Get Summary of Federal Form 1099 R Statements Department of 2022

Understanding the Federal Form 1099-R Statements

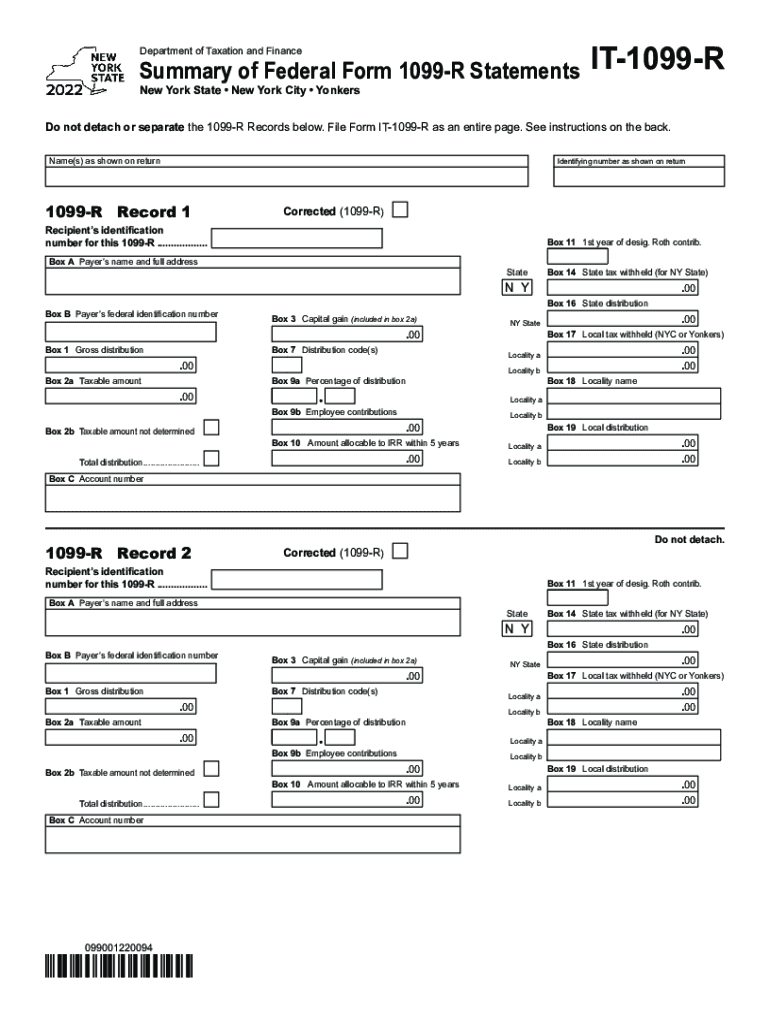

The Federal Form 1099-R is used to report distributions from pensions, annuities, retirement plans, IRAs, and other similar financial instruments. This form is essential for both the issuer and the recipient, as it outlines the total amount distributed during the tax year and any taxes withheld. The information reported on this form is crucial for accurately filing income tax returns, ensuring compliance with IRS regulations.

Steps to Complete the Federal Form 1099-R

Completing the Federal Form 1099-R involves several key steps:

- Gather necessary information: Collect details such as the recipient's name, address, and Social Security number, along with the amount distributed and any tax withheld.

- Fill out the form: Enter the recipient's information and the distribution details accurately in the appropriate fields of the form.

- Submit the form: Send the completed form to the IRS and provide a copy to the recipient by the required deadline.

Filing Deadlines for the Federal Form 1099-R

It is important to be aware of the filing deadlines associated with the Federal Form 1099-R. Generally, the form must be submitted to the IRS by the end of February if filed on paper or by the end of March if filed electronically. Recipients should also receive their copy by January 31 of the following year. Adhering to these deadlines helps avoid penalties and ensures timely reporting of income.

Legal Use of the Federal Form 1099-R

The Federal Form 1099-R serves a legal purpose by documenting income received from retirement accounts. This form is recognized by the IRS and is necessary for both tax compliance and record-keeping. Proper usage of the form helps protect against potential audits and ensures that all distributions are reported accurately, thus minimizing the risk of penalties for underreporting income.

Who Issues the Federal Form 1099-R?

The Federal Form 1099-R is typically issued by financial institutions, retirement plan administrators, and other entities that manage retirement accounts. These issuers are responsible for providing accurate information regarding distributions to both the IRS and the recipients. It is essential for these entities to maintain accurate records to ensure compliance and facilitate the correct reporting of income.

Key Elements of the Federal Form 1099-R

Several key elements are included in the Federal Form 1099-R that recipients should be aware of:

- Distribution Amount: The total amount distributed during the tax year.

- Tax Withheld: Any federal income tax withheld from the distribution.

- Distribution Code: A code that indicates the type of distribution, which is crucial for tax reporting purposes.

- Recipient Information: Includes the recipient's name, address, and Social Security number, ensuring proper identification.

Examples of Using the Federal Form 1099-R

Examples of when to use the Federal Form 1099-R include:

- Receiving distributions from a traditional IRA upon retirement.

- Cashing out a pension plan from a former employer.

- Taking early withdrawals from a 401(k) plan, which may incur penalties.

Quick guide on how to complete get summary of federal form 1099 r statements department of

Complete Get Summary Of Federal Form 1099 R Statements Department Of effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Manage Get Summary Of Federal Form 1099 R Statements Department Of on any device using the airSlate SignNow apps for Android or iOS and streamline any document-based task today.

The easiest method to modify and eSign Get Summary Of Federal Form 1099 R Statements Department Of without any hassle

- Locate Get Summary Of Federal Form 1099 R Statements Department Of and click on Get Form to begin.

- Utilize the tools provided to submit your form.

- Emphasize important sections of the documents or cover sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Get Summary Of Federal Form 1099 R Statements Department Of and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get summary of federal form 1099 r statements department of

Create this form in 5 minutes!

How to create an eSignature for the get summary of federal form 1099 r statements department of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a NY federal form and why is it important?

A NY federal form is a document required for various federal tax-related purposes in New York. This form ensures compliance with federal regulations and helps in accurate reporting of income, deductions, and credits. Utilizing airSlate SignNow allows for seamless eSigning and submission of these forms, streamlining your tax processes.

-

How does airSlate SignNow simplify the process of completing a NY federal form?

airSlate SignNow provides an intuitive platform that simplifies the completion of a NY federal form by allowing users to easily fill out, sign, and send documents online. The user-friendly interface ensures that even those unfamiliar with digital forms can manage their paperwork efficiently. With airSlate SignNow, you can eliminate the need for printing or mailing paperwork.

-

Are there any costs associated with using airSlate SignNow for a NY federal form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for individuals and businesses. Plans start at an affordable monthly rate, which includes unlimited eSigning for your NY federal forms. This cost-effective solution saves time and resources while ensuring compliance and accuracy.

-

Can I integrate airSlate SignNow with other applications for handling NY federal forms?

Absolutely! airSlate SignNow can seamlessly integrate with various applications such as Google Drive, Dropbox, and CRM systems. This integration helps streamline your workflow by allowing you to access and manage your NY federal forms from familiar platforms, enhancing your overall productivity.

-

What are the security features of airSlate SignNow when dealing with NY federal forms?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the NY federal form. The platform employs advanced encryption, secure storage, and authentication protocols to protect your data from unauthorized access. Rest assured, your information is safe while you eSign and send your forms.

-

Can I track the status of my NY federal form with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your NY federal form in real-time. You will receive notifications and updates as your document moves through the signing process. This feature helps you stay informed and ensures that all necessary actions are completed promptly.

-

Is airSlate SignNow suitable for businesses that frequently file NY federal forms?

Definitely! airSlate SignNow is an excellent solution for businesses that regularly handle NY federal forms. The platform's efficiency, cost-effectiveness, and user-friendly interface make it ideal for companies looking to manage their documentation seamlessly and ensure compliance with federal requirements.

Get more for Get Summary Of Federal Form 1099 R Statements Department Of

- Texas warranty deed 497327453 form

- Texas special deed form

- Gas mineral form

- Gift deed from an individual to three individuals texas form

- General warranty deed from an individual to two individuals texas form

- Special warranty deed individual to llc texas form

- Special warranty deed individual to husband and wife texas form

- Special warranty deed individual to two trusts texas form

Find out other Get Summary Of Federal Form 1099 R Statements Department Of

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free