Aetna Life Insurance Beneficiary 2002

What is the Aetna Life Insurance Beneficiary

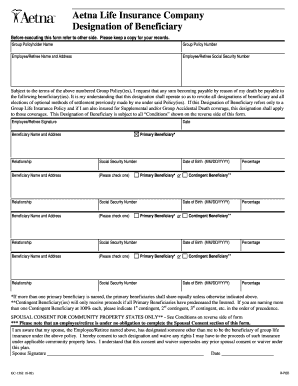

The Aetna life insurance beneficiary is the individual or entity designated to receive the benefits from a life insurance policy upon the policyholder's death. This designation is crucial as it determines who will receive the financial support intended by the policyholder. Beneficiaries can be family members, friends, or even charitable organizations. It is essential to keep this information up to date to reflect any changes in personal circumstances, such as marriage, divorce, or the birth of a child.

Steps to complete the Aetna Life Insurance Beneficiary

Completing the Aetna life insurance beneficiary form involves several important steps. First, gather all necessary personal information, including the full names, addresses, and Social Security numbers of the beneficiaries. Next, fill out the beneficiary designation form accurately, ensuring that all details are correct. It is advisable to review the form for any errors before submission. Once completed, submit the form according to Aetna's guidelines, which may include online submission or mailing it to a specified address.

Legal use of the Aetna Life Insurance Beneficiary

The legal use of the Aetna life insurance beneficiary designation is governed by state laws and the terms of the insurance policy. To ensure that the designation is legally binding, the policyholder must follow the proper procedures for completing and submitting the beneficiary form. This includes obtaining the necessary signatures and ensuring compliance with any state-specific regulations. A properly designated beneficiary can help avoid potential disputes and ensure that the intended recipients receive the benefits without complications.

Key elements of the Aetna Life Insurance Beneficiary

Several key elements define the Aetna life insurance beneficiary designation. These include the beneficiary's full name, relationship to the policyholder, and percentage of the benefit they will receive. It is crucial to specify whether the beneficiary is a primary or contingent beneficiary, as this will determine the order of payout. Additionally, policyholders should consider the implications of naming minors as beneficiaries, as this may require a trust or guardian to manage the funds until the child reaches adulthood.

How to use the Aetna Life Insurance Beneficiary

Using the Aetna life insurance beneficiary designation effectively involves understanding the implications of your choices. Policyholders should regularly review their beneficiary designations to ensure they reflect current wishes. In the event of the policyholder's death, beneficiaries should contact Aetna promptly to initiate the claims process. This typically requires submitting a death certificate and completing any necessary claim forms. Understanding the process can help beneficiaries receive their benefits in a timely manner.

State-specific rules for the Aetna Life Insurance Beneficiary

State-specific rules regarding the Aetna life insurance beneficiary designation can vary significantly. Some states have particular requirements for how beneficiaries must be designated, including restrictions on naming certain individuals or entities. Additionally, laws concerning the distribution of benefits can differ, especially in cases involving divorce or separation. It is important for policyholders to familiarize themselves with their state's regulations to ensure compliance and avoid potential legal issues.

Quick guide on how to complete aetna life insurance beneficiary

Effortlessly Manage Aetna Life Insurance Beneficiary on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an outstanding environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Handle Aetna Life Insurance Beneficiary on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Steps to Edit and Electronically Sign Aetna Life Insurance Beneficiary with Ease

- Locate Aetna Life Insurance Beneficiary and click Get Form to begin.

- Use the tools provided to complete your form.

- Mark important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or errors that necessitate printing additional copies of documents. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Aetna Life Insurance Beneficiary and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct aetna life insurance beneficiary

Create this form in 5 minutes!

How to create an eSignature for the aetna life insurance beneficiary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Aetna life insurance beneficiary?

An Aetna life insurance beneficiary is an individual or entity designated to receive the death benefit from an Aetna life insurance policy. This designation ensures that the proceeds are distributed according to the policyholder's wishes after their passing, making it crucial for financial planning.

-

How do I designate a beneficiary for my Aetna life insurance?

To designate a beneficiary for your Aetna life insurance policy, you typically need to complete a beneficiary designation form provided by Aetna. Ensure to include all relevant details about your chosen beneficiary to avoid any complications during claims processing.

-

Can I change my Aetna life insurance beneficiary?

Yes, you can change your Aetna life insurance beneficiary at any time by submitting a new beneficiary designation form to Aetna. It’s important to keep your beneficiary information up-to-date to reflect any changes in your personal circumstances, such as marriage or divorce.

-

How does Aetna life insurance coverage work?

Aetna life insurance coverage provides a death benefit to your designated beneficiary upon your passing. The coverage amount and premiums you pay depend on the policy you choose, allowing you to tailor it to your financial needs and goals for your Aetna life insurance beneficiary.

-

What types of Aetna life insurance policies are available?

Aetna offers various types of life insurance policies, including term life, whole life, and universal life insurance. Each type has different features and benefits, allowing you to select the best option that meets your needs and supports your Aetna life insurance beneficiary.

-

Are there any additional benefits for Aetna life insurance policyholders?

In addition to the death benefit, many Aetna life insurance policies may offer additional features like critical illness coverage and cash value accumulation. These benefits can enhance your policy's value and provide more security for your Aetna life insurance beneficiary.

-

What is the cost of Aetna life insurance?

The cost of Aetna life insurance varies based on factors such as age, health, policy type, and coverage amount. It's essential to get a personalized quote to understand the premium you would pay, ensuring it meets your budget while safeguarding your Aetna life insurance beneficiary.

Get more for Aetna Life Insurance Beneficiary

- Guidelines for completing vetting invitation form nvb 1

- Reciprocity application arizona state board of cosmetology form

- Celebrate recovery open share small group discussion worksheet form

- Nurse application form 64079260

- Chapter 17 resource glencoe science level blue olgcnj form

- New mexico durable power attorney health care form

- Form irs 14446 fill online printable fillable

- Warranty claim form sleepm global inc

Find out other Aetna Life Insurance Beneficiary

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney