Deed of Gift to Trust Form

What is the deed of gift to trust?

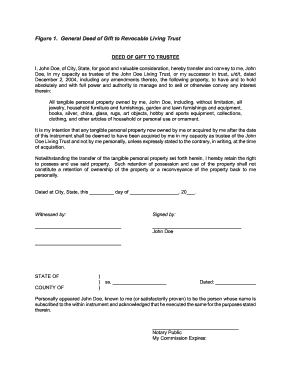

A general deed of gift to revocable living trust is a legal document that allows an individual (the grantor) to transfer property or assets into a trust. This transfer is intended to benefit the beneficiaries designated by the grantor while maintaining control over the assets during their lifetime. The revocable nature of the trust means that the grantor can modify or revoke the trust at any time, providing flexibility in estate planning. This type of deed is particularly useful for managing assets and ensuring they are distributed according to the grantor's wishes after their passing.

Steps to complete the deed of gift to trust

Completing a general deed of gift to revocable living trust involves several key steps. First, identify the assets you wish to transfer into the trust. Next, draft the deed, ensuring it includes essential details such as the names of the grantor and trustee, a description of the assets, and the intended beneficiaries. Once the document is prepared, it must be signed by the grantor in the presence of a notary public to ensure its legal validity. After notarization, the deed should be filed with the appropriate state office if required, and copies should be provided to all relevant parties.

Legal use of the deed of gift to trust

The legal use of a general deed of gift to revocable living trust is governed by state laws, which may vary. Generally, the deed must comply with the Uniform Trust Code and state-specific regulations regarding property transfers. It is essential to ensure that the deed is executed properly to avoid any disputes or challenges in the future. Additionally, the deed should clearly outline the terms of the trust, including how the assets are to be managed and distributed, to provide legal clarity and protection for all parties involved.

Key elements of the deed of gift to trust

Several key elements must be included in a general deed of gift to revocable living trust to ensure its effectiveness. These elements include:

- Grantor Information: The name and address of the individual transferring the assets.

- Trustee Information: The name and address of the person or entity managing the trust.

- Asset Description: A detailed description of the assets being transferred, including any relevant identification numbers.

- Beneficiary Designation: The names and addresses of the individuals or entities that will benefit from the trust.

- Signatures: The grantor's signature, along with the date and notary acknowledgment.

How to use the deed of gift to trust

Using a general deed of gift to revocable living trust involves executing the document and transferring the specified assets into the trust. Once the deed is signed and notarized, the grantor should ensure that the assets are formally titled in the name of the trust. This may involve changing the title of real estate, bank accounts, or other property to reflect the trust's name. It is crucial to keep records of these changes and provide copies of the deed to the trustee and beneficiaries to ensure transparency and proper management of the trust assets.

State-specific rules for the deed of gift to trust

Each state may have specific rules and regulations governing the use of a general deed of gift to revocable living trust. It is important to consult state laws to ensure compliance with any requirements related to notarization, filing, and tax implications. Some states may require additional documentation or specific language to be included in the deed. Understanding these nuances can help avoid legal complications and ensure that the trust operates smoothly according to the grantor's intentions.

Quick guide on how to complete deed of gift to trust

Effortlessly Set Up Deed Of Gift To Trust on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to locate the appropriate form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Administer Deed Of Gift To Trust on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based activity today.

The easiest way to alter and electronically sign Deed Of Gift To Trust with ease

- Locate Deed Of Gift To Trust and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with the tools that airSlate SignNow provides for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Deed Of Gift To Trust and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the deed of gift to trust

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a general deed of gift of to revokable living trust?

A general deed of gift of to revokable living trust is a legal document that allows an individual to transfer assets into a revocable living trust. This type of deed ensures that assets are managed in accordance with your wishes during your lifetime and can be altered or revoked as necessary. By using airSlate SignNow, you can easily create and sign these documents online for your convenience.

-

How does airSlate SignNow simplify the process of creating a general deed of gift of to revokable living trust?

airSlate SignNow provides user-friendly templates and tools to help you easily create a general deed of gift of to revokable living trust. The platform guides you step-by-step, ensuring that you include all necessary legal elements. This efficient approach saves time and reduces the risk of errors in your documents.

-

What are the benefits of using airSlate SignNow for my legal documents?

Using airSlate SignNow for your legal documents, including a general deed of gift of to revokable living trust, offers convenience, speed, and security. You can create, edit, and eSign documents from anywhere, streamlining the process. Additionally, the platform provides secure storage for your documents, ensuring that your information remains confidential.

-

Is there a cost associated with using airSlate SignNow for drafting a general deed of gift of to revokable living trust?

Yes, airSlate SignNow offers different pricing plans that cater to various needs, including those who need to create a general deed of gift of to revokable living trust. Each plan provides basic features along with advanced options for teams and businesses. We recommend checking the pricing page for a detailed breakdown of plans and features.

-

Can I collaborate with others when creating a general deed of gift of to revokable living trust on airSlate SignNow?

Absolutely! airSlate SignNow allows for seamless collaboration, enabling you to invite others to review and sign the general deed of gift of to revokable living trust. This ensures that all parties involved can contribute to and finalize the document efficiently. Collaboration features make it easy to communicate and gather necessary approvals.

-

What security measures does airSlate SignNow implement for my documents?

airSlate SignNow prioritizes your document security by employing robust encryption methods and secure data storage practices. When creating a general deed of gift of to revokable living trust, you can trust that your sensitive information is protected against unauthorized access. Regular security audits and compliance with industry standards further enhance the safety of your documents.

-

Are there any integrations available with airSlate SignNow when working on legal documents?

Yes, airSlate SignNow integrates with various third-party applications to enhance your workflow when creating legal documents like a general deed of gift of to revokable living trust. Popular integrations include cloud storage services, CRM systems, and productivity tools, enabling you to connect your existing systems for a more streamlined experience.

Get more for Deed Of Gift To Trust

- Dh3039 independent living skills assessment completed by the clients health professional or support provider if the client has form

- Form summons to defendant 104 lro rgl 200

- To je potpisni karton form

- Car window tint va laws stickers form

- Request for exception form graduate division

- Health form and immunization record form midlands technical midlandstech

- Sick leave request form university of new mexico

- The mini mental state examination mmse mount sinai hospital form

Find out other Deed Of Gift To Trust

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation