Loan Confirmation Format in Excel

What is the loan confirmation format in Excel

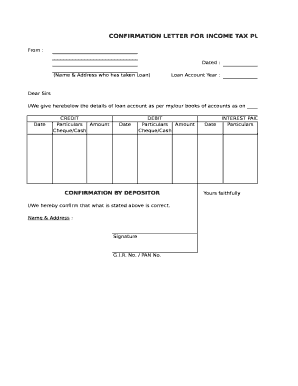

The loan confirmation format in Excel is a structured template used to document the details of a loan agreement. This format typically includes essential information such as the borrower's name, loan amount, interest rate, repayment schedule, and terms of the loan. Utilizing Excel for this purpose allows for easy data manipulation and calculation, providing a clear overview of the loan details. This format is particularly useful for lenders and financial institutions to maintain accurate records and facilitate communication with borrowers.

How to use the loan confirmation format in Excel

To effectively use the loan confirmation format in Excel, follow these steps:

- Open a new Excel spreadsheet and select a blank template.

- Label the columns with relevant headings such as "Borrower Name," "Loan Amount," "Interest Rate," "Repayment Schedule," and "Loan Terms."

- Input the necessary information for each loan into the respective columns.

- Utilize Excel's formula functions to calculate totals, such as interest accrued over time or total payments due.

- Save the document in a secure location, ensuring it is easily accessible for future reference.

Key elements of the loan confirmation format in Excel

When creating a loan confirmation letter format in Excel, it is crucial to include specific key elements to ensure clarity and completeness. These elements typically comprise:

- Borrower Information: Full name, address, and contact details of the borrower.

- Lender Information: Name and contact information of the lending institution or individual.

- Loan Amount: The total sum being borrowed.

- Interest Rate: The percentage charged on the loan amount.

- Repayment Terms: Details regarding the repayment schedule, including due dates and payment amounts.

- Signatures: Spaces for both the lender and borrower to sign, indicating agreement to the terms.

Steps to complete the loan confirmation format in Excel

Completing the loan confirmation format in Excel involves several straightforward steps:

- Gather all necessary information about the loan and the parties involved.

- Open the loan confirmation template in Excel.

- Fill in the borrower and lender information accurately.

- Enter the loan amount, interest rate, and repayment terms in the designated fields.

- Review the document for accuracy and completeness before finalizing.

- Save the completed document and share it with the involved parties as needed.

Legal use of the loan confirmation format in Excel

The loan confirmation format in Excel can be legally binding if it meets specific criteria. To ensure its legal validity:

- Both parties must agree to the terms outlined in the document.

- Signatures from both the borrower and lender should be included, ideally in a manner that complies with eSignature laws.

- The document must clearly state the terms of the loan, including repayment obligations and consequences for non-compliance.

Examples of using the loan confirmation format in Excel

Examples of scenarios where the loan confirmation format in Excel is beneficial include:

- A bank issuing a personal loan to a customer, documenting the loan details for both parties.

- A family member lending money to a relative, creating a formal record of the loan agreement.

- A small business securing a loan for expansion, ensuring all terms are clearly outlined and agreed upon.

Quick guide on how to complete loan confirmation format in excel

Complete Loan Confirmation Format In Excel smoothly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Loan Confirmation Format In Excel on any platform with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign Loan Confirmation Format In Excel effortlessly

- Find Loan Confirmation Format In Excel and click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark relevant sections of your documents or hide sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a conventional ink signature.

- Verify the details and click the Done button to save your updates.

- Choose how you wish to share your form, by email, SMS, or invitation link, or download it to your computer.

Put aside worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you prefer. Modify and eSign Loan Confirmation Format In Excel and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan confirmation format in excel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan confirmation letter?

A loan confirmation letter is a document that serves as official confirmation of a loan agreement, outlining the terms and conditions of the loan. It is typically provided by lenders to reassure borrowers about the availability of funds. Using airSlate SignNow, you can easily create and eSign your loan confirmation letter for added convenience.

-

How does airSlate SignNow help with loan confirmation letters?

airSlate SignNow offers a user-friendly platform that allows you to create, send, and eSign loan confirmation letters quickly. Our solution streamlines the document process, ensuring that your loan confirmation letters are not only professional but also legally binding. This efficiency saves you time and simplifies the loan documentation process.

-

What features does airSlate SignNow provide for loan confirmation letters?

With airSlate SignNow, you have access to a variety of features to enhance your loan confirmation letters, including customizable templates, eSignature capabilities, and secure document storage. These features ensure that your letters are tailored to your specific needs and that they are executed swiftly and securely. You can manage all your loan documentation from a single platform.

-

Is there a cost associated with using airSlate SignNow for loan confirmation letters?

Yes, there is a cost to using airSlate SignNow, but it is designed to be an affordable solution for businesses of all sizes. Our pricing plans are flexible, allowing you to choose options that best fit your budget and needs. By using airSlate SignNow, you invest in a cost-effective way to manage your loan confirmation letters and other documents.

-

How secure are loan confirmation letters created with airSlate SignNow?

Security is a top priority at airSlate SignNow, and all loan confirmation letters are protected with advanced encryption technology. This ensures that your sensitive information remains confidential and secure throughout the signing process. You can trust airSlate SignNow to keep your loan confirmation letters safe from unauthorized access.

-

Can airSlate SignNow integrate with other software for managing loan confirmation letters?

Absolutely! airSlate SignNow supports integrations with a variety of software applications that can further streamline the management of your loan confirmation letters. This includes popular CRM systems, document storage services, and more, allowing for seamless workflow and better organization of your loan documentation.

-

What benefits can I expect when using airSlate SignNow for loan confirmation letters?

Using airSlate SignNow for your loan confirmation letters offers numerous benefits, including improved efficiency, enhanced organization, and straightforward collaboration within your team. The ability to eSign documents quickly eliminates delays in your loan processing. Additionally, our platform provides a reliable audit trail for compliance and record-keeping purposes.

Get more for Loan Confirmation Format In Excel

- Email for non payment form

- Michigan jpay form

- Collection agency license checklist requirements cis state mi form

- Hsbcyyyy form

- X ray request and release form jennifer sokolosky dmd

- Automatic transmission diagnostic worksheet form

- Citibank direct deposit form pdf

- Vehicle rent to own car contract template form

Find out other Loan Confirmation Format In Excel

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation