it 201 Form 2015

What is the It 201 Form

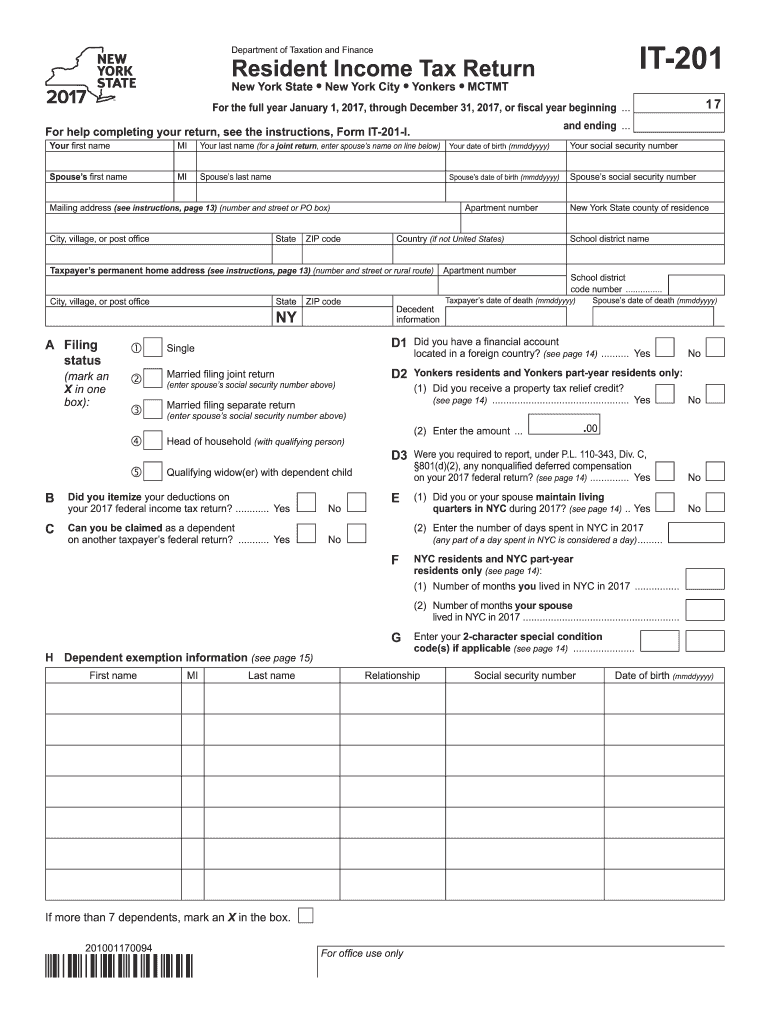

The It 201 Form is a tax document used by residents of New York State to report their personal income tax. This form is essential for individuals who need to calculate their tax liability based on their income earned during the tax year. It serves as a comprehensive tool for taxpayers, allowing them to detail their earnings, deductions, and credits to determine the amount owed or refunded by the state. The form is designed to comply with New York State tax laws and regulations, ensuring that individuals fulfill their tax obligations accurately.

How to use the It 201 Form

Using the It 201 Form involves several key steps to ensure accurate reporting of your income. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your total income, adjustments, and deductions in the appropriate sections. Be sure to follow the instructions carefully to avoid errors. Once completed, review the form for accuracy before submitting it. The It 201 Form can be filed electronically or mailed to the New York State Department of Taxation and Finance, depending on your preference.

Steps to complete the It 201 Form

Completing the It 201 Form requires a systematic approach to ensure all information is accurately reported. Here are the essential steps:

- Gather Documents: Collect all income statements, including W-2s and 1099s.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Include all sources of income in the designated sections.

- Claim Deductions: Identify and enter applicable deductions to reduce taxable income.

- Calculate Tax Liability: Use the tax tables provided with the form to determine your tax owed or refund due.

- Review and Sign: Ensure all information is accurate, then sign and date the form.

- Submit: File electronically or mail the completed form to the appropriate address.

Legal use of the It 201 Form

The It 201 Form must be completed and submitted in accordance with New York State tax laws. It is legally binding, meaning that the information provided must be truthful and accurate. Failure to comply with the legal requirements can result in penalties, including fines or interest on unpaid taxes. Taxpayers are encouraged to keep copies of their submitted forms and any supporting documentation for their records, as these may be needed for future reference or audits.

Filing Deadlines / Important Dates

Timely filing of the It 201 Form is crucial to avoid penalties. The standard deadline for submitting the form is typically April fifteenth of each year for the previous tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, as well as specific dates for estimated tax payments if applicable. Keeping track of these deadlines helps ensure compliance with state tax regulations.

Form Submission Methods

The It 201 Form can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file electronically using approved e-filing software, which often provides a streamlined process and instant confirmation of receipt. Alternatively, the form can be printed, signed, and mailed to the New York State Department of Taxation and Finance. In-person submissions are also accepted at designated tax offices, although this method may require an appointment. Each submission method has its own advantages, such as speed or personal assistance.

Quick guide on how to complete it 201 2015 form

Your assistance manual on how to prepare your It 201 Form

If you’re curious about how to create and submit your It 201 Form, here are a few brief instructions on how to simplify tax submission.

To start, you just need to sign up for your airSlate SignNow account to transform your document handling online. airSlate SignNow is an incredibly user-friendly and effective document solution that enables you to modify, generate, and finalize your tax documents with ease. With its editor, you can toggle between text, checkboxes, and eSignatures while being able to revisit to amend details as necessary. Enhance your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your It 201 Form within moments:

- Set up your account and begin working on PDFs in moments.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Click Obtain form to access your It 201 Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-binding eSignature (if required).

- Review your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically with airSlate SignNow. Please be aware that filing on paper can increase errors and delay refunds. Additionally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct it 201 2015 form

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do I fill up form for SNAP 2015?

Hey! Firstly I do hope that you know all about the SNAP as then you will be better prepared for the examination. The SNAP 2015 Application Form for the examination is completely online and is done in two stages namely the test registration and the registration to the individual colleges post the examination. In the linked article you will get the complee process of applying online. Good luck!

-

What is the link for filling out the CAT 2015 form?

CAT 2014

-

How can I fill out an ITR for year 2015-16?

Try ClearTax, the easiest e-filing platform in India

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

Create this form in 5 minutes!

How to create an eSignature for the it 201 2015 form

How to create an eSignature for the It 201 2015 Form online

How to generate an eSignature for your It 201 2015 Form in Chrome

How to create an eSignature for signing the It 201 2015 Form in Gmail

How to make an electronic signature for the It 201 2015 Form straight from your mobile device

How to generate an electronic signature for the It 201 2015 Form on iOS devices

How to create an electronic signature for the It 201 2015 Form on Android devices

People also ask

-

What is the IT 201 Form and why is it important?

The IT 201 Form is a crucial tax document used by New York residents to report their income tax obligations. Understanding and accurately completing the IT 201 Form is vital to ensure compliance with state tax laws and to avoid penalties. airSlate SignNow provides a seamless way to eSign this form, making the process easier and more efficient.

-

How can I eSign the IT 201 Form using airSlate SignNow?

With airSlate SignNow, eSigning the IT 201 Form is simple. After uploading your form, you can easily add your electronic signature and date, ensuring your document is legally binding. This streamlined process saves you time and effort, allowing you to focus on other important tasks.

-

Is there a cost associated with using airSlate SignNow for the IT 201 Form?

airSlate SignNow offers flexible pricing plans to accommodate various user needs, including a free trial for new users. You can choose a plan that best fits your business requirements, ensuring you have the tools necessary to manage your IT 201 Form efficiently without breaking the bank.

-

What features does airSlate SignNow offer for handling the IT 201 Form?

airSlate SignNow includes features such as document templates, real-time collaboration, and secure storage, all designed to enhance your experience with the IT 201 Form. Additionally, our intuitive interface allows you to complete and send your forms quickly, ensuring a smooth workflow.

-

Can I integrate airSlate SignNow with other applications for the IT 201 Form?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, allowing you to enhance your workflow when dealing with the IT 201 Form. Whether you use CRM systems, cloud storage services, or other business tools, our integrations help you streamline your processes and keep everything organized.

-

What are the benefits of using airSlate SignNow for the IT 201 Form?

Using airSlate SignNow to manage your IT 201 Form offers several advantages, including time savings, enhanced security, and improved accuracy. Our platform reduces the risk of errors by allowing you to fill out and sign forms electronically, ensuring you meet all tax deadlines efficiently.

-

Is airSlate SignNow compliant with legal standards for the IT 201 Form?

Absolutely! airSlate SignNow complies with all necessary legal standards for electronic signatures, ensuring that your IT 201 Form is valid and recognized by tax authorities. Our platform utilizes advanced encryption and security measures to protect your sensitive information throughout the signing process.

Get more for It 201 Form

- The burden report cardiovascular disease ampamp stroke in texas form

- Divorce in washington form

- Marriage divorce certificate counter order form

- Wic vendor agreement between the state of wisconsin form

- Formulaire grc 5592

- Driver assessment form

- Driver assessment form 74316815

- S175 permission to transfer goods between certain vessels s175 permission to transfer goods between certain vessels form

Find out other It 201 Form

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation