Schedule D Form 2011

What is the Schedule D Form

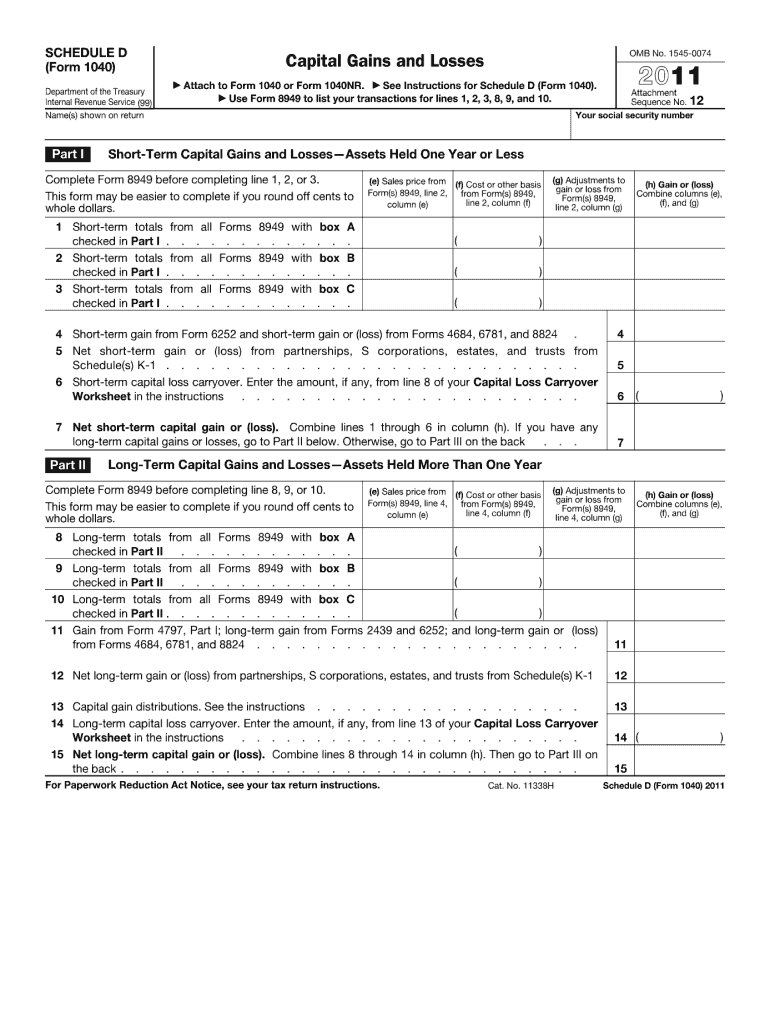

The Schedule D Form is a tax document used by individuals and businesses in the United States to report capital gains and losses from the sale of assets. This form is crucial for taxpayers who have sold stocks, bonds, or other investments throughout the tax year. By detailing these transactions, the Schedule D Form helps determine the overall tax liability based on the net capital gain or loss.

How to use the Schedule D Form

Using the Schedule D Form involves several steps. Taxpayers must first gather all relevant information regarding their capital transactions, including purchase and sale dates, amounts, and any associated costs. Once this information is compiled, individuals can fill out the form, reporting each transaction accurately. It is essential to ensure that all calculations are correct, as errors can lead to complications with the IRS.

Steps to complete the Schedule D Form

Completing the Schedule D Form requires a systematic approach:

- Collect all necessary documents related to asset sales.

- Determine the holding period for each asset to classify gains or losses as short-term or long-term.

- Fill out Part I for short-term transactions and Part II for long-term transactions.

- Calculate the total gains and losses, and transfer the net amount to your main tax return.

Legal use of the Schedule D Form

The Schedule D Form must be completed accurately to ensure compliance with IRS regulations. Failing to report capital gains or losses can result in penalties or audits. It's important to retain all supporting documentation for at least three years, as the IRS may request this information during an audit. Using reliable electronic tools can enhance the accuracy and security of the filing process.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when submitting the Schedule D Form. Typically, the form is due on April 15 of the year following the tax year being reported. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may file, which can provide additional time for submission.

Examples of using the Schedule D Form

Common scenarios for using the Schedule D Form include:

- Individuals selling stocks or mutual funds for a profit.

- Real estate transactions where property is sold at a gain.

- Business owners liquidating assets or investments.

Each of these situations requires accurate reporting of gains and losses to ensure proper tax calculations.

Quick guide on how to complete schedule d 2011 form

Complete Schedule D Form effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers a superb environmentally friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and eSign your documents promptly without delays. Manage Schedule D Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-based process today.

The easiest way to modify and eSign Schedule D Form effortlessly

- Find Schedule D Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow has developed specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate recreating new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Schedule D Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule d 2011 form

Create this form in 5 minutes!

How to create an eSignature for the schedule d 2011 form

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is a Schedule D Form and why do I need it?

The Schedule D Form is used to report capital gains and losses from investments. It is essential for accurately filing your tax return, as it helps you track your investment performance and calculate tax obligations. Using airSlate SignNow makes it easy to eSign and submit your Schedule D Form efficiently.

-

How does airSlate SignNow help me with my Schedule D Form?

AirSlate SignNow streamlines the process of completing and eSigning your Schedule D Form. You can easily upload your document, add necessary signatures, and share it with your tax professionals or collaborators. This ensures a smooth experience and compliance with tax regulations.

-

Is airSlate SignNow affordable for businesses needing to file a Schedule D Form?

Yes, airSlate SignNow offers cost-effective plans that cater to businesses of all sizes, allowing you to manage your Schedule D Form without breaking the bank. You can choose from various pricing tiers to find the right fit for your needs. The investment in our platform pays off with increased efficiency and reduced paperwork.

-

Can I integrate airSlate SignNow with accounting software for my Schedule D Form?

Absolutely! AirSlate SignNow integrates seamlessly with popular accounting software, enhancing your ability to manage and file your Schedule D Form. This integration ensures your financial data is organized and easily accessible, which simplifies tax preparation and filing.

-

What features does airSlate SignNow offer for eSigning my Schedule D Form?

AirSlate SignNow offers a variety of features for eSigning your Schedule D Form, including customizable templates, secure signing options, and real-time tracking. These functionalities ensure that you can complete your documents quickly and securely, which is crucial during tax season.

-

Is my data secure when I use airSlate SignNow to handle my Schedule D Form?

Yes, security is a top priority for airSlate SignNow. We utilize encryption and robust security protocols to protect your data while handling your Schedule D Form. This way, you can confidently complete your eSigning without worrying about data bsignNowes.

-

How quickly can I complete my Schedule D Form using airSlate SignNow?

With airSlate SignNow, you can complete and eSign your Schedule D Form in minutes. The intuitive interface and user-friendly features allow for swift document preparation, enabling you to meet your tax deadlines without stress.

Get more for Schedule D Form

- Instructions for form 945 x rev february 2014 irsgov

- Form 14653 2014

- Form 990 t fillable 2014

- Form 1041 n rev december 2015 irsgov irs

- 13615 2015 form

- Form 4419 2015

- Publication 974 rev december 2015 premium tax credit ptc for use in preparing 2015 returns irs form

- Publication 962 rev 10 2017 lifes a little easier with eitc form

Find out other Schedule D Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF