W 4p Form 2015

What is the W-4P Form

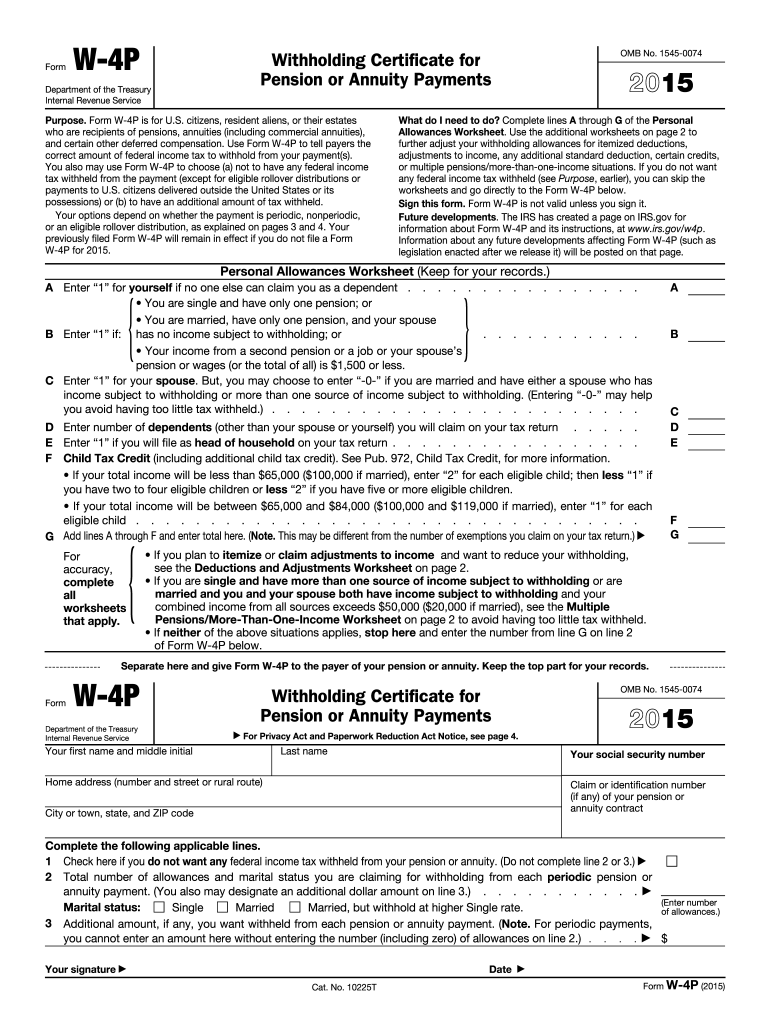

The W-4P Form, officially known as the Withholding Certificate for Pension or Annuity Payments, is a crucial document used in the United States for tax purposes. It allows individuals receiving pension or annuity payments to instruct their payers on how much federal income tax to withhold from these payments. This form is particularly important for retirees and those receiving periodic payments from retirement plans, as it helps ensure that the correct amount of tax is withheld, preventing underpayment or overpayment of taxes.

How to Use the W-4P Form

Using the W-4P Form involves a straightforward process. First, individuals must obtain the form from the IRS or their pension provider. After filling out the necessary information, including personal details and withholding preferences, the completed form should be submitted to the payer of the pension or annuity. It is essential to review the form periodically, especially if there are changes in income, tax status, or life circumstances, to ensure that withholding amounts remain accurate.

Steps to Complete the W-4P Form

Completing the W-4P Form requires attention to detail. Here are the steps to follow:

- Download the W-4P Form from the IRS website or request it from your pension provider.

- Provide your personal information, including your name, address, and Social Security number.

- Indicate your marital status and the number of allowances you wish to claim.

- Specify any additional amount you want withheld from each payment.

- Sign and date the form before submitting it to your payer.

Legal Use of the W-4P Form

The W-4P Form is legally recognized as a valid document for establishing federal tax withholding on pension and annuity payments. To be compliant, individuals must ensure that the form is filled out accurately and submitted to the appropriate payer. The IRS requires that the information provided is truthful, as any discrepancies can lead to penalties or issues during tax filing.

IRS Guidelines for the W-4P Form

The IRS provides specific guidelines for completing the W-4P Form. It is essential to follow these guidelines to ensure compliance and accuracy. The IRS recommends reviewing the form annually or whenever significant changes occur in your financial situation. Additionally, the IRS provides worksheets that can help individuals determine the correct number of allowances and withholding amounts based on their unique circumstances.

Filing Deadlines / Important Dates

Understanding the deadlines associated with the W-4P Form is vital for proper tax planning. While there is no specific deadline for submitting the W-4P Form, it should be completed and submitted before the first payment is received to ensure proper withholding. For those who need to make changes, submitting a new form promptly can help avoid under-withholding and potential tax liabilities at the end of the year.

Examples of Using the W-4P Form

There are various scenarios where the W-4P Form is applicable. For instance:

- A retiree receiving monthly pension payments may use the form to adjust withholding based on their tax bracket.

- An individual who has recently started receiving annuity payments can use the W-4P to ensure adequate tax withholding from the start.

- Someone who has experienced a significant life change, such as marriage or divorce, may need to update their form to reflect their new tax situation.

Quick guide on how to complete 2015 w 4p form

Effortlessly prepare W 4p Form on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed forms, allowing you to locate the right document and safely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without hassle. Handle W 4p Form on any device using the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

How to edit and eSign W 4p Form with ease

- Obtain W 4p Form and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections or redact sensitive information using the specialized tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your adjustments.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign W 4p Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 w 4p form

Create this form in 5 minutes!

How to create an eSignature for the 2015 w 4p form

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF document on Android devices

People also ask

-

What is the W 4p Form and why is it important?

The W 4p Form is a tax form used to determine the amount of federal income tax to withhold from your paycheck. It is crucial for ensuring that you withhold the correct amount of taxes to avoid underpayment or overpayment during tax season.

-

How can airSlate SignNow help with signing the W 4p Form?

airSlate SignNow allows users to easily send and eSign the W 4p Form online, streamlining the entire process. With its user-friendly interface, you can complete and sign the form securely, saving time and reducing paperwork.

-

What features of airSlate SignNow make it ideal for using the W 4p Form?

airSlate SignNow offers features like customizable templates, real-time collaboration, and robust security, making it ideal for handling the W 4p Form. Additionally, it allows you to track document status, ensuring you never miss a deadline.

-

Is there a cost associated with using airSlate SignNow for the W 4p Form?

Yes, airSlate SignNow offers several pricing plans to cater to different business needs. Each plan includes features that support efficient management of documents like the W 4p Form at a cost-effective rate.

-

Can I integrate airSlate SignNow with other applications for the W 4p Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage the W 4p Form alongside other business tools. This flexibility enhances your workflow by keeping everything connected.

-

What security measures does airSlate SignNow implement for the W 4p Form?

airSlate SignNow prioritizes your security with features like encryption, secure data storage, and two-factor authentication. These measures ensure that your W 4p Form and any sensitive information are always protected.

-

How does the eSigning process for the W 4p Form work with airSlate SignNow?

The eSigning process with airSlate SignNow is straightforward. Simply upload the W 4p Form, add your signature field, and send it out for signing, making it quick and easy for all parties involved to complete it securely.

Get more for W 4p Form

- F103 form

- The debbie gayden lavizzo scholarship form

- Grant approval form

- Csu san bernardino police stolen property supplemental report date case number this supplemental report form is a tool to

- Handover certificate form

- Benedict transcript form

- Transcript request form turks and caicos islands community college tcicc

- A new direct deposit ohio university credit union oucu form

Find out other W 4p Form

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF