Fillable it 201 2021

What is the fillable IT-201?

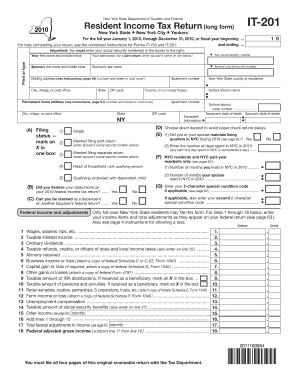

The fillable IT-201 is a tax form used by residents of New York State to report their income and calculate their tax liability. This form is essential for individuals who need to file their personal income taxes with the New York State Department of Taxation and Finance. The IT-201 form allows taxpayers to detail their income sources, claim deductions and credits, and determine the amount of tax owed or the refund due. It is specifically designed for those who are filing as individuals and is commonly referred to as the New York State Resident Income Tax Return.

Steps to complete the fillable IT-201

Completing the fillable IT-201 involves several key steps to ensure accurate reporting of income and tax liability. Follow these steps for a smooth filing process:

- Gather necessary documents, including W-2 forms, 1099s, and any other income statements.

- Access the fillable IT-201 form online, ensuring you have the latest version.

- Begin filling out personal information, such as your name, address, and Social Security number.

- Report your income by entering amounts from your gathered documents into the appropriate sections of the form.

- Claim deductions and credits that apply to your situation, which may reduce your taxable income.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy and completeness before submitting.

How to obtain the fillable IT-201

The fillable IT-201 form can be easily obtained online through the New York State Department of Taxation and Finance website. It is available as a downloadable PDF that can be filled out electronically. Additionally, taxpayers can request a paper version of the form by contacting the department directly or visiting local tax offices. Ensure you are using the correct version for the tax year you are filing, as forms may vary from year to year.

Legal use of the fillable IT-201

The fillable IT-201 form is legally recognized as a valid document for reporting income and taxes owed to the state of New York. To ensure compliance with tax laws, it is crucial to fill out the form accurately and submit it by the designated filing deadlines. Electronic submissions are accepted, and using a reliable eSignature solution can enhance the legal standing of your submission. Adhering to the guidelines set forth by the New York State Department of Taxation and Finance will help avoid penalties and ensure that your tax obligations are met.

Filing deadlines / Important dates

Filing deadlines for the IT-201 form are typically aligned with federal tax deadlines. For most taxpayers, the due date for filing is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to be aware of these dates to avoid late filing penalties. Additionally, if you need more time to prepare your return, you may file for an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required documents

To accurately complete the fillable IT-201, several key documents are required. These include:

- W-2 forms from employers, detailing your earned income.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as interest, dividends, or rental income.

- Documentation for deductions and credits, including receipts and statements.

- Social Security number and identification information.

Having these documents ready will facilitate a more efficient and accurate filing process.

Examples of using the fillable IT-201

Using the fillable IT-201 can vary based on individual circumstances. For instance, a single taxpayer with a standard job would fill out the form primarily with W-2 income and claim standard deductions. In contrast, a self-employed individual might report income from multiple sources, including 1099 forms, and may have additional deductions related to business expenses. Each taxpayer's situation is unique, and understanding how to accurately report income and claim deductions is crucial for compliance and maximizing potential refunds.

Quick guide on how to complete fillable it 201

Complete Fillable It 201 effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without any holdups. Manage Fillable It 201 on any device with airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The easiest way to alter and eSign Fillable It 201 with ease

- Find Fillable It 201 and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Edit and eSign Fillable It 201 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable it 201

Create this form in 5 minutes!

How to create an eSignature for the fillable it 201

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 201 form 2010, and how does it relate to airSlate SignNow?

The IT 201 form 2010 is a tax form used by New York State residents to report their personal income. With airSlate SignNow, you can easily fill out, sign, and send the IT 201 form 2010 electronically, streamlining your tax filing process and ensuring compliance.

-

How can airSlate SignNow help me complete the IT 201 form 2010 efficiently?

airSlate SignNow provides an intuitive platform for filling out the IT 201 form 2010, complete with templates and eSignature capabilities. This means you can prepare your form quickly and securely, allowing for a more efficient filing experience.

-

Is there a cost associated with using airSlate SignNow to fill out the IT 201 form 2010?

Yes, airSlate SignNow offers various pricing plans, including a free trial, to cater to different needs. After the trial, you can choose a cost-effective plan that fits your business requirements for handling the IT 201 form 2010 and other documents.

-

What features does airSlate SignNow offer for the IT 201 form 2010?

airSlate SignNow includes features such as document templates, eSigning, and secure cloud storage, all tailored for documents like the IT 201 form 2010. These features allow you to manage your tax documents easily while ensuring data security and compliance.

-

Can I integrate airSlate SignNow with other tools for processing the IT 201 form 2010?

Absolutely! airSlate SignNow can be integrated with various applications such as CRM systems, accounting software, and project management tools, enhancing your workflow while working with the IT 201 form 2010. This allows for seamless document management across your business processes.

-

What are the benefits of using airSlate SignNow for the IT 201 form 2010?

Using airSlate SignNow for the IT 201 form 2010 provides several benefits, including faster processing times, reduced paper clutter, and enhanced document security. These advantages help streamline your tax filing process and improve overall business efficiency.

-

Is airSlate SignNow suitable for both individuals and businesses handling the IT 201 form 2010?

Yes, airSlate SignNow is designed to serve both individuals and businesses needing to handle documents like the IT 201 form 2010. Its user-friendly interface and robust features make it ideal for anyone looking to simplify their document management.

Get more for Fillable It 201

Find out other Fillable It 201

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure