PDF Instructions for Form it 201 Department of Taxation and Finance 2020

What is the PDF Instructions For Form IT 201

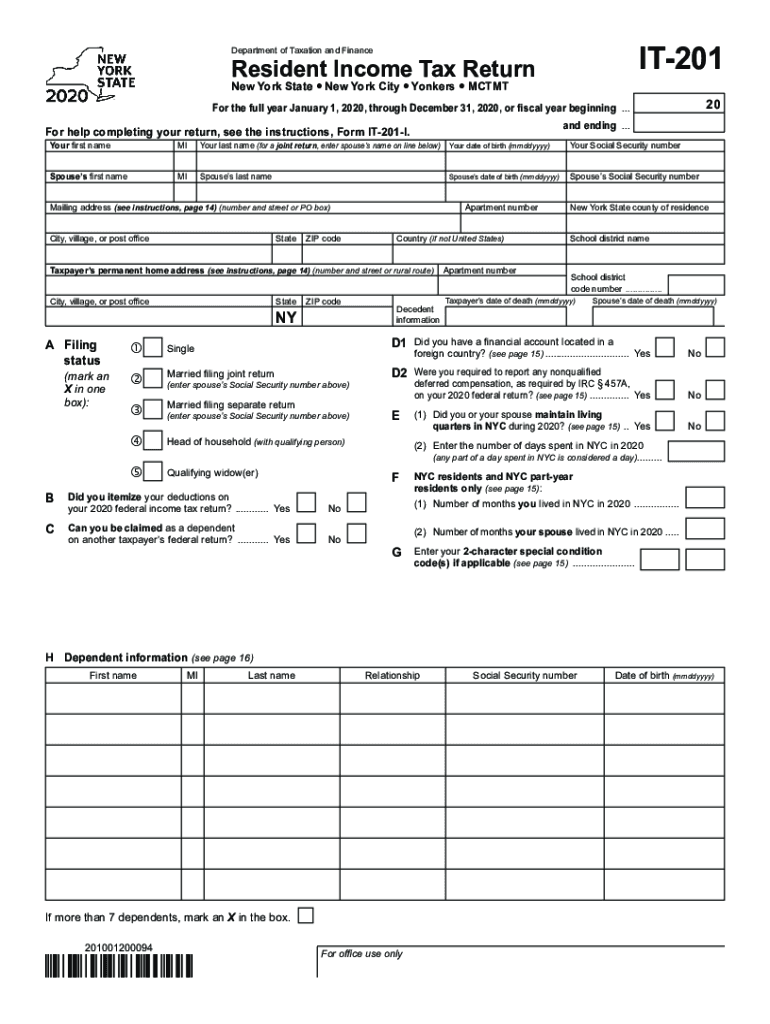

The PDF Instructions for Form IT 201 are detailed guidelines provided by the New York State Department of Taxation and Finance. This document assists taxpayers in accurately completing the IT 201 tax form, which is essential for filing personal income tax returns in New York State. The instructions cover various aspects, including eligibility criteria, required documentation, and specific line-by-line guidance to ensure compliance with state tax laws.

Steps to complete the PDF Instructions For Form IT 201

Completing the PDF Instructions for Form IT 201 involves several key steps:

- Review the eligibility criteria to confirm that you qualify to use Form IT 201.

- Gather all necessary documents, such as W-2 forms, 1099 forms, and any other income statements.

- Follow the line-by-line instructions in the PDF to fill out the form accurately.

- Double-check all entries for accuracy and completeness before submission.

- Choose your submission method: online, by mail, or in person, as detailed in the instructions.

Key elements of the PDF Instructions For Form IT 201

The key elements of the PDF Instructions for Form IT 201 include:

- Filing Status: Information on how to determine your filing status, which affects your tax rate and eligibility for certain credits.

- Income Reporting: Guidelines on how to report various types of income, including wages, dividends, and unemployment compensation.

- Tax Credits: Details on available tax credits that may reduce your overall tax liability, such as the Earned Income Credit.

- Signature Requirements: Instructions for signing the form, which are crucial for its validity.

Filing Deadlines / Important Dates

Filing deadlines for Form IT 201 are critical to avoid penalties. Typically, the deadline for submitting your New York State income tax return is April 15th. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to check for any updates or changes in deadlines each tax year.

Form Submission Methods

Taxpayers have several options for submitting Form IT 201:

- Online Submission: Many taxpayers choose to file electronically through approved e-filing services, which can expedite processing and reduce errors.

- Mail: Completed forms can be mailed to the designated address provided in the instructions. Ensure to use the correct postage and consider certified mail for tracking.

- In-Person: Some taxpayers may opt to submit their forms in person at a local tax office, which may provide immediate confirmation of receipt.

Eligibility Criteria

To file Form IT 201, taxpayers must meet specific eligibility criteria, including:

- Residency: You must be a resident of New York State for the entire tax year.

- Income Limits: There may be income thresholds that determine your eligibility to use this form.

- Filing Status: Your filing status must align with the requirements set forth in the instructions.

Quick guide on how to complete pdf instructions for form it 201 department of taxation and finance

Effortlessly Prepare PDF Instructions For Form IT 201 Department Of Taxation And Finance on Any Device

Digital document management has become increasingly favored by enterprises and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, enabling you to access the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without any holdups. Handle PDF Instructions For Form IT 201 Department Of Taxation And Finance on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign PDF Instructions For Form IT 201 Department Of Taxation And Finance with Ease

- Find PDF Instructions For Form IT 201 Department Of Taxation And Finance and click on Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to confirm your changes.

- Select your preferred method to send your form via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, frustrating form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign PDF Instructions For Form IT 201 Department Of Taxation And Finance and ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf instructions for form it 201 department of taxation and finance

Create this form in 5 minutes!

How to create an eSignature for the pdf instructions for form it 201 department of taxation and finance

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the IT 201 tax form and why is it important?

The IT 201 tax form is a New York State income tax return that individuals use to report their income and calculate their taxes owed. It's important because it ensures compliance with state tax laws and helps taxpayers to claim any eligible tax credits and deductions, ultimately impacting their financial health.

-

How can airSlate SignNow assist with the IT 201 tax form process?

airSlate SignNow streamlines the process of preparing and submitting the IT 201 tax form by allowing users to easily fill out, sign, and send documents electronically. This reduces the hassle of physical paperwork and enhances the efficiency of tax preparation.

-

What are the costs associated with using airSlate SignNow for the IT 201 tax form?

airSlate SignNow offers various subscription plans with competitive pricing to cater to different business needs. You can choose a plan that fits your budget, allowing you to efficiently manage documents related to the IT 201 tax form without breaking the bank.

-

Are there specific features in airSlate SignNow that help with the IT 201 tax form?

Yes, airSlate SignNow offers features such as templates, customizable workflows, and secure eSigning, which simplify the process of completing the IT 201 tax form. These features reduce errors and speed up the completion time for tax-related documents.

-

Can airSlate SignNow integrate with accounting software for the IT 201 tax form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enabling users to easily import and export data related to the IT 201 tax form. This integration enhances workflow efficiency and helps maintain accurate financial records.

-

Is airSlate SignNow secure for handling sensitive tax documents like the IT 201 tax form?

Yes, airSlate SignNow prioritizes security and complies with industry standards to protect sensitive information, including documents such as the IT 201 tax form. Your data is encrypted, ensuring it remains confidential and secure during the signing process.

-

What benefits can I expect from using airSlate SignNow for the IT 201 tax form?

Using airSlate SignNow for the IT 201 tax form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced accessibility. These advantages free up valuable time for tax preparers and ensure a smoother filing experience.

Get more for PDF Instructions For Form IT 201 Department Of Taxation And Finance

- Volunteer personality quiz pdf form

- Beauty pageant application form pdf 340117499

- Personal statement for masters example pdf form

- Dayc 2 examiners manual pdf form

- Independent major declaration form grinnell college web grinnell

- Request form for official copies of your evaluation 03 doc

- Mpt logistics form

- Www azed govadultedserviceshse transcript requesthse transcript requestarizona department of education form

Find out other PDF Instructions For Form IT 201 Department Of Taxation And Finance

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter