8863 Form 2011

What is the 8863 Form

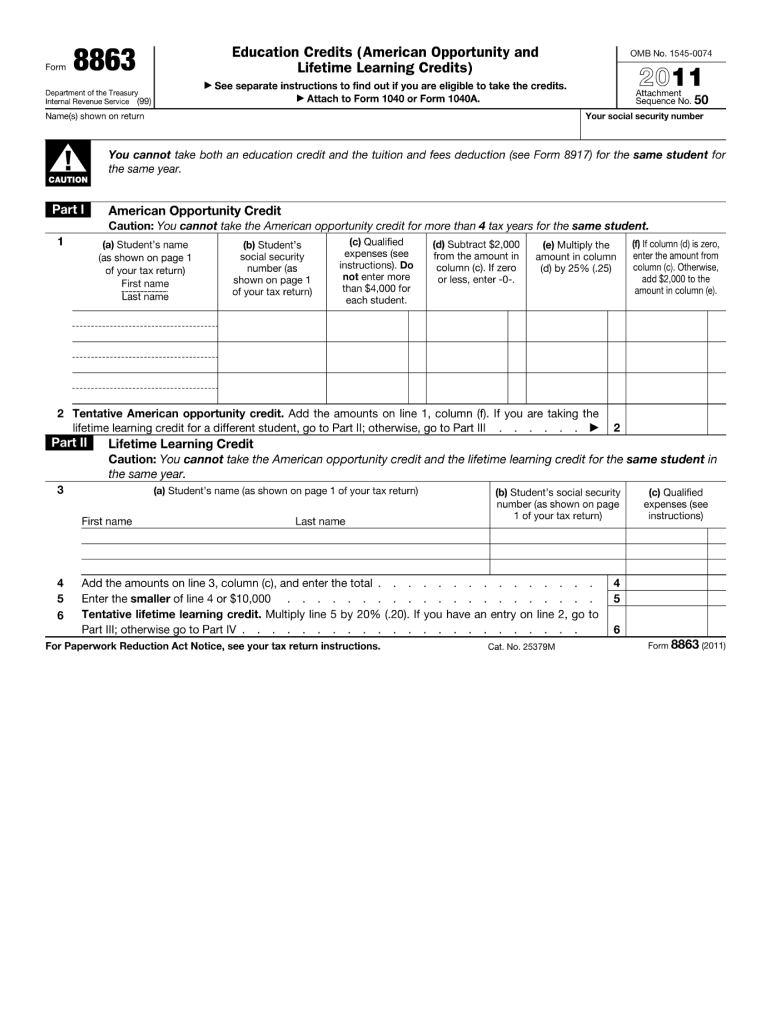

The 8863 Form, officially known as the Education Credits (American Opportunity and Lifetime Learning Credits) form, is used by taxpayers in the United States to claim education-related tax credits. These credits can significantly reduce the amount of tax owed, providing financial relief for students and their families. The form allows taxpayers to report qualified education expenses for eligible students enrolled in higher education institutions. Understanding the purpose and requirements of the 8863 Form is essential for maximizing potential tax benefits.

How to use the 8863 Form

Using the 8863 Form involves several steps to ensure accurate reporting of education expenses. Taxpayers must first gather necessary documentation, including Form 1098-T, which provides information on tuition payments. After that, individuals fill out the form by entering personal information, details about the eligible student, and the amounts spent on qualified expenses. It is crucial to follow the instructions provided by the IRS to ensure that all information is correctly reported, as errors can lead to delays or rejection of the claim.

Steps to complete the 8863 Form

Completing the 8863 Form involves a structured approach to ensure accuracy. Here are the steps to follow:

- Gather documents: Collect Form 1098-T and receipts for qualified expenses.

- Fill in personal information: Enter your name, Social Security number, and filing status.

- Provide student details: Include the name and Social Security number of the eligible student.

- Report qualified expenses: List the amounts for tuition, fees, and course materials.

- Calculate credits: Determine the amount of the American Opportunity Credit or Lifetime Learning Credit you qualify for.

- Review and submit: Double-check the information for accuracy before submitting the form with your tax return.

Legal use of the 8863 Form

The legal use of the 8863 Form is governed by IRS guidelines, which outline eligibility requirements and the types of expenses that qualify for education credits. To ensure compliance, taxpayers must accurately report their education expenses and adhere to the specified limits for each credit. Misrepresentation or failure to meet eligibility criteria can result in penalties or disqualification from claiming the credits. It is essential to keep thorough records and documentation to support the claims made on the form.

Filing Deadlines / Important Dates

Filing deadlines for the 8863 Form align with the general tax filing deadlines in the United States. Typically, individual tax returns are due on April fifteenth of each year. However, if taxpayers require additional time, they can file for an extension, which extends the deadline by six months. It is important to note that any taxes owed must still be paid by the original due date to avoid penalties and interest. Keeping track of these dates ensures that taxpayers can effectively plan their filing and maximize their education credits.

Eligibility Criteria

Eligibility for the education credits claimed on the 8863 Form is based on several factors. Taxpayers must be enrolled in an eligible educational institution and must be pursuing a degree or recognized credential. Additionally, the credits are available for students who meet the income limitations set by the IRS. For the American Opportunity Credit, the student must not have completed four years of post-secondary education before the tax year in question. Understanding these criteria is crucial for determining qualification and ensuring compliance when filing.

Quick guide on how to complete 2011 8863 form

Complete 8863 Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage 8863 Form on any device with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and eSign 8863 Form with ease

- Locate 8863 Form and click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize important sections of the documents or redact confidential information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign 8863 Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 8863 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 8863 form

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is the 8863 Form used for?

The 8863 Form is used to claim education credits, specifically the American Opportunity Credit and the Lifetime Learning Credit, on your tax return. By using the 8863 Form, you can potentially reduce your tax liability, making it a crucial document for eligible students and their families.

-

How can airSlate SignNow help with the 8863 Form?

airSlate SignNow offers a streamlined solution for signing and sending the 8863 Form electronically. With our easy-to-use platform, you can quickly gather signatures from all necessary parties, ensuring your form is submitted accurately and on time.

-

What features does airSlate SignNow provide for the 8863 Form?

Our platform includes features such as customizable templates, secure cloud storage, and real-time tracking for the 8863 Form. These tools enhance efficiency and help you manage your documents effectively, giving you peace of mind during tax season.

-

Is there a cost to use airSlate SignNow for submitting the 8863 Form?

airSlate SignNow offers competitive pricing plans that cater to different business needs, ensuring that submitting the 8863 Form remains cost-effective. You can choose from various subscription options, all designed to provide excellent value for your document management needs.

-

Can I integrate airSlate SignNow with my accounting software for the 8863 Form?

Yes! airSlate SignNow seamlessly integrates with popular accounting software, making it easy to manage your 8863 Form and related documents in one place. This integration simplifies your workflow and enhances productivity when preparing your tax filings.

-

What are the benefits of using airSlate SignNow for the 8863 Form?

Using airSlate SignNow for the 8863 Form offers benefits such as increased efficiency, reduced paper usage, and enhanced security for your sensitive information. Our platform ensures that you can focus on what's important—claiming your education credits—without the hassle of traditional paperwork.

-

Is airSlate SignNow secure for handling the 8863 Form?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your documents, including the 8863 Form. We use encryption, secure data storage, and compliance with regulations to ensure your information remains confidential and secure.

Get more for 8863 Form

Find out other 8863 Form

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF