Tax Form it 201 2018

What is the Tax Form It 201

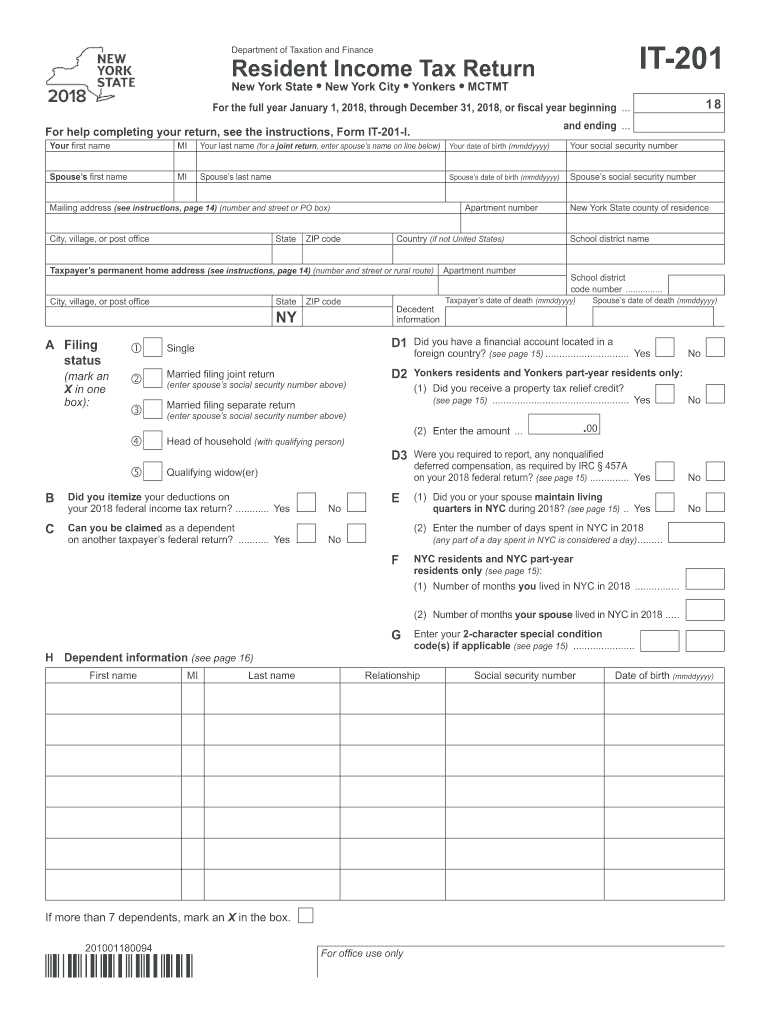

The IT-201 form is a New York State resident income tax return used by individuals to report their income and calculate their tax liability. This form is essential for residents who earn income within the state and need to comply with New York tax laws. It includes various sections where taxpayers can detail their income sources, deductions, and credits. Understanding the purpose of the IT-201 form is crucial for accurate tax reporting and compliance.

Steps to complete the Tax Form It 201

Completing the IT-201 form involves several key steps to ensure accuracy and compliance with state tax regulations. First, gather all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, fill in personal information, such as your name, address, and Social Security number. Then, report all sources of income and apply any applicable deductions or credits. It is important to double-check all entries for accuracy before signing and submitting the form.

How to obtain the Tax Form It 201

The IT-201 form can be obtained through the New York State Department of Taxation and Finance website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, taxpayers can access fillable online versions that allow for digital completion. It is advisable to ensure that you are using the correct version of the form for the tax year you are filing.

Legal use of the Tax Form It 201

The IT-201 form must be used in accordance with New York State tax laws. It is legally binding once signed and submitted, and taxpayers are responsible for the accuracy of the information provided. Using the form correctly helps avoid penalties and ensures compliance with state tax obligations. It is important to keep copies of submitted forms and any supporting documents for future reference and potential audits.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines for the IT-201 form to avoid penalties. Generally, the form is due on April fifteenth of the year following the tax year being reported. If April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any changes or extensions that may apply each tax year.

Form Submission Methods (Online / Mail / In-Person)

The IT-201 form can be submitted through various methods to accommodate different preferences. Taxpayers can file online using the New York State Department of Taxation and Finance e-file system, which offers a secure and efficient way to submit forms. Alternatively, the completed form can be mailed to the appropriate address listed in the form instructions. In some cases, individuals may also be able to submit the form in person at designated tax offices.

Quick guide on how to complete it 201 2018 2019 form

Your assistance manual on preparing your Tax Form It 201

If you’re wondering how to fill out and submit your Tax Form It 201, here are some brief guidelines on making tax submission simpler.

To begin, you merely need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that allows you to modify, draft, and finalize your income tax forms with ease. With its editor, you can alternate between text, checkboxes, and eSignatures, and return to amend responses as necessary. Streamline your tax organization with advanced PDF editing, eSigning, and easy sharing.

Follow the steps outlined below to finalize your Tax Form It 201 in just a few minutes:

- Create your account and begin editing PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your Tax Form It 201 in our editor.

- Complete the necessary fillable sections with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Review your document and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to submit your taxes electronically with airSlate SignNow. Be aware that submitting on paper can lead to increased return errors and postponed reimbursements. Naturally, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct it 201 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

Which ITR form should an NRI fill out for AY 2018–2019 if there are two rental incomes in India other than that from interests?

Choosing Correct Income Tax form is the important aspect of filling Income tax return.Lets us discuss it one by one.ITR -1 —— Mainly used for salary income , other source income, one house property income ( upto Rs. 50 Lakhs ) for Individual Resident Assessees only.ITR-2 —- For Salary Income , Other source income ( exceeding Rs. 50 lakhs) house property income from more than one house and Capital Gains / Loss Income for Individual Resident or Non- Resident Assessees and HUF Assessees only.ITR 3— Income from Business or profession Together with any other income such as Salary Income, Other sources, Capital Gains , House property ( Business/ Profession income is must for filling this form) . For individual and HUF Assessees OnlySo in case NRI Assessees having rental income from two house property , then ITR need to be filed in Form ITR 2.For Detail understanding please refer to my video link.

-

Is it advantageous to fill out the JEE Mains 2018 form as soon as possible?

Yes. It is advantageous to fill out the JEE Mains 2018 form as soon as possible? Click here to know more about what are the advantage of filling JEE Main Application Form Earlier.

-

How do I fill out the BHU's form of B.Com in 2018 and crack it?

you can fill from to go through bhu portal and read all those instruction and download previous year question paper . that u will get at the portal and solve more and more question paper and read some basics from your study level .focus on study save ur time and energy .do best to achieve your goal .for more detail discus with gajendra ta mtech in iit bhu .AND PKN .good luck .

Create this form in 5 minutes!

How to create an eSignature for the it 201 2018 2019 form

How to create an electronic signature for the It 201 2018 2019 Form online

How to create an electronic signature for your It 201 2018 2019 Form in Google Chrome

How to make an electronic signature for putting it on the It 201 2018 2019 Form in Gmail

How to generate an electronic signature for the It 201 2018 2019 Form right from your smartphone

How to generate an eSignature for the It 201 2018 2019 Form on iOS

How to make an eSignature for the It 201 2018 2019 Form on Android OS

People also ask

-

What is Tax Form It 201 and how does it work with airSlate SignNow?

Tax Form It 201 is a specific tax document used for reporting income and deductions. With airSlate SignNow, you can easily prepare, send, and eSign Tax Form It 201, ensuring that your submissions are both efficient and compliant with tax regulations. Our platform streamlines the process, allowing users to manage their tax forms digitally.

-

How can I integrate Tax Form It 201 into my existing workflows?

Integrating Tax Form It 201 into your workflows is simple with airSlate SignNow. Our platform offers seamless integrations with popular tools like Google Drive, Dropbox, and more, allowing you to import and manage your tax forms efficiently. You can easily create templates for Tax Form It 201 to standardize submissions across your organization.

-

What are the pricing options for using airSlate SignNow for Tax Form It 201?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses alike. Whether you’re a small business or a large enterprise, you can choose a plan that allows you to manage Tax Form It 201 and other documents cost-effectively. Explore our pricing page to find the right option for your needs.

-

Can airSlate SignNow help me track the status of my Tax Form It 201 submissions?

Yes, airSlate SignNow provides robust tracking features for your Tax Form It 201 submissions. You can easily monitor the status of sent documents, receive notifications when they are viewed or signed, and maintain an organized record of all transactions. This ensures you stay updated throughout the process.

-

Is it secure to eSign Tax Form It 201 using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your documents, including Tax Form It 201. We utilize advanced encryption protocols and comply with industry standards to protect your sensitive information. You can confidently eSign your tax forms knowing they are secure.

-

What features does airSlate SignNow offer for managing Tax Form It 201?

airSlate SignNow offers a variety of features to enhance your management of Tax Form It 201. These include customizable templates, automated reminders for deadlines, and the ability to collect signatures from multiple parties. Our user-friendly interface makes it easy to navigate through these features.

-

Can I use airSlate SignNow on mobile devices to manage Tax Form It 201?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage Tax Form It 201 on the go. Whether you’re at the office or traveling, you can access, edit, and eSign your tax forms directly from your smartphone or tablet. This flexibility enhances productivity and convenience.

Get more for Tax Form It 201

Find out other Tax Form It 201

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online