Nd Form 307

What is the North Dakota Form 307?

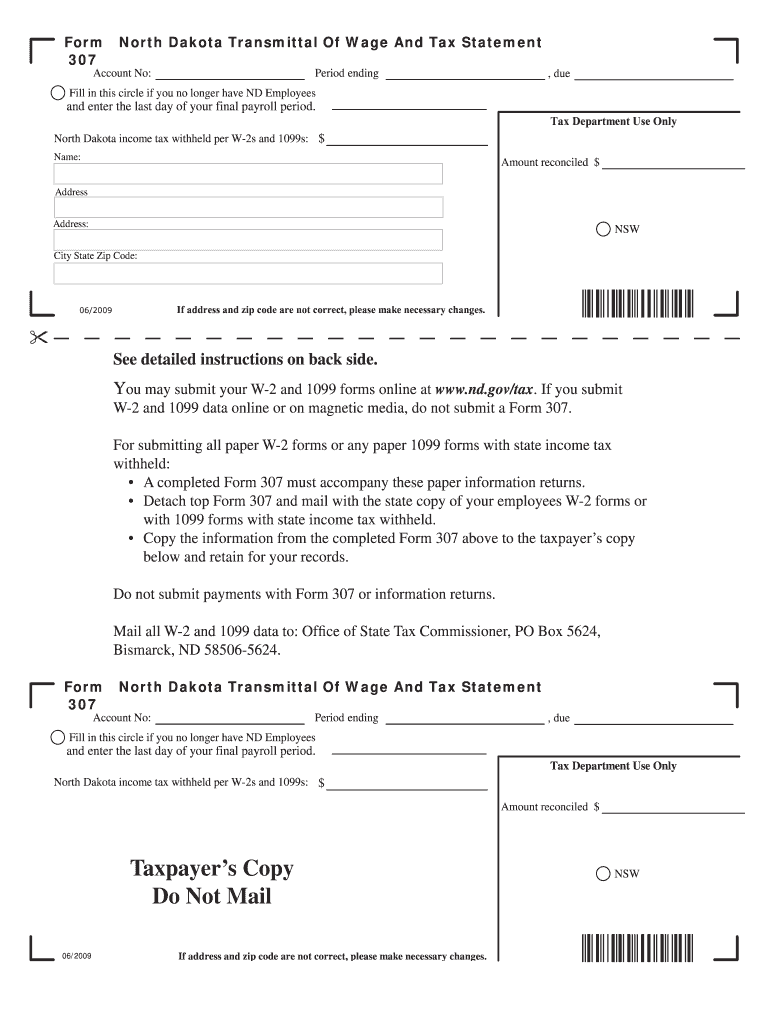

The North Dakota Form 307, also known as the Transmittal of Wage and Tax Statements, is a crucial document used by employers to report wages paid and taxes withheld for their employees. This form is essential for ensuring compliance with state tax regulations and is typically submitted to the North Dakota Office of State Tax Commissioner. It serves as a summary of the information reported on individual employee W-2 forms, consolidating data for easier processing and review.

Steps to Complete the North Dakota Form 307

Completing the North Dakota Form 307 involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant employee wage and tax information, including total wages paid, state income tax withheld, and any other pertinent details. Next, accurately fill out the required fields on the form, ensuring that all figures match those reported on the individual W-2 forms. After completing the form, review it carefully for any errors or omissions before submission.

Legal Use of the North Dakota Form 307

The North Dakota Form 307 is legally binding when completed correctly and submitted on time. It adheres to the guidelines set forth by the North Dakota Office of State Tax Commissioner and complies with federal regulations. Proper use of this form ensures that employers meet their tax obligations and helps avoid penalties associated with non-compliance. It is important for employers to understand their responsibilities regarding wage reporting and tax withholding to maintain legal compliance.

How to Obtain the North Dakota Form 307

The North Dakota Form 307 can be obtained through the North Dakota Office of State Tax Commissioner's website. Employers may also find the form available in various tax preparation software programs. It is advisable to ensure that you are using the most current version of the form to comply with any updates in tax regulations. For those who prefer a paper version, the form can be printed directly from the website.

Form Submission Methods

Employers have several options for submitting the North Dakota Form 307. The form can be filed electronically through the North Dakota Office of State Tax Commissioner's online portal, which is the preferred method for many due to its efficiency and speed. Alternatively, employers may choose to mail the completed form to the designated address provided on the form itself. In-person submissions are also an option, although less common. It is essential to keep track of submission deadlines to avoid late fees or penalties.

Filing Deadlines / Important Dates

Timely filing of the North Dakota Form 307 is critical to avoid penalties. The form is typically due by the end of January following the tax year being reported. Employers should be aware of any changes to deadlines and ensure that they submit the form along with any associated payments by the specified due date. Keeping a calendar of important tax dates can help employers stay organized and compliant.

Quick guide on how to complete form 307 north dakota transmittal of wage and tax statement form 307 north dakota transmittal of wage and tax statement

Effortlessly Prepare Nd Form 307 on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly without delays. Manage Nd Form 307 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and Electronically Sign Nd Form 307

- Obtain Nd Form 307 and select Get Form to begin.

- Make use of the tools available to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional ink signature.

- Review all information and click the Done button to save your modifications.

- Select your preferred method for sharing your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require new document printouts. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Nd Form 307 while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I get a copy of my wage and tax statements (Form W-2)?

Ask your employer (or former employer). They were obligated to provide it to you by now. If they haven’t, perhaps they do not have your current address.If they know where to find you but are refusing to provide you your W-2, they are breaking the law. You should report them to the IRS as they may not be paying the taxes they have withheld from your wages which would be stealing from you (as well as the government). Report them immediately. You might even get a reward for turning them in.

Create this form in 5 minutes!

How to create an eSignature for the form 307 north dakota transmittal of wage and tax statement form 307 north dakota transmittal of wage and tax statement

How to create an electronic signature for your Form 307 North Dakota Transmittal Of Wage And Tax Statement Form 307 North Dakota Transmittal Of Wage And Tax Statement in the online mode

How to make an electronic signature for your Form 307 North Dakota Transmittal Of Wage And Tax Statement Form 307 North Dakota Transmittal Of Wage And Tax Statement in Google Chrome

How to generate an eSignature for putting it on the Form 307 North Dakota Transmittal Of Wage And Tax Statement Form 307 North Dakota Transmittal Of Wage And Tax Statement in Gmail

How to generate an electronic signature for the Form 307 North Dakota Transmittal Of Wage And Tax Statement Form 307 North Dakota Transmittal Of Wage And Tax Statement right from your smart phone

How to create an eSignature for the Form 307 North Dakota Transmittal Of Wage And Tax Statement Form 307 North Dakota Transmittal Of Wage And Tax Statement on iOS devices

How to create an electronic signature for the Form 307 North Dakota Transmittal Of Wage And Tax Statement Form 307 North Dakota Transmittal Of Wage And Tax Statement on Android devices

People also ask

-

What is the Nd Form 307 used for?

The Nd Form 307 is a crucial document utilized in various administrative processes, particularly in North Dakota. It is often used for reporting purposes and requires electronic signatures for authentication. With airSlate SignNow, you can easily create, send, and eSign Nd Form 307, streamlining your workflow.

-

How does airSlate SignNow simplify the Nd Form 307 process?

airSlate SignNow simplifies the Nd Form 307 process by providing an intuitive platform that allows users to prepare and manage documents electronically. You can easily customize the Nd Form 307, add signers, and track the signing process in real-time. This not only saves time but also enhances the accuracy of your submissions.

-

Is there a cost associated with using airSlate SignNow for Nd Form 307?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs. Each plan provides access to features that simplify the eSigning process for documents like the Nd Form 307. You can choose a plan that fits your budget and the volume of documents you need to manage.

-

Can I integrate airSlate SignNow with other software for processing Nd Form 307?

Absolutely! airSlate SignNow integrates seamlessly with numerous software applications, enhancing your ability to manage the Nd Form 307. Whether you're using CRM systems or project management tools, these integrations allow for a more cohesive workflow and data management.

-

What features does airSlate SignNow offer for managing Nd Form 307?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure storage for managing the Nd Form 307. Additionally, it provides options for adding multiple signers, ensuring that the signing process is efficient and organized.

-

How secure is the signing process for Nd Form 307 with airSlate SignNow?

The signing process for Nd Form 307 through airSlate SignNow is highly secure, utilizing encryption and robust authentication measures. This ensures that your documents remain confidential and are protected against unauthorized access, giving you peace of mind.

-

Can I use airSlate SignNow on mobile devices for Nd Form 307?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage and eSign Nd Form 307 on the go. Whether you’re using a smartphone or tablet, the mobile app provides a user-friendly experience for document management.

Get more for Nd Form 307

- Tc 40r utah recycling market development zones tax credit forms ampamp publications

- 2022 utah tc 40 individual income tax return forms ampamp publications

- Revised jee main 2022 dates for april blogbyjuscom form

- Hartford circle offering statementmortgage law form

- Welcome to boone county ky form

- Kentucky form 740 es estimated income tax return

- Judgeexecutive boone county ky form

- Boone county fiscal court tax forms fill and signboone county fiscal courtpva of boone county kyoccupational

Find out other Nd Form 307

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online