JudgeExecutive Boone County, KY 2022

Filing Deadlines / Important Dates

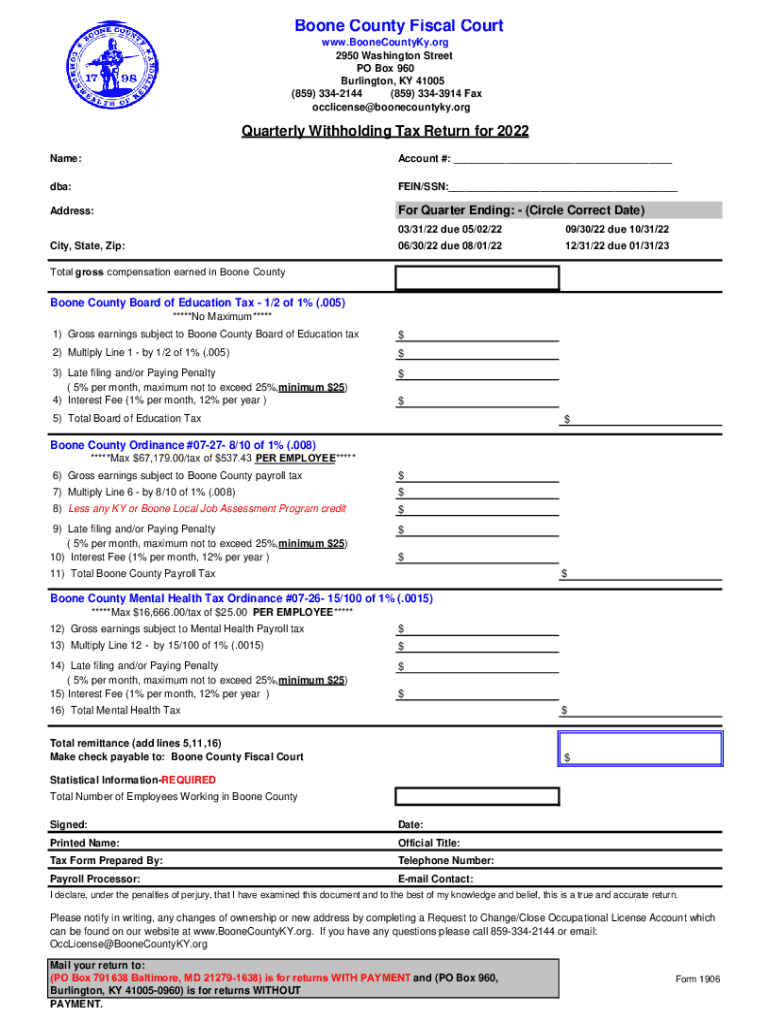

When preparing to submit your Kentucky withholding return, it is essential to be aware of the key filing deadlines. Typically, the Kentucky withholding return must be filed on a quarterly basis. For most employers, the due dates for these returns are:

- First quarter: Due by April 30

- Second quarter: Due by July 31

- Third quarter: Due by October 31

- Fourth quarter: Due by January 31 of the following year

It is important to adhere to these dates to avoid penalties and ensure compliance with state regulations.

Required Documents

To successfully complete the Kentucky withholding return, you will need specific documents. These typically include:

- Employee W-2 forms for reporting wages and withholding amounts

- Any relevant payroll records that detail employee earnings

- Documentation of any tax credits or adjustments applicable to your business

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in your submission.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting their Kentucky withholding return. These methods include:

- Online: Many businesses prefer to file electronically through the Kentucky Department of Revenue's online portal, which offers a streamlined process.

- Mail: You can also submit your return via traditional mail. Ensure that you send it to the correct address and allow enough time for delivery.

- In-Person: For those who prefer face-to-face interactions, visiting a local Department of Revenue office is an option.

Each method has its advantages, so choose the one that best fits your needs and ensures timely submission.

Penalties for Non-Compliance

Failure to file your Kentucky withholding return by the due date can result in penalties. These penalties may include:

- Late filing penalties, which can accumulate over time

- Interest on any unpaid taxes, calculated from the due date until payment is made

- Potential legal action for continued non-compliance

Understanding these consequences can motivate timely and accurate filing, helping to avoid unnecessary financial burdens.

Digital vs. Paper Version

Choosing between a digital and paper version of the Kentucky withholding return can affect your filing experience. The digital version often provides benefits such as:

- Faster processing times

- Immediate confirmation of submission

- Access to electronic records for easier tracking

Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. However, it can lead to longer processing times and potential delays.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios can influence how you approach the Kentucky withholding return. For instance:

- Self-employed individuals: They may need to make estimated tax payments throughout the year rather than withholding taxes from wages.

- Retired individuals: They might have different withholding requirements based on pension income.

- Students: If employed part-time, students may have specific considerations regarding their withholding status.

Understanding these scenarios can help tailor your approach to filing and ensure compliance with state tax laws.

Quick guide on how to complete judgeexecutive boone county ky

Easily Configure JudgeExecutive Boone County, KY on Any Device

Managing documents online has gained popularity among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage JudgeExecutive Boone County, KY on any device with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to Alter and Electronically Sign JudgeExecutive Boone County, KY with Ease

- Obtain JudgeExecutive Boone County, KY and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes requiring reprinting of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device. Modify and electronically sign JudgeExecutive Boone County, KY and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct judgeexecutive boone county ky

Create this form in 5 minutes!

People also ask

-

What is a Kentucky withholding return?

A Kentucky withholding return is a document that businesses must file to report the amount of taxes withheld from employee wages. Filing a Kentucky withholding return ensures compliance with state tax regulations and helps businesses avoid penalties.

-

How can airSlate SignNow help with my Kentucky withholding return?

airSlate SignNow simplifies the process of preparing and submitting your Kentucky withholding return by allowing you to securely eSign and send documents online. Our platform enhances efficiency and ensures that your returns are submitted accurately and on time.

-

Is airSlate SignNow cost-effective for filing Kentucky withholding returns?

Yes, airSlate SignNow offers affordable pricing plans that cater to various business needs. By utilizing our platform for your Kentucky withholding return, you can save both time and money while ensuring compliance with state tax laws.

-

What features does airSlate SignNow provide for managing Kentucky withholding returns?

airSlate SignNow provides features such as document templates, electronic signatures, and tracking capabilities. These tools make it easier to efficiently manage your Kentucky withholding return, streamlining the entire filing process.

-

Can I integrate airSlate SignNow with other accounting software for my Kentucky withholding return?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and payroll software, allowing you to easily manage your Kentucky withholding return alongside your financial reporting needs.

-

What are the benefits of using airSlate SignNow for my Kentucky withholding return?

Using airSlate SignNow for your Kentucky withholding return provides increased efficiency, accuracy, and security. You can reduce manual errors and ensure timely submissions, ultimately minimizing the risk of penalties associated with late filings.

-

How secure is airSlate SignNow when handling Kentucky withholding returns?

airSlate SignNow prioritizes security with advanced encryption and data protection measures. When handling your Kentucky withholding return, you can trust that your sensitive information is safe and secure.

Get more for JudgeExecutive Boone County, KY

Find out other JudgeExecutive Boone County, KY

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy