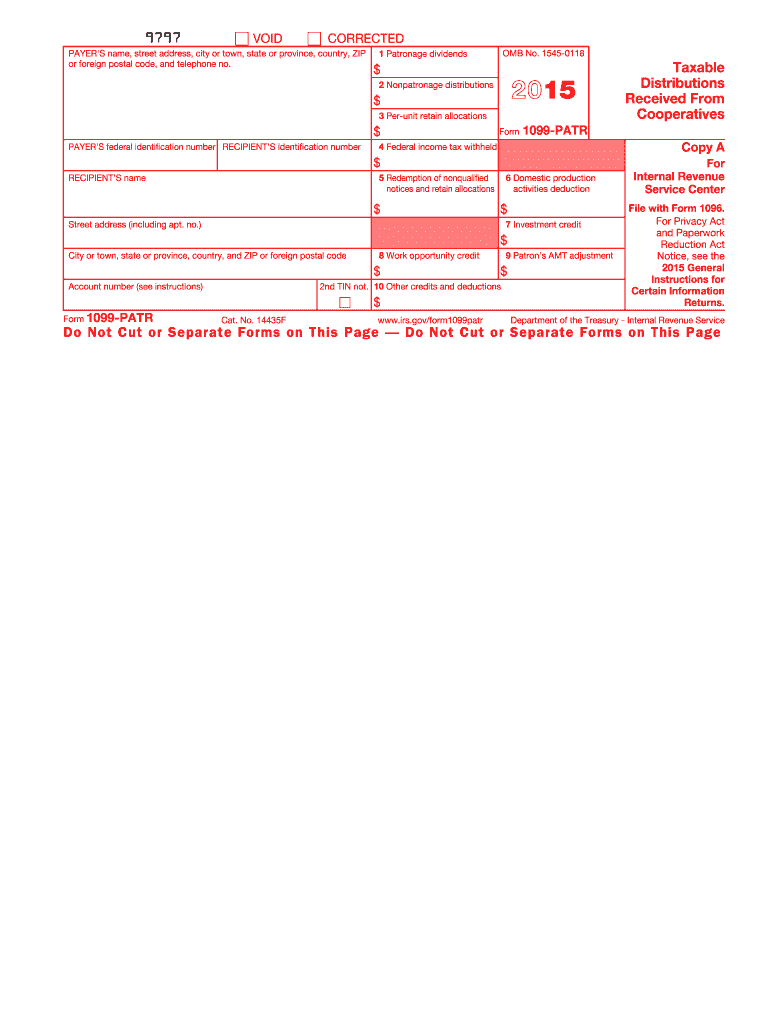

1099 Form 2015

What is the 1099 Form

The 1099 Form is a crucial tax document used in the United States to report various types of income that are not classified as wages, salaries, or tips. It is primarily utilized by businesses and individuals to document payments made to independent contractors, freelancers, and other non-employees. The form ensures that the Internal Revenue Service (IRS) receives accurate information about income earned, helping to maintain transparency in the tax system. There are several variants of the 1099 Form, each designated for specific types of income, such as interest, dividends, and miscellaneous income.

Steps to complete the 1099 Form

Completing the 1099 Form involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary information, including the recipient's name, address, and Social Security number or Employer Identification Number (EIN). Next, identify the type of income being reported and select the appropriate 1099 variant. Fill in the form with the relevant amounts paid during the tax year, ensuring that all figures are accurate. Finally, review the completed form for any errors, and submit it to the IRS by the specified deadline, while also providing a copy to the recipient.

Legal use of the 1099 Form

The legal use of the 1099 Form is governed by IRS regulations, which require accurate reporting of income to prevent tax evasion. Businesses must issue a 1099 Form to any individual or entity that they have paid $600 or more in a calendar year for services rendered. Failure to issue the form can result in penalties for the payer. Additionally, recipients of the 1099 Form must report the income on their tax returns, as it is considered taxable income. Understanding the legal implications of the 1099 Form is essential for both payers and recipients to ensure compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Form are critical for compliance with IRS regulations. Typically, businesses must provide the completed forms to recipients by January thirty-first of the year following the tax year in which the payments were made. The deadline for filing the 1099 Form with the IRS is usually February twenty-eighth for paper submissions and March thirty-first for electronic submissions. It is important to be aware of these dates to avoid penalties and ensure that all income is reported accurately and on time.

Who Issues the Form

The 1099 Form is issued by businesses or individuals who make payments to non-employees, including independent contractors, freelancers, and other service providers. It is the responsibility of the payer to accurately complete and distribute the form. Various types of 1099 Forms are used depending on the nature of the payment, such as the 1099-MISC for miscellaneous income or the 1099-NEC specifically for reporting non-employee compensation. Understanding who is required to issue the form is essential for compliance with IRS guidelines.

Examples of using the 1099 Form

There are numerous scenarios in which the 1099 Form is applicable. For instance, a business that hires a freelance graphic designer for a project and pays them $1,000 must issue a 1099-NEC to report that payment. Similarly, if an individual earns interest income from a bank account exceeding ten dollars, the bank will issue a 1099-INT to report that income. These examples illustrate the diverse applications of the 1099 Form across various income types and situations, highlighting its importance in the tax reporting process.

Quick guide on how to complete 1099 2015 form

Complete 1099 Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 1099 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign 1099 Form with ease

- Locate 1099 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal significance as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign 1099 Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 1099 2015 form

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is a 1099 Form and why is it important?

A 1099 Form is an IRS document used to report income other than wages, salaries, and tips. It's crucial for independent contractors and freelancers to accurately report their earnings during tax season. By using airSlate SignNow, you can easily eSign and send 1099 Forms, ensuring compliance and efficient record-keeping.

-

How can airSlate SignNow help with 1099 Form management?

AirSlate SignNow streamlines the management of 1099 Forms by allowing users to electronically sign and send these documents quickly. Its user-friendly interface makes it easy to create, send, and track 1099 Forms. This simplifies the process and enhances efficiency for businesses handling multiple contractors.

-

What features does airSlate SignNow offer for processing 1099 Forms?

AirSlate SignNow offers features like document templates, in-app eSigning, and status tracking for 1099 Forms. These features help automate the workflow, reduce paperwork, and ensure that you meet deadlines. This efficiency helps businesses save time and reduce errors in document handling.

-

Is airSlate SignNow affordable for businesses filing 1099 Forms?

Yes, airSlate SignNow offers cost-effective pricing plans that make it accessible for businesses of all sizes to manage 1099 Forms. With flexible subscription options and usage-based pricing, you only pay for what you use, ensuring you get excellent value. This affordability makes it easier to maintain compliance without overspending.

-

Can I integrate airSlate SignNow with my accounting software for 1099 Forms?

Absolutely! AirSlate SignNow can seamlessly integrate with popular accounting software, allowing for smooth data transfer when managing 1099 Forms. This integration helps minimize manual entry and potential errors, ensuring that your financial records are accurate and up-to-date.

-

What benefits does eSigning 1099 Forms provide?

eSigning 1099 Forms with airSlate SignNow offers benefits such as enhanced security, faster turnaround times, and reduced paper waste. Digital signatures are legally binding and provide an efficient way to obtain necessary signatures without the delays of traditional mail. This results in quicker processing and compliance for all parties involved.

-

How secure is the data when using airSlate SignNow for 1099 Forms?

AirSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Your data is protected during the sending and signing of 1099 Forms, ensuring confidentiality and integrity. This peace of mind allows you to focus on your business while knowing your documents are secure.

Get more for 1099 Form

- Gpcsf 11 supreme court of georgia form

- Tax id ssn federal tax id form

- 2005 t 7 form

- Small claims court stipulated installment payment stipulated installment payment guamselfhelp form

- Petition to compromise doubtful claim of minor form

- 470 5526 authorized representative for managed care appeals form

- Increase in frequency of rourkela gunupur rajya rani express form

- Ia criminal check form

Find out other 1099 Form

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed