W 4p Form 2013

What is the W-4P Form

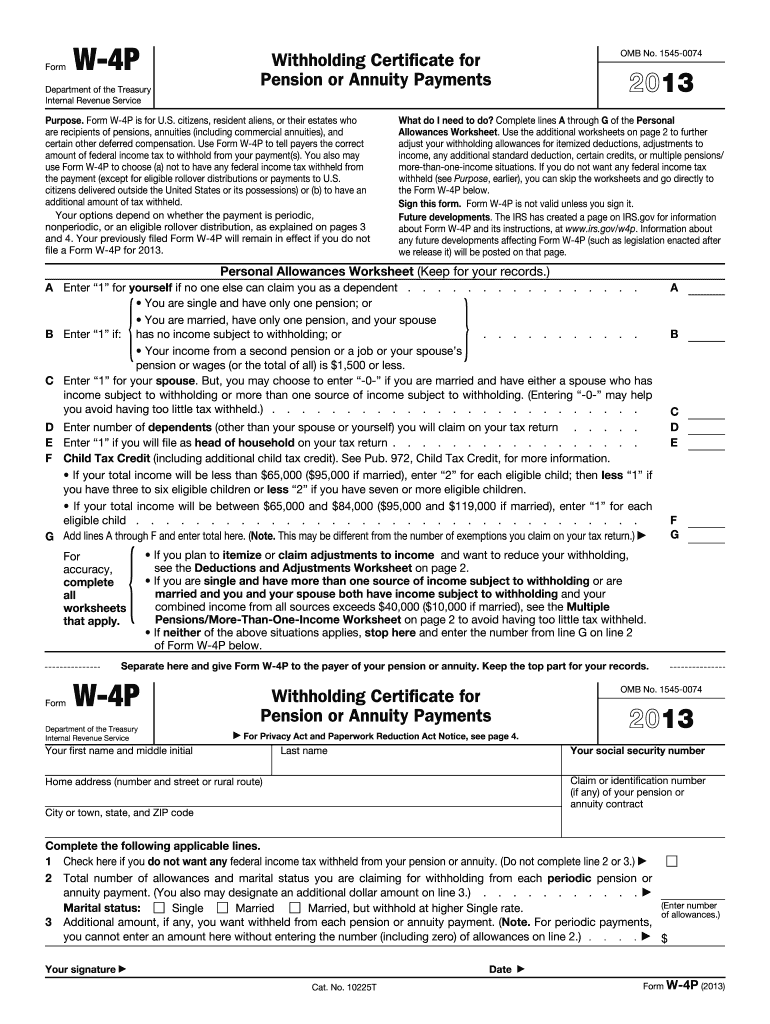

The W-4P Form, also known as the Withholding Certificate for Pension or Annuity Payments, is a crucial document used by individuals receiving pension or annuity payments in the United States. This form allows recipients to instruct payers on how much federal income tax to withhold from their payments. By accurately completing the W-4P, individuals can manage their tax liability effectively and avoid underpayment penalties during tax season.

How to Use the W-4P Form

Using the W-4P Form involves several straightforward steps. First, individuals need to obtain the form, which can be downloaded from the IRS website or requested from their pension plan administrator. After obtaining the form, recipients should fill out their personal information, including name, address, and Social Security number. Next, they must indicate their filing status and any additional withholding amounts they wish to specify. Once completed, the form should be submitted to the payer of the pension or annuity payments.

Steps to Complete the W-4P Form

Completing the W-4P Form can be done in a few simple steps:

- Download or request the W-4P Form.

- Fill in your personal details, including your name, address, and Social Security number.

- Select your filing status from the options provided.

- Indicate any additional amount you want withheld from your payments, if applicable.

- Sign and date the form to validate it.

- Submit the completed form to your pension or annuity payer.

Legal Use of the W-4P Form

The W-4P Form is legally recognized by the IRS and must be completed accurately to ensure compliance with federal tax withholding regulations. It serves as a formal request for the appropriate amount of tax to be withheld from pension or annuity payments. Failure to submit a valid W-4P may result in higher tax liabilities or under-withholding, leading to potential penalties. Therefore, it is essential to keep the form updated, especially when there are changes in personal circumstances or tax laws.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the W-4P Form. These include instructions on how to complete the form, the importance of accurate information, and the implications of withholding choices. The IRS recommends that individuals review their withholding status annually or whenever there are significant life changes, such as marriage, divorce, or retirement. Adhering to these guidelines helps ensure that taxpayers are not subject to unexpected tax bills at the end of the year.

Filing Deadlines / Important Dates

While the W-4P Form does not have a specific filing deadline like tax returns, it is crucial to submit it as soon as pension or annuity payments begin. Individuals should also be aware of important tax deadlines, such as the annual tax return filing date, typically April 15. Keeping track of these dates ensures that individuals remain compliant with tax regulations and avoid potential penalties for under-withholding.

Who Issues the Form

The W-4P Form is typically issued by the pension or annuity plan administrator. This may include employers, insurance companies, or financial institutions that manage retirement accounts. Recipients should contact their plan administrator if they have questions about the form or need assistance in completing it. It is important to ensure that the form is submitted to the correct entity to facilitate accurate withholding from payments.

Quick guide on how to complete 2013 w 4p form

Complete W 4p Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle W 4p Form on any platform using airSlate SignNow's Android or iOS applications, and enhance any document-related task today.

How to edit and eSign W 4p Form with ease

- Locate W 4p Form and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you prefer to send your form: via email, text (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all of your document management needs in just a few clicks from any device you prefer. Edit and eSign W 4p Form and ensure outstanding communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 w 4p form

Create this form in 5 minutes!

How to create an eSignature for the 2013 w 4p form

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is the W 4p Form and how does it differ from the regular W-4?

The W 4p Form is a tax withholding certificate specifically designed for pensions and annuities. Unlike the standard W-4 used for employment, the W 4p Form allows retirees and beneficiaries to indicate their withholding preferences for pension plans. This ensures accurate tax withholding directly from retirement income.

-

How can airSlate SignNow help me with the W 4p Form?

airSlate SignNow streamlines the process of signing and sending W 4p Forms digitally. With our platform, you can easily create, edit, and securely send your W 4p Form to recipients for eSignature. This eliminates paperwork hassles and enhances efficiency in managing your tax documents.

-

Is there a cost to use airSlate SignNow for handling the W 4p Form?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Each plan includes features that make it easy to prepare and eSign the W 4p Form, ensuring you get a cost-effective solution for managing your documents. Check our website for detailed pricing and feature comparisons.

-

What integrations does airSlate SignNow offer for managing the W 4p Form?

airSlate SignNow seamlessly integrates with various tools and applications, including CRM systems, cloud storage services, and email platforms. This allows you to manage your W 4p Form easily across different platforms and ensures that your workflow remains efficient and organized. Explore our integration options to see what best suits your needs.

-

Can I track the status of my W 4p Form once sent through airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for every document you send, including the W 4p Form. You’ll receive notifications when the form is viewed, signed, or completed, giving you complete control over your document’s status.

-

Is it safe to send the W 4p Form using airSlate SignNow?

Yes, safety is a top priority for airSlate SignNow. Our platform uses advanced encryption and security protocols to ensure that your W 4p Form and other documents are protected during transmission and storage. You can send your forms with confidence, knowing your personal information remains secure.

-

What additional features does airSlate SignNow offer for the W 4p Form?

In addition to eSigning, airSlate SignNow offers various features for the W 4p Form, such as templates, automated workflows, and mobile access. These features make it easy to prepare documents, track progress, and manage your forms from anywhere, enhancing overall productivity and organization.

Get more for W 4p Form

Find out other W 4p Form

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now