Texas Form 05 102 Instructions 2018

Understanding the Texas Form 05 102 Instructions

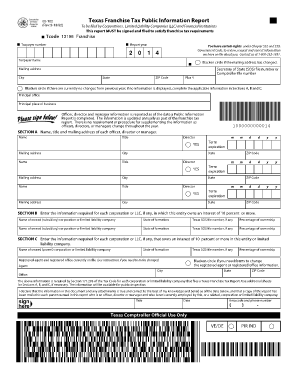

The Texas Form 05 102, also known as the Texas Franchise Tax Public Information Report, is essential for businesses operating in Texas. This form provides vital information about a business's financial status, ownership, and operational details. It is a requirement for entities that are subject to franchise tax in Texas. Understanding the instructions for filling out this form is crucial to ensure compliance with state regulations and to avoid potential penalties.

Steps to Complete the Texas Form 05 102 Instructions

Completing the Texas Form 05 102 involves several key steps. First, gather all necessary information about your business, including the legal name, address, and the type of entity. Next, accurately report your revenue figures, as this will determine your franchise tax obligations. Follow the specific sections of the form, ensuring that all required fields are filled out completely. After completing the form, review it for accuracy before submission. This careful attention to detail can prevent delays and issues with your filing.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Texas Form 05 102. Generally, the form is due on May 15 of each year for most businesses. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day. Keeping track of these important dates helps ensure that your business remains compliant with Texas tax laws and avoids late fees or penalties.

Form Submission Methods

The Texas Form 05 102 can be submitted through various methods, including online, by mail, or in person. For online submissions, businesses can use the Texas Comptroller's website, which offers a streamlined process. If submitting by mail, ensure that the form is sent to the correct address and that sufficient postage is applied. In-person submissions can be made at designated Comptroller offices. Each method has its advantages, so choose the one that best fits your business's needs.

Legal Use of the Texas Form 05 102 Instructions

Understanding the legal implications of the Texas Form 05 102 is crucial for compliance. The information provided in this form is used by the state to assess franchise tax liabilities. Accurate and truthful reporting is not only a legal requirement but also helps maintain your business's good standing. Misrepresentation or failure to file can lead to penalties, including fines and interest on unpaid taxes. Therefore, it is vital to adhere to all legal guidelines when completing and submitting this form.

Required Documents for Filing

Before completing the Texas Form 05 102, gather all required documents to ensure a smooth filing process. This typically includes financial statements, previous tax returns, and any supporting documentation related to your business operations. Having these documents on hand will help you accurately report your business's financial status and comply with the requirements set forth by the Texas Comptroller.

Key Elements of the Texas Form 05 102 Instructions

The Texas Form 05 102 includes several key elements that must be understood for proper completion. These elements typically include sections for business identification, revenue reporting, ownership details, and any applicable exemptions. Familiarizing yourself with these components will facilitate a more efficient filing process and help ensure that all necessary information is accurately reported.

Quick guide on how to complete texas form 05 102 instructions

Complete Texas Form 05 102 Instructions effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Texas Form 05 102 Instructions on any device using airSlate SignNow’s Android or iOS applications and streamline any document-based process today.

The simplest way to edit and electronically sign Texas Form 05 102 Instructions with ease

- Find Texas Form 05 102 Instructions and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Mark relevant sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Verify all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Texas Form 05 102 Instructions and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct texas form 05 102 instructions

Create this form in 5 minutes!

How to create an eSignature for the texas form 05 102 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas franchise tax public information report 2019?

The Texas franchise tax public information report 2019 is a document that provides important details about a business's financial status and tax obligations in Texas. It includes crucial information such as the business’s revenue, ownership, and the type of business entity. Understanding this report is essential for compliance and maintaining good standing with the state.

-

How can airSlate SignNow help with the Texas franchise tax public information report 2019?

airSlate SignNow streamlines the process of sending and eSigning documents, including the Texas franchise tax public information report 2019. With its user-friendly interface, you can quickly prepare and send your reports for signatures, ensuring that you stay compliant while saving time and reducing paperwork.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, such as the Texas franchise tax public information report 2019, offers numerous benefits including faster processing, easy tracking of document status, and enhanced security for sensitive information. Additionally, it eliminates the hassle of printing and mailing, making tax season much more manageable.

-

What features does airSlate SignNow provide that can assist with tax documentation?

airSlate SignNow offers a variety of features that assist with tax documentation, including customizable templates, automated reminders, and secure eSigning options. These features make it easy to prepare and finalize the Texas franchise tax public information report 2019 while ensuring all parties are informed and compliant.

-

Is airSlate SignNow cost-effective for preparing tax documents?

Yes, airSlate SignNow is a cost-effective solution for preparing tax documents such as the Texas franchise tax public information report 2019. Its pricing plans are tailored to fit different business needs, allowing you to choose the one that best suits your budget while gaining access to comprehensive eSigning features.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow can be integrated with various software tools commonly used for tax management. This integration allows for seamless data transfer and ensures that your Texas franchise tax public information report 2019 is efficiently processed alongside your other financial documents.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes security when handling sensitive tax information. With features like secure encryption and compliant data storage, you can confidently manage your Texas franchise tax public information report 2019 and other sensitive documents without worrying about unauthorized access.

Get more for Texas Form 05 102 Instructions

- Dor stay order st louis county form

- Pdf worker report of injury form c060 january wcb worker report of injury form c060

- Blank carrier profile template 270305312 form

- Annual reconciliation of employer wage tax phila form

- Opera limited opra stock price today quote ampamp news form

- Trrrc membership request form update

- 25 west end avenue somerville nj form

- Opra request form hopatcong borough

Find out other Texas Form 05 102 Instructions

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile