Form W 8 Attachment X 2014-2026

What is the Form W-8 Attachment X

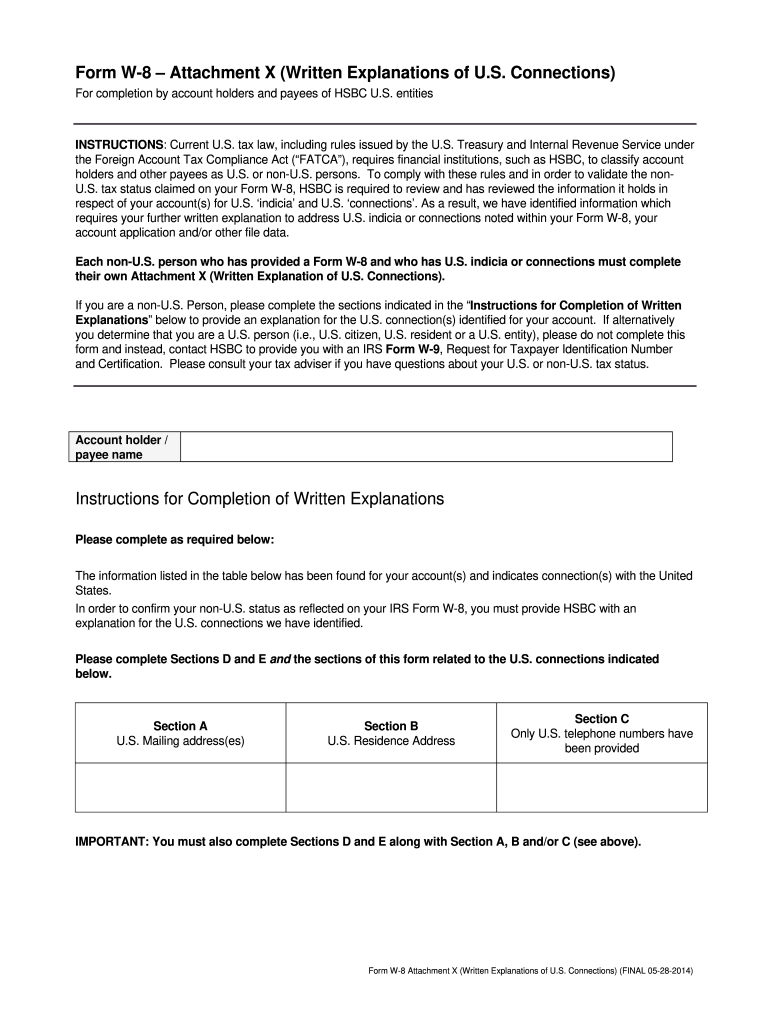

The Form W-8 Attachment X is a crucial document used by foreign individuals and entities to certify their foreign status for U.S. tax purposes. This form is specifically designed to be attached to the primary Form W-8, which is used to claim tax treaty benefits or to establish that the individual or entity is not subject to U.S. tax withholding. The Attachment X provides additional information that supports the claims made on the main W-8 form, ensuring compliance with IRS regulations.

Steps to Complete the Form W-8 Attachment X

Completing the Form W-8 Attachment X involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your foreign tax identification number and details regarding the tax treaty benefits you are claiming. Follow these steps:

- Fill out your personal or business information accurately.

- Indicate the type of income you are receiving and the applicable tax treaty.

- Provide your foreign tax identification number.

- Sign and date the form to affirm its accuracy.

Ensure that all information is current and correct to avoid delays or issues with processing.

Legal Use of the Form W-8 Attachment X

The legal use of the Form W-8 Attachment X is governed by IRS regulations. This form is essential for foreign individuals and entities to establish their eligibility for reduced withholding tax rates under applicable tax treaties. Properly completing and submitting this form helps ensure compliance with U.S. tax laws, preventing potential penalties for incorrect withholding. It is important to understand that failure to provide this form when required can result in the application of the maximum withholding tax rate.

Examples of Using the Form W-8 Attachment X

There are various scenarios where the Form W-8 Attachment X is utilized. For instance, a foreign artist receiving royalties from a U.S. company may need to submit this form to claim a reduced withholding rate based on a tax treaty. Similarly, a foreign investor earning interest from U.S. bank accounts may use the Attachment X to certify their foreign status and avoid unnecessary withholding. Each example illustrates how this form plays a vital role in facilitating international transactions while adhering to U.S. tax regulations.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form W-8 Attachment X. These guidelines outline the necessary information required, the importance of accuracy, and the implications of non-compliance. It is crucial for filers to refer to the IRS instructions for the W-8 series to ensure that they meet all requirements. This includes understanding the types of income that qualify for treaty benefits and the documentation needed to support claims.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-8 Attachment X can vary depending on the type of income and the payer's requirements. Generally, it is advisable to submit the form before the first payment is made to ensure that the correct withholding rates are applied. Keeping track of important dates related to tax treaty renewals or changes in tax law is also essential for maintaining compliance and avoiding penalties.

Quick guide on how to complete form w 8 attachment x

Learn how to navigate the Form W 8 Attachment X completion with this simple guide

Electronic filing and signNowing documents online is gaining traction and has become a primary preference for numerous users. It offers several benefits over conventional printed documents, including convenience, time efficiency, enhanced accuracy, and security.

With platforms like airSlate SignNow, you can access, modify, sign, enhance, and transmit your Form W 8 Attachment X without getting entangled in repetitive printing and scanning. Follow this concise tutorial to initiate and finalize your form.

Follow these steps to obtain and complete Form W 8 Attachment X

- Begin by clicking the Get Form button to access your form in our editor.

- Observe the green label on the left indicating mandatory fields so you don't miss them.

- Utilize our professional tools to annotate, modify, sign, secure, and enhance your form.

- Safeguard your document or transform it into a fillable form using the tools available in the right panel.

- Review the form and check for any mistakes or inconsistencies.

- Click DONE to complete the editing process.

- Rename your form or keep it unchanged.

- Select the storage option you prefer to retain your form, send it via USPS, or click the Download Now button to save your file.

If Form W 8 Attachment X is not what you were looking for, you can explore our extensive library of pre-imported templates that you can fill out with minimal effort. Visit our platform today!

Create this form in 5 minutes or less

FAQs

-

How can you fill out the W-8BEN form (no tax treaty)?

A payer of a reportable payment may treat a payee as foreign if the payer receives an applicable Form W-8 from the payee. Provide this Form W-8BEN to the requestor if you are a foreign individual that is a participating payee receiving payments in settlement of payment card transactions that are not effectively connected with a U.S. trade or business of the payee.As stated by Mr. Ivanov below, Since Jordan is not one of the countries listed as a tax treaty country, it appears that you would only complete Part I of the Form W-8BEN, Sign your name and date the Certification in Part III.http://www.irs.gov/pub/irs-pdf/i...Hope this is helpful.

-

How do I fill out the Amazon Affiliate W-8 Tax Form as a non-US individual?

It depends on your circumstances.You will probably have a form W8 BEN (for individuals/natural persons) or a form W8 BEN E (for corporations or other businesses that are not natural persons).Does your country have a double tax convention with the USA? Check here United States Income Tax Treaties A to ZDoes your income from Amazon relate to a business activity and does it specifically not include Dividends, Interest, Royalties, Licensing Fees, Fees in return for use of a technology, rental of property or offshore oil exploration?Is all the work carried out to earn this income done outside the US, do you have no employees, assets or offices located in the US that contributed to earning this income?Were you resident in your home country in the year that you earned this income and not resident in the US.Are you registered to pay tax on your business profits in your home country?If you meet these criteria you will probably be looking to claim that the income is taxable at zero % withholding tax under article 7 of your tax treaty as the income type is business profits arises solely from business activity carried out in your home country.

-

Which W-8 form should I fill out as an LLC company?

How do they know to request a W-8 instead of a W-9? Are you Foreign?Assuming you need to submit a W-8 instead of a W-9, here are the questions to guide your W-8 decision.Do you have other members in your LLC? If you are the only member, a Single Member LLC is a Disregarded Entity taxed on your personal tax return. So you would submit the W-8BEN.If you have other members, are you subject to the default status or have you elected corporate status?If you are subject to the default status, your LLC is taxed as a partnership so submit the W-8IMYIf you elected Corporate status, submit the W-8BEN-E.https://www.irs.gov/pub/irs-pdf/...Other great answers here. Especially good advice from Carl and Mark, get to a CPA.

-

How much will be the fee to fill out the XAT form?

The XAT Registration fee is Rs. 1700(late fee Rs. 2000). This is had increased from last year.If you want to apply for XLRI programmes then pay additional Rs.300 (late fee Rs. 500)The last date for registration is 30th Nov 2018. The exam is on 6th Jan 2019.All the best

Create this form in 5 minutes!

How to create an eSignature for the form w 8 attachment x

How to make an electronic signature for the Form W 8 Attachment X in the online mode

How to make an eSignature for the Form W 8 Attachment X in Google Chrome

How to generate an electronic signature for putting it on the Form W 8 Attachment X in Gmail

How to make an eSignature for the Form W 8 Attachment X right from your smartphone

How to make an electronic signature for the Form W 8 Attachment X on iOS devices

How to make an eSignature for the Form W 8 Attachment X on Android OS

People also ask

-

What is Form W 8 Attachment X and why do I need it?

Form W 8 Attachment X is a crucial document used by foreign entities to signNow their status for U.S. tax purposes. It helps in claiming tax treaty benefits and ensuring compliance with IRS regulations. Understanding how to properly fill out and submit Form W 8 Attachment X is essential for businesses engaged in international transactions.

-

How can airSlate SignNow help me manage Form W 8 Attachment X?

airSlate SignNow streamlines the process of sending and eSigning Form W 8 Attachment X. With its intuitive interface, you can easily upload, share, and ensure that all parties sign the document electronically, which speeds up processing and enhances compliance.

-

Is airSlate SignNow affordable for small businesses needing Form W 8 Attachment X management?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our cost-effective solution ensures that small businesses can efficiently manage Form W 8 Attachment X without breaking the bank, allowing you to focus on your core operations.

-

What features does airSlate SignNow offer for handling Form W 8 Attachment X?

airSlate SignNow provides numerous features for managing Form W 8 Attachment X, including customizable templates, secure storage, and audit trails. These features ensure that you can create, send, and track your documents efficiently while maintaining compliance with regulatory requirements.

-

Can I integrate airSlate SignNow with other software for Form W 8 Attachment X processing?

Absolutely! airSlate SignNow supports various integrations with popular software applications, allowing you to automate workflows related to Form W 8 Attachment X. This means you can connect your existing tools to streamline document handling and enhance productivity.

-

What are the benefits of using airSlate SignNow for Form W 8 Attachment X?

Using airSlate SignNow for Form W 8 Attachment X offers numerous benefits, including improved efficiency, reduced processing time, and enhanced security for sensitive information. Our electronic signature solution ensures that your documents are signed quickly and stored securely.

-

How secure is airSlate SignNow when processing Form W 8 Attachment X?

Security is a top priority at airSlate SignNow. When processing Form W 8 Attachment X, our platform uses advanced encryption and compliance with industry standards to protect your data. You can trust that your documents are safe and secure throughout the signing process.

Get more for Form W 8 Attachment X

- Waste disposal proposal and contract for municipality form

- Agreement salon form

- Contractor commission form

- Independent contractor employment 497334924 form

- Self employed independent contractor employment agreement general form

- Personal guarantee contract form

- Personal guaranty form

- Corporation employee form

Find out other Form W 8 Attachment X

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement