Printable New York Form it 201 Individual Income Tax Department of Taxation and FinanceNew York Form it 201 Individual Income Ta 2021

Understanding the Printable New York Form IT-201

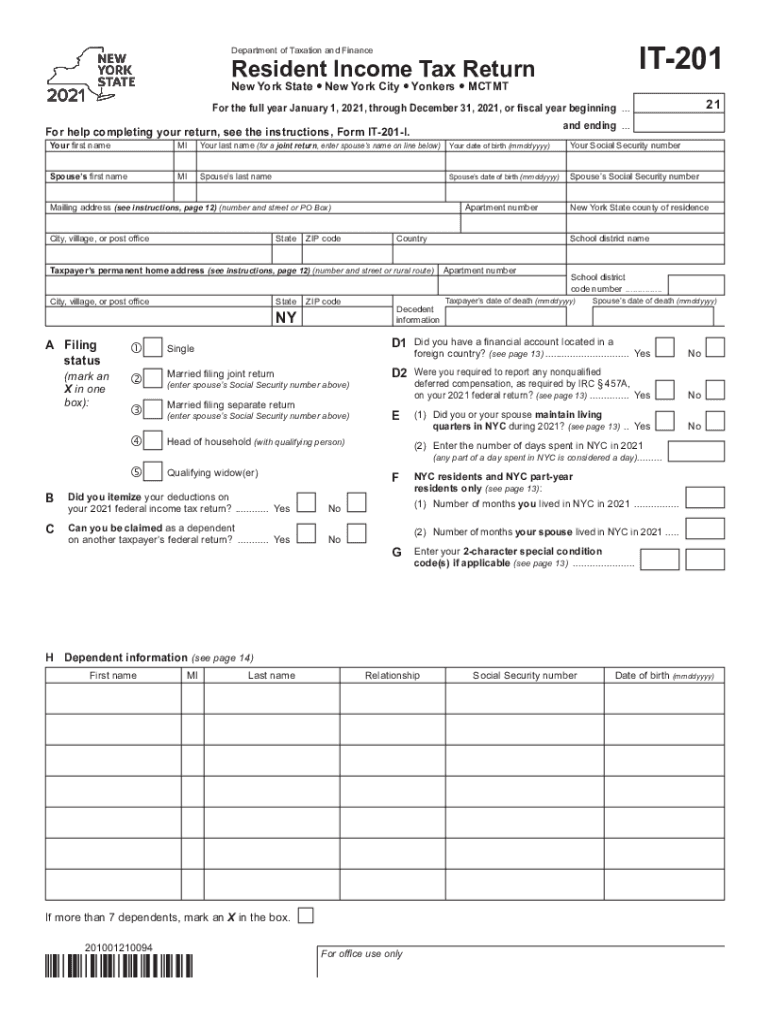

The Printable New York Form IT-201 is the Individual Income Tax Return used by residents of New York State to report their income and calculate their tax liability. This form is essential for individuals who earn income in New York and need to comply with state tax regulations. The IT-201 form includes sections for reporting various types of income, deductions, and credits, making it a comprehensive tool for tax preparation.

Steps to Complete the Printable New York Form IT-201

Completing the Printable New York Form IT-201 involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Input your total income from all sources in the designated sections.

- Claim deductions and credits: Identify any eligible deductions or credits that can reduce your taxable income.

- Calculate tax liability: Follow the instructions to determine the amount of tax owed or the refund due.

- Sign and date the form: Ensure that you sign and date the form before submission.

Legal Use of the Printable New York Form IT-201

The Printable New York Form IT-201 is legally recognized by the New York State Department of Taxation and Finance. To be considered valid, the form must be completed accurately and submitted by the specified deadlines. Electronic signatures are accepted, provided they comply with eSignature laws in the United States. This ensures that the form is legally binding and can be used for official tax purposes.

Obtaining the Printable New York Form IT-201

The Printable New York Form IT-201 can be obtained directly from the New York State Department of Taxation and Finance website. It is available in PDF format, allowing users to download, print, and fill it out manually. Additionally, many tax preparation software programs offer the IT-201 form as part of their services, making it easier for taxpayers to complete their returns electronically.

Filing Deadlines for the Printable New York Form IT-201

It is important to be aware of the filing deadlines associated with the Printable New York Form IT-201. Typically, the form must be submitted by April 15 for the previous tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions they may need to file their returns, which can be requested through the appropriate channels.

Required Documents for Completing the IT-201

When filling out the Printable New York Form IT-201, certain documents are essential to ensure accurate reporting:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductible expenses

- Proof of tax credits, if applicable

Having these documents ready will streamline the process and help avoid errors that could lead to complications with the tax filing.

Quick guide on how to complete printable 2020 new york form it 201 individual income tax department of taxation and financenew york form it 201 individual

Effortlessly Prepare Printable New York Form IT 201 Individual Income Tax Department Of Taxation And FinanceNew York Form IT 201 Individual Income Ta on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Administer Printable New York Form IT 201 Individual Income Tax Department Of Taxation And FinanceNew York Form IT 201 Individual Income Ta on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to Edit and eSign Printable New York Form IT 201 Individual Income Tax Department Of Taxation And FinanceNew York Form IT 201 Individual Income Ta Without Stress

- Locate Printable New York Form IT 201 Individual Income Tax Department Of Taxation And FinanceNew York Form IT 201 Individual Income Ta and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Printable New York Form IT 201 Individual Income Tax Department Of Taxation And FinanceNew York Form IT 201 Individual Income Ta and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 new york form it 201 individual income tax department of taxation and financenew york form it 201 individual

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 new york form it 201 individual income tax department of taxation and financenew york form it 201 individual

The best way to generate an e-signature for a PDF online

The best way to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The best way to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

The best way to create an e-signature for a PDF on Android

People also ask

-

What is the IT 201 form PDF, and why is it important?

The IT 201 form PDF is a crucial document for New York State taxpayers, used to report income and calculate personal income tax. Having the correct form ensures compliance with state tax regulations, helping you avoid penalties. Utilizing tools like airSlate SignNow can simplify the eSigning process for this important document.

-

How can I eSign the IT 201 form PDF using airSlate SignNow?

To eSign the IT 201 form PDF using airSlate SignNow, simply upload your document to the platform, add recipient email addresses, and place signature fields. The intuitive interface makes the process quick and straightforward, ensuring your form is signed securely and efficiently. You can send, track, and manage your forms all in one place.

-

Is there a cost associated with using airSlate SignNow for the IT 201 form PDF?

airSlate SignNow offers various pricing plans to cater to different business needs, including a free trial option. The cost-effective solution is designed to save you time and resources while preparing and sending the IT 201 form PDF. Review our pricing page for detailed options and see which plan fits your requirements best.

-

What features make airSlate SignNow ideal for handling the IT 201 form PDF?

airSlate SignNow provides features such as advanced security, customizable templates, and real-time document tracking that are perfect for handling the IT 201 form PDF. The platform allows for seamless collaboration and ensures that all your documents are stored securely. You can easily access your signed forms whenever needed.

-

Can I integrate airSlate SignNow with other software to manage the IT 201 form PDF?

Yes, airSlate SignNow offers integrations with numerous third-party applications like Google Drive and Dropbox, enabling you to manage the IT 201 form PDF conveniently. These integrations help streamline your workflow by allowing you to access and manage all your documents in one place. Check our integrations page for a complete list of supported apps.

-

What are the benefits of using airSlate SignNow for the IT 201 form PDF?

Using airSlate SignNow for the IT 201 form PDF offers several benefits including ease of use, increased efficiency, and secure storage. The platform helps you complete your document signing processes quickly, ensuring that you meet tax deadlines without hassle. Additionally, all signed documents are stored securely and can be accessed anytime.

-

How secure is my information when using airSlate SignNow for the IT 201 form PDF?

airSlate SignNow employs advanced encryption and security measures to ensure that your information, including the IT 201 form PDF, is safe. The platform adheres to industry-leading security standards to protect your data from unauthorized access. You can eSign your documents with confidence knowing that your sensitive information is secure.

Get more for Printable New York Form IT 201 Individual Income Tax Department Of Taxation And FinanceNew York Form IT 201 Individual Income Ta

Find out other Printable New York Form IT 201 Individual Income Tax Department Of Taxation And FinanceNew York Form IT 201 Individual Income Ta

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney

- How Do I Electronic signature South Carolina Unlimited Power of Attorney

- How Can I Electronic signature Alaska Limited Power of Attorney

- How To Electronic signature Massachusetts Retainer Agreement Template

- Electronic signature California Limited Power of Attorney Now

- Electronic signature Colorado Limited Power of Attorney Now

- Electronic signature Georgia Limited Power of Attorney Simple

- Electronic signature Nevada Retainer Agreement Template Myself

- Electronic signature Alabama Limited Partnership Agreement Online

- Can I Electronic signature Wisconsin Retainer Agreement Template

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy