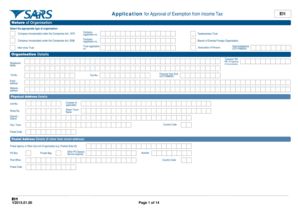

Ei1 Form

What is the Ei1 Form

The Ei1 form, also known as the application for approval of exemption from income tax, is a crucial document for individuals or entities seeking tax exemption in the United States. This form is primarily utilized by taxpayers who wish to apply for a status that exempts them from certain income tax obligations. Understanding the purpose and requirements of the Ei1 form is essential for ensuring compliance with tax regulations.

How to Use the Ei1 Form

Using the Ei1 form involves several steps to ensure proper completion and submission. First, gather all necessary documentation that supports your application for tax exemption. This may include financial statements, identification documents, and any previous tax filings. After collecting the required materials, fill out the form accurately, ensuring all information is clear and legible. Once completed, review the form for any errors before submitting it to the appropriate tax authority.

Steps to Complete the Ei1 Form

Completing the Ei1 form requires careful attention to detail. Follow these steps for a successful submission:

- Obtain the latest version of the Ei1 form from the appropriate tax authority.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details regarding the nature of your income and the reason for seeking exemption.

- Attach any supporting documents that validate your claim for exemption.

- Review the completed form for accuracy and completeness.

- Submit the form either online, by mail, or in person, as per the guidelines provided by the tax authority.

Legal Use of the Ei1 Form

The Ei1 form must be used in accordance with legal requirements to ensure its validity. It is essential to comply with all relevant tax laws and regulations when submitting this form. Failure to adhere to these legal standards may result in the rejection of the application or potential penalties. Understanding the legal implications of the Ei1 form is vital for taxpayers seeking to maintain compliance with tax obligations.

Eligibility Criteria

To qualify for exemption using the Ei1 form, applicants must meet specific eligibility criteria set forth by tax authorities. Generally, these criteria include factors such as income level, type of income, and the purpose for which the exemption is sought. It is important to review the eligibility requirements carefully to determine if you qualify before completing the form.

Form Submission Methods

The Ei1 form can be submitted through various methods, depending on the preferences of the applicant and the requirements of the tax authority. Common submission methods include:

- Online submission through the tax authority's official website.

- Mailing the completed form to the designated address provided in the form instructions.

- In-person submission at local tax offices or designated locations.

Examples of Using the Ei1 Form

Examples of situations where the Ei1 form may be utilized include individuals applying for tax-exempt status due to low income, non-profit organizations seeking exemption for charitable activities, or businesses applying for exemption based on specific operational criteria. Each scenario requires careful consideration of the eligibility criteria and supporting documentation to ensure a successful application process.

Quick guide on how to complete ei1 form

Effortlessly Prepare Ei1 Form on Any Device

Digital document management has become increasingly popular among both companies and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, revise, and electronically sign your documents without any holdups. Manage Ei1 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Ei1 Form

- Locate Ei1 Form and click Get Form to begin the process.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with specialized tools offered by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Ei1 Form and ensure exceptional communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ei1 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is sars ei1 and how does it relate to airSlate SignNow?

SARS EI1 refers to a specific form required by South Africa's revenue service for employers. With airSlate SignNow, businesses can streamline the process of preparing and signing these documents electronically, making compliance with sars ei1 requirements much easier.

-

How can airSlate SignNow simplify sars ei1 document management?

AirSlate SignNow provides tools that enable users to create, send, and track sars ei1 forms seamlessly. The platform allows for automated reminders, secure storage, and real-time updates on the status of your documents, enhancing your overall workflow.

-

Is airSlate SignNow cost-effective for handling sars ei1 forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing sars ei1 documents. With flexible pricing plans, businesses can choose a package that suits their needs, all without compromising on essential features for document signing and management.

-

What features does airSlate SignNow offer for sars ei1 compliance?

AirSlate SignNow includes features such as customizable templates, in-person signing options, and comprehensive audit trails to ensure compliance with sars ei1 regulations. These features help businesses meet legal requirements while simplifying their document management process.

-

Can airSlate SignNow integrate with other tools for sars ei1 processing?

Absolutely! AirSlate SignNow integrates with a variety of business tools, making it easier to handle sars ei1 forms alongside other essential software. This integration capability enhances efficiency and ensures that all your document workflows are connected seamlessly.

-

What are the benefits of using airSlate SignNow for sars ei1 documentation?

Using airSlate SignNow for sars ei1 documentation offers benefits like improved accuracy and faster turnaround times. By digitizing the signing process, businesses reduce errors and enhance productivity, leading to better compliance with sars ei1 requirements.

-

How secure is airSlate SignNow when handling sensitive sars ei1 documents?

AirSlate SignNow prioritizes security, employing advanced encryption and data protection measures for all documents, including sars ei1 forms. This ensures that sensitive information is kept confidential and secure throughout the signing process.

Get more for Ei1 Form

Find out other Ei1 Form

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF