Fsa 2370 2014

What is the FSA 2370?

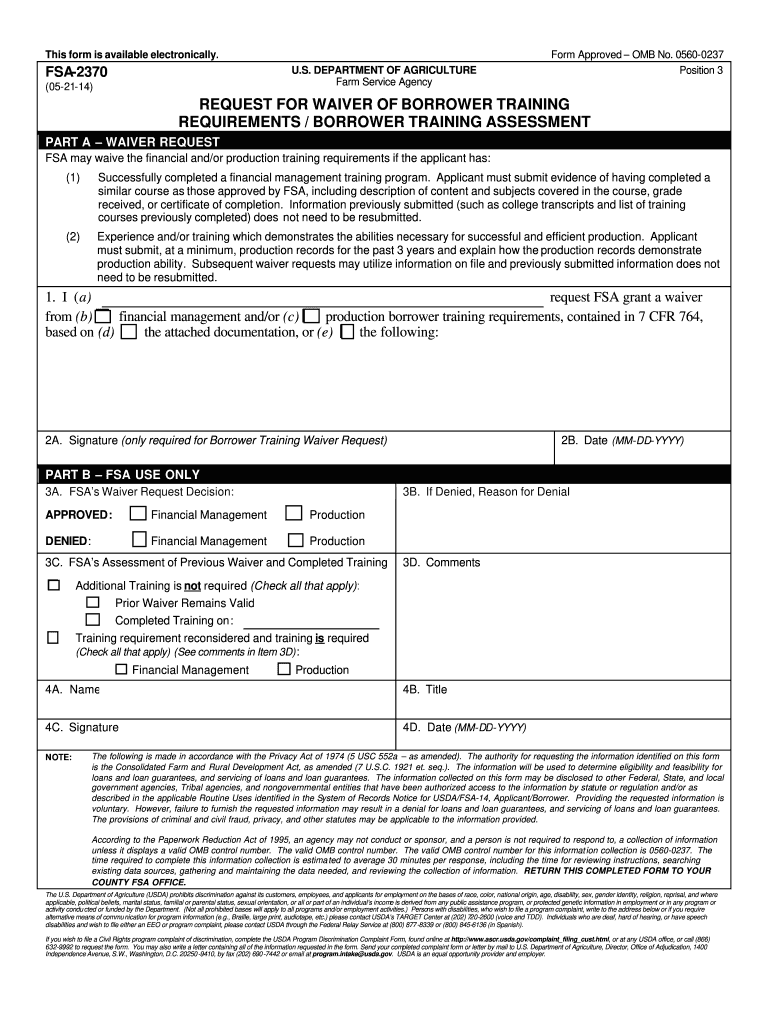

The FSA 2370 is a form used by the United States Department of Agriculture (USDA) for various agricultural programs. It is primarily associated with the Farm Service Agency (FSA) and is designed to collect necessary information from individuals or entities participating in these programs. The form may be required for applications related to farm loans, disaster assistance, or other agricultural benefits. Understanding the purpose and requirements of the FSA 2370 is essential for ensuring compliance and successful application processing.

How to Use the FSA 2370

Using the FSA 2370 involves several key steps. First, gather all relevant information, including personal identification details and any required documentation related to your agricultural operations. Next, carefully fill out the form, ensuring that all sections are completed accurately. Once the form is filled, you can submit it through the appropriate channels, which may include online submission, mailing, or in-person delivery at a USDA service center. It is important to review the completed form for accuracy before submission to avoid delays in processing.

Steps to Complete the FSA 2370

Completing the FSA 2370 involves a systematic approach:

- Step 1: Gather necessary documents, such as proof of identity and any supporting materials related to your agricultural activities.

- Step 2: Access the FSA 2370 form through the USDA website or obtain a physical copy from a local USDA service center.

- Step 3: Fill out the form, ensuring that you provide all required information accurately.

- Step 4: Review the completed form for any errors or omissions.

- Step 5: Submit the form via the designated method, whether online, by mail, or in person.

Legal Use of the FSA 2370

The FSA 2370 is legally binding when completed and submitted in accordance with USDA regulations. To ensure its legal validity, it is crucial to provide accurate information and comply with all applicable guidelines. The form may be subject to audits or reviews by USDA officials, so maintaining transparency and accuracy is essential. Additionally, electronic submissions must adhere to the eSignature laws to ensure that they are recognized as legally valid.

Required Documents

When completing the FSA 2370, certain documents may be required to support your application. These can include:

- Proof of identity, such as a driver's license or Social Security number.

- Documentation of agricultural operations, including farm ownership or lease agreements.

- Financial statements or records related to your farming activities.

- Any previous correspondence with the USDA or other relevant agencies.

Form Submission Methods

The FSA 2370 can be submitted through various methods, providing flexibility for users. These methods include:

- Online: Submit electronically through the USDA's online portal, ensuring compliance with eSignature laws.

- Mail: Send the completed form to your local USDA service center via postal mail.

- In-Person: Deliver the form directly to a USDA service center for immediate processing.

Quick guide on how to complete fsa 2370 usda service center eforms us department of forms sc egov usda

Complete Fsa 2370 effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Fsa 2370 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Fsa 2370 without hassle

- Obtain Fsa 2370 and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Mark important sections of your documents or redact sensitive details with tools offered by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Fsa 2370 to ensure flawless communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fsa 2370 usda service center eforms us department of forms sc egov usda

Create this form in 5 minutes!

How to create an eSignature for the fsa 2370 usda service center eforms us department of forms sc egov usda

How to generate an electronic signature for the Fsa 2370 Usda Service Center Eforms Us Department Of Forms Sc Egov Usda in the online mode

How to generate an eSignature for the Fsa 2370 Usda Service Center Eforms Us Department Of Forms Sc Egov Usda in Chrome

How to make an electronic signature for signing the Fsa 2370 Usda Service Center Eforms Us Department Of Forms Sc Egov Usda in Gmail

How to generate an eSignature for the Fsa 2370 Usda Service Center Eforms Us Department Of Forms Sc Egov Usda from your smart phone

How to make an eSignature for the Fsa 2370 Usda Service Center Eforms Us Department Of Forms Sc Egov Usda on iOS devices

How to create an eSignature for the Fsa 2370 Usda Service Center Eforms Us Department Of Forms Sc Egov Usda on Android OS

People also ask

-

What is the fsa 2037 feature in airSlate SignNow?

The fsa 2037 feature in airSlate SignNow allows businesses to streamline their document signing process through efficient electronic signatures. This innovative solution not only enhances user experience but also complies with industry standards for security and legality.

-

How does airSlate SignNow's fsa 2037 pricing compare to other eSignature solutions?

airSlate SignNow offers competitive pricing for its fsa 2037 solution compared to other eSignature platforms. With flexible pricing plans tailored to organizations of all sizes, businesses can find an affordable option that meets their eSigning needs without compromising on features.

-

What are the benefits of using airSlate SignNow with fsa 2037?

Using airSlate SignNow with the fsa 2037 feature provides numerous benefits, including increased efficiency and reduced turnaround time for document signing. This solution simplifies workflows, lowers operational costs, and improves overall compliance, making it an ideal choice for businesses.

-

Can I integrate fsa 2037 with other software applications?

Yes, airSlate SignNow's fsa 2037 is designed to integrate seamlessly with a variety of software applications. This flexibility allows businesses to connect their existing tools and enhance their workflows, making document management even more efficient.

-

Is the fsa 2037 feature secure?

Absolutely, the fsa 2037 feature in airSlate SignNow prioritizes security through robust encryption and authentication measures. This ensures that all documents signed are safe, secure, and compliant with regulations, so you can trust that your sensitive information is well-protected.

-

How can fsa 2037 improve my team’s productivity?

Implementing airSlate SignNow with the fsa 2037 feature can signNowly enhance your team’s productivity by automating the document signing process. This not only saves time but also reduces the likelihood of errors, allowing your team to focus on more critical tasks.

-

What types of documents can I sign with fsa 2037?

With airSlate SignNow's fsa 2037 feature, you can sign a wide range of documents, including contracts, agreements, and forms. This versatility makes it an excellent solution for various industries and use cases, easily accommodating your document signing needs.

Get more for Fsa 2370

- Enhanced form it 213 claim for empire state child credit

- K 210 underpayment of individual estimated tax rev 7 22 if you are an individual taxpayer including farmer or fisher use this form

- Dr 0204 tax year ending computation of penalty due based form

- Form it 2 summary of federal form w 2 statements tax year 2022

- Colorado severance tax booklet book 0021 booklet includes dr 0021 dr 0021d dr 0021s form

- Ifta inc 4thq2022 gasoline kansas department of revenue form

- Get summary of federal form 1099 r statements department of

- 2022 income tax formsc corporationsdepartment of revenue taxation

Find out other Fsa 2370

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy