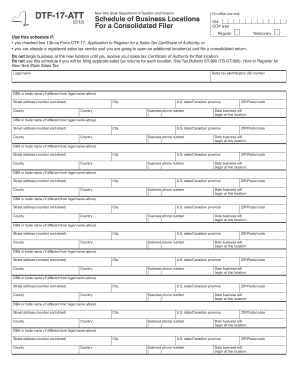

Dtf 17 Att Form

What is the DTF 17 ATT?

The DTF 17 ATT is a form issued by the New York State Department of Taxation and Finance. It is primarily used for claiming a credit for taxes paid to other jurisdictions. This form is essential for taxpayers who have earned income in another state and wish to avoid double taxation on that income. Understanding the purpose of the DTF 17 ATT is crucial for ensuring compliance with tax regulations and for maximizing potential tax benefits.

How to use the DTF 17 ATT

Using the DTF 17 ATT involves several steps to ensure accurate completion and submission. Taxpayers must first gather relevant information, including income details from other states and any tax payments made. The form requires specific entries, such as the amount of tax paid to other jurisdictions and the corresponding income earned. After filling out the form, it can be submitted electronically or by mail, depending on the taxpayer's preference and eligibility.

Steps to complete the DTF 17 ATT

Completing the DTF 17 ATT involves a systematic approach:

- Gather necessary documentation, including W-2 forms and tax returns from other states.

- Fill in personal information, such as your name, address, and Social Security number.

- Detail the income earned in other states and the taxes paid to those jurisdictions.

- Double-check all entries for accuracy to avoid delays in processing.

- Submit the completed form either electronically through the state’s tax portal or by mailing it to the appropriate address.

Legal use of the DTF 17 ATT

The DTF 17 ATT is legally binding when filled out correctly and submitted in compliance with New York State tax laws. It is important for taxpayers to ensure that all information provided is accurate and truthful to avoid penalties. The form serves as a declaration of the taxpayer's intent to claim a credit for taxes paid to other jurisdictions, which is a legal right under state tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the DTF 17 ATT align with the general tax filing deadlines in New York State. Typically, taxpayers must submit their forms by April fifteenth of the year following the tax year in question. It is essential to stay informed about any changes to these deadlines, as late submissions may result in penalties or the loss of tax credits.

Required Documents

When completing the DTF 17 ATT, taxpayers must provide several supporting documents to substantiate their claims. Required documents include:

- W-2 forms from employers in other states.

- Tax returns or documentation from the other jurisdictions where income was earned.

- Proof of tax payments made to those states, such as receipts or confirmation letters.

Form Submission Methods (Online / Mail / In-Person)

The DTF 17 ATT can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file online via the New York State tax portal, which offers a streamlined process. Alternatively, the form can be mailed to the designated address provided by the Department of Taxation and Finance. In-person submissions are generally not available for this form, emphasizing the importance of electronic or postal methods for filing.

Quick guide on how to complete dtf 17 att

Effortlessly prepare Dtf 17 Att on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents rapidly without any hold-ups. Manage Dtf 17 Att on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign Dtf 17 Att effortlessly

- Obtain Dtf 17 Att and then click Acquire Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Finish button to save your modifications.

- Select your preferred method of sending the form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign Dtf 17 Att to ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtf 17 att

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dtf 17 att and how does it work?

The dtf 17 att is a document template format designed for seamless electronic signing. It simplifies the process of creating, sending, and signing documents, allowing businesses to streamline their workflows efficiently.

-

How much does it cost to use dtf 17 att with airSlate SignNow?

Pricing for using dtf 17 att with airSlate SignNow varies based on your subscription plan. The platform is known for its cost-effective solutions, making it accessible for businesses of all sizes.

-

What features are included in the dtf 17 att option?

The dtf 17 att option includes essential features like customizable templates, secure storage, and real-time tracking. These features enhance document management and ensure that processes are completed efficiently.

-

Are there any benefits to using dtf 17 att for my business?

Using dtf 17 att can signNowly reduce turnaround times on document processes, increase efficiency, and enhance overall productivity. Additionally, it ensures compliance with legal standards for electronic signatures.

-

Can dtf 17 att integrate with other software solutions?

Yes, dtf 17 att can easily integrate with various business applications and software solutions. This compatibility allows for seamless data transfer and enhanced automation capabilities in document workflows.

-

How secure is the dtf 17 att platform for eSignatures?

The dtf 17 att platform offers robust security measures, including encryption and secure cloud storage. This ensures that your documents are protected from unauthorized access and comply with industry standards.

-

Is the dtf 17 att user-friendly for individuals new to eSigning?

Absolutely! The dtf 17 att feature is designed with user experience in mind, making it simple for anyone to create and sign documents. Even those new to electronic signing can navigate the platform with ease.

Get more for Dtf 17 Att

- Landscaping schedule template form

- Dcu joint account form

- State of florida department of transportation 850 040 02 maintenance ogc form

- Form 3c

- Northstarmls change form

- Idaho residency determination worksheet form

- State dept form ds 082 famguardian

- Functional limitation assessment form seneca college

Find out other Dtf 17 Att

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service