Form 14134

Understanding Form 14135

The IRS Form 14135, also known as the IRS discharge form 14135, is primarily used for the purpose of discharging a tax lien. This form allows taxpayers to request the removal of a federal tax lien from public records once their tax obligations have been satisfied. It is essential for individuals and businesses looking to clear their financial records and improve their credit standing.

Steps to Complete Form 14135

Completing the IRS Form 14135 involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your personal identification details and tax account information. Follow these steps:

- Provide your name, address, and taxpayer identification number.

- Indicate the specific tax periods for which the lien was filed.

- Attach any supporting documentation that verifies the satisfaction of your tax obligations.

- Review the form for completeness and accuracy before submission.

It is crucial to ensure all information is correct to avoid delays in processing your request.

Legal Use of Form 14135

The IRS Form 14135 is legally binding when completed and submitted correctly. To ensure its legal validity, it must comply with the requirements set forth by the IRS. This includes providing accurate information and submitting the form within the designated timeframe. Once approved, the discharge will be recorded, and the lien will be removed from public records, allowing for a fresh start in financial matters.

Filing Deadlines and Important Dates

Timeliness is essential when submitting Form 14135. While there are no strict deadlines for filing this form, it is advisable to submit it as soon as your tax obligations have been met. Delays in filing may prolong the presence of the lien on your record, potentially impacting your credit score and financial opportunities.

Form Submission Methods

IRS Form 14135 can be submitted through various methods to accommodate different preferences. You can choose to file the form online, which is the most efficient method, or you may opt to send it via mail. If you prefer in-person submission, visiting your local IRS office is also an option. Ensure that you keep a copy of the submitted form for your records, regardless of the submission method chosen.

Required Documents for Form 14135

When preparing to submit Form 14135, certain documents may be required to support your request. These documents typically include:

- Proof of payment or settlement of the tax liability.

- Any correspondence from the IRS regarding the lien.

- Identification documents to verify your identity.

Having these documents ready can streamline the process and help ensure a successful discharge of the lien.

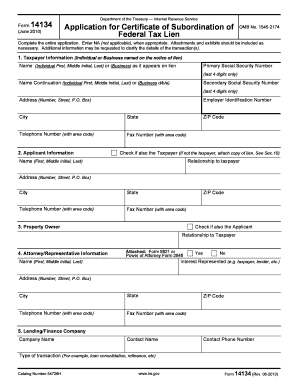

Quick guide on how to complete form 14134

Effortlessly Prepare Form 14134 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It presents an ideal environmentally friendly alternative to traditional printed and signed forms, allowing you to access the necessary document and securely store it online. airSlate SignNow equips you with all the resources required to generate, modify, and electronically sign your documents swiftly and without delays. Manage Form 14134 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to modify and electronically sign Form 14134 with ease

- Locate Form 14134 and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of the documents or redact confidential information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 14134 and ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14134

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 14135 and how does it work?

Form 14135 is an essential document for specific federal procedures, and airSlate SignNow simplifies its signing and submission process. With airSlate SignNow, users can easily fill out, eSign, and share form 14135 securely online. The platform's user-friendly interface allows for a seamless experience, ensuring compliance and efficiency.

-

Is there a free trial available for using airSlate SignNow with form 14135?

Yes, airSlate SignNow offers a free trial that allows users to explore all features, including the handling of form 14135. This trial period enables potential customers to experience the ease of electronic signatures and document management without any initial investment. It's a great way to see how airSlate SignNow can improve your workflow.

-

Can I integrate airSlate SignNow with other tools for processing form 14135?

Absolutely! airSlate SignNow offers a variety of integrations with popular tools such as Google Drive, Dropbox, and CRM systems, which can enhance the processing of form 14135. By connecting your existing workflow tools with airSlate SignNow, you can streamline document management and signature processes, making it more efficient.

-

What are the security features provided by airSlate SignNow for form 14135?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like form 14135. The platform implements industry-standard encryption protocols and ensures secure storage, protecting your documents throughout the signing process. Additionally, airSlate SignNow complies with regulations such as GDPR, ensuring that your data is safe and private.

-

How much does airSlate SignNow cost for processing form 14135?

airSlate SignNow offers flexible pricing plans that cater to various business needs when it comes to processing form 14135. Users can choose from individual, business, or enterprise plans, with different features and capacities depending on their requirements. This ensures that everyone can find a suitable option that fits their budget.

-

Can I use airSlate SignNow for multiple forms, including form 14135?

Yes, airSlate SignNow is designed to handle multiple document types, including various forms like form 14135. This capability allows users to manage all their documentation needs under one platform, facilitating a more organized and efficient workflow. Whether you need eSignatures for contracts, agreements, or different forms, airSlate SignNow has you covered.

-

What are the benefits of using airSlate SignNow for form 14135?

Using airSlate SignNow for form 14135 offers numerous benefits, such as time-saving eSigning capabilities and increased accuracy during form completion. The platform helps eliminate paper-based processes, reducing administrative overhead and the risk of errors. Additionally, users can track document status in real time, ensuring a seamless process from start to finish.

Get more for Form 14134

Find out other Form 14134

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online