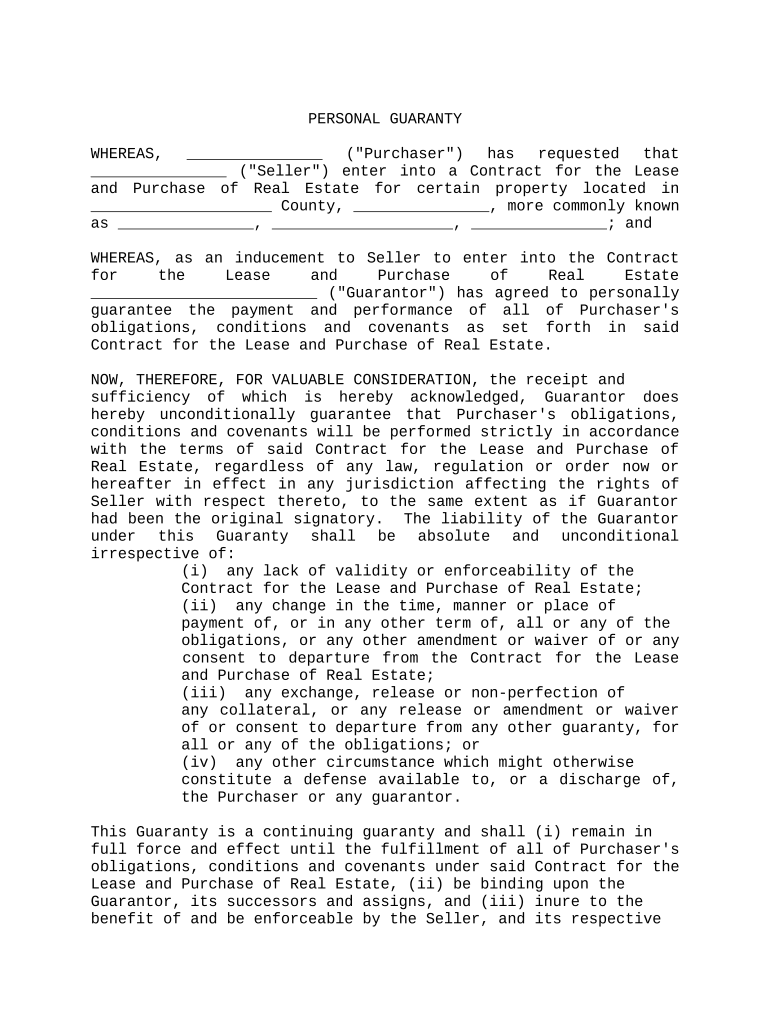

Personal Guarantee Contract Form

What is the Personal Guarantee Contract

A personal guarantee contract is a legal document where an individual agrees to be personally responsible for the debts or obligations of a business or another individual. This contract is commonly used in business financing, where lenders require a personal guarantee from business owners to secure loans. By signing this contract, the individual commits to using personal assets to satisfy the debt if the primary borrower defaults. Understanding this contract is crucial for anyone involved in business transactions, as it can significantly impact personal finances.

Key elements of the Personal Guarantee Contract

Several key elements define a personal guarantee contract, ensuring its enforceability and clarity. These elements include:

- Identification of parties: The contract must clearly identify the guarantor and the party to whom the guarantee is made.

- Description of obligations: It should specify the obligations being guaranteed, including the amount and terms of the debt.

- Conditions of liability: The contract should outline the circumstances under which the guarantor will be held liable.

- Duration of the guarantee: The timeframe during which the guarantee is valid must be stated.

- Signatures: The contract must be signed by the guarantor to be legally binding.

These elements ensure that all parties understand their responsibilities and the potential risks involved.

How to use the Personal Guarantee Contract

Using a personal guarantee contract involves several steps to ensure that it serves its intended purpose. First, the parties involved should discuss the terms and conditions of the guarantee. Next, the contract should be drafted, incorporating the key elements mentioned earlier. Once both parties agree on the terms, the guarantor should sign the document. It is advisable to keep a copy of the signed contract for record-keeping and future reference. This contract is often required by lenders to mitigate risks associated with lending, making it a vital tool in business financing.

Steps to complete the Personal Guarantee Contract

Completing a personal guarantee contract requires careful attention to detail. Here are the essential steps:

- Gather information: Collect all necessary details about the parties involved and the obligations being guaranteed.

- Draft the contract: Create the document, ensuring it includes all key elements and complies with relevant laws.

- Review the contract: Both parties should review the document to ensure clarity and mutual understanding.

- Sign the contract: The guarantor must sign the document, making it legally binding.

- Store the contract securely: Keep a copy in a safe place for future reference.

Following these steps ensures that the personal guarantee contract is executed properly and serves its legal purpose.

Legal use of the Personal Guarantee Contract

The legal use of a personal guarantee contract is governed by state laws and regulations. It is essential for the contract to comply with these laws to be enforceable. Typically, the contract should be clear, concise, and free from ambiguity. Courts generally uphold personal guarantees as long as they are properly executed and the terms are reasonable. It is advisable for individuals to consult with legal professionals when drafting or signing a personal guarantee contract to ensure compliance with applicable laws and to understand the implications of their commitments.

Examples of using the Personal Guarantee Contract

Personal guarantee contracts are commonly used in various scenarios, including:

- Business loans: A bank may require a personal guarantee from a business owner when approving a loan to ensure repayment.

- Leases: Landlords may ask for a personal guarantee from business tenants to protect against potential defaults on lease payments.

- Supplier agreements: Suppliers might request a personal guarantee to secure payment for goods and services provided to a business.

These examples illustrate the importance of personal guarantees in securing financial transactions and protecting the interests of lenders and service providers.

Quick guide on how to complete personal guarantee contract

Effortlessly prepare Personal Guarantee Contract on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to obtain the correct template and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Personal Guarantee Contract on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign Personal Guarantee Contract effortlessly

- Obtain Personal Guarantee Contract and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that function.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your documentation management needs with just a few clicks from any device you prefer. Edit and eSign Personal Guarantee Contract to guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a guarantee lease and how can it benefit my business?

A guarantee lease is a type of lease agreement that provides assurance to landlords about rent payments. By using airSlate SignNow, you can easily set up and manage guarantee leases, ensuring that your agreements are secure and legally binding. This can ultimately protect your business from potential losses due to unpaid rent.

-

How does airSlate SignNow streamline the process of creating a guarantee lease?

airSlate SignNow offers templates and customizable options for creating guarantee leases, making the process quick and efficient. With its user-friendly interface, you can draft, edit, and send your agreements for electronic signatures in just a few clicks. This ensures that your lease agreements are executed promptly and professionally.

-

What are the pricing options for using airSlate SignNow for guarantee leases?

airSlate SignNow provides competitive pricing plans that cater to various business needs, including handling guarantee leases. With flexible pricing tiers, you can choose a plan that fits your volume of document management. Additionally, you can take advantage of a trial period to assess the service before committing to a subscription.

-

Can I integrate airSlate SignNow with other tools I use for managing guarantee leases?

Yes, airSlate SignNow offers seamless integrations with popular business applications such as CRM systems and project management tools. This means you can easily incorporate guarantee lease management into your existing workflows. Streamlining your processes enhances efficiency and aligns your operations with your business goals.

-

Is it secure to use airSlate SignNow for my guarantee lease documents?

Absolutely! airSlate SignNow employs robust security measures, including encryption and compliance with data protection regulations, to safeguard your guarantee lease documents. Your information is protected throughout the signing process, giving you peace of mind that your agreements are handled securely.

-

What features does airSlate SignNow offer specifically for guarantee lease management?

airSlate SignNow includes features such as templates for guarantee leases, automated reminders for payments, and tracking of lease agreement statuses. These tools enhance your ability to manage your lease effectively and ensure timely execution. Moreover, you can easily customize your documents to meet specific requirements.

-

How can airSlate SignNow improve the efficiency of my guarantee lease processes?

By leveraging airSlate SignNow's electronic signature capabilities, you can expedite the signing process for your guarantee leases. Reducing reliance on paper documents and manual tracking allows you to focus on more critical aspects of your business. The efficient workflow helps in managing leases seamlessly, enhancing overall productivity.

Get more for Personal Guarantee Contract

- Forms ampamp templateshealthmil military health system

- Printable 2020 indiana form in occ other certified credits

- Kansas form ia 22 questionnaire of earnings allocation

- Printable 2020 kansas form k 40pt property tax relief claim

- Printable 2020 kentucky form 2210 k underpayment of estimated tax by individuals

- R 2868v sd 121 louisiana department of revenue individual form

- Printable 2020 louisiana form r 210nr nonresident and part year resident underpayment penalty computation worksheet

- Nj form 2210 underpayment of estimated tax by individuals

Find out other Personal Guarantee Contract

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template