to ensure compliance with local tax regulations.

Quick guide on how to complete how to file dayton city taxes

Prepare How To File Dayton City Taxes seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents quickly without delays. Manage How To File Dayton City Taxes on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign How To File Dayton City Taxes without hassle

- Obtain How To File Dayton City Taxes and click Obtain Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important parts of the documents or redact sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just a few seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Complete button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign How To File Dayton City Taxes and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to file dayton city taxes

Create this form in 5 minutes!

How to create an eSignature for the how to file dayton city taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio City tax return form used for?

The Ohio City tax return form is used by residents and businesses to report their taxable income to city authorities. It ensures that individuals and organizations comply with local tax regulations. Filing this form accurately prevents legal complications and penalties.

-

How can airSlate SignNow help me with my Ohio City tax return form?

airSlate SignNow simplifies the process of preparing and signing your Ohio City tax return form. With our user-friendly platform, you can easily import necessary data, eSign documents, and submit them without the hassle of printing and scanning. This streamlines your tax filing process signNowly.

-

Is there a cost associated with using airSlate SignNow for my Ohio City tax return form?

airSlate SignNow offers cost-effective solutions for eSigning and managing your documents, including the Ohio City tax return form. Pricing plans ensure you get access to essential features without breaking the bank. You can choose a plan that fits your budget and needs.

-

What features are included for managing the Ohio City tax return form?

With airSlate SignNow, you get features like customizable templates, secure eSigning, and real-time tracking for your Ohio City tax return form. Additionally, our platform allows for collaborative editing, making it easy for multiple parties to contribute. These tools enhance accuracy and efficiency.

-

Can I integrate airSlate SignNow with my existing accounting software for the Ohio City tax return form?

Yes, airSlate SignNow supports integrations with various accounting software, allowing you to import and manage your Ohio City tax return form seamlessly. This integration helps you maintain accurate financial records while simplifying the tax filing process. You can easily sync data between platforms for better efficiency.

-

What benefits does airSlate SignNow offer for eSigning my Ohio City tax return form?

Using airSlate SignNow for eSigning your Ohio City tax return form provides numerous benefits, including enhanced security, convenience, and a reduced turnaround time. Our platform complies with legal regulations to ensure your eSignatures are valid. This convenience minimizes the need for physical paperwork and expedites the filing process.

-

How do I get started with airSlate SignNow for my Ohio City tax return form?

Getting started with airSlate SignNow is easy! Simply sign up for an account, select a pricing plan that suits your needs, and access our intuitive interface to begin working on your Ohio City tax return form. You'll have access to a range of tools designed to simplify your document management and signing processes.

Get more for How To File Dayton City Taxes

Find out other How To File Dayton City Taxes

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document