941x Form 2014

What is the 941x Form

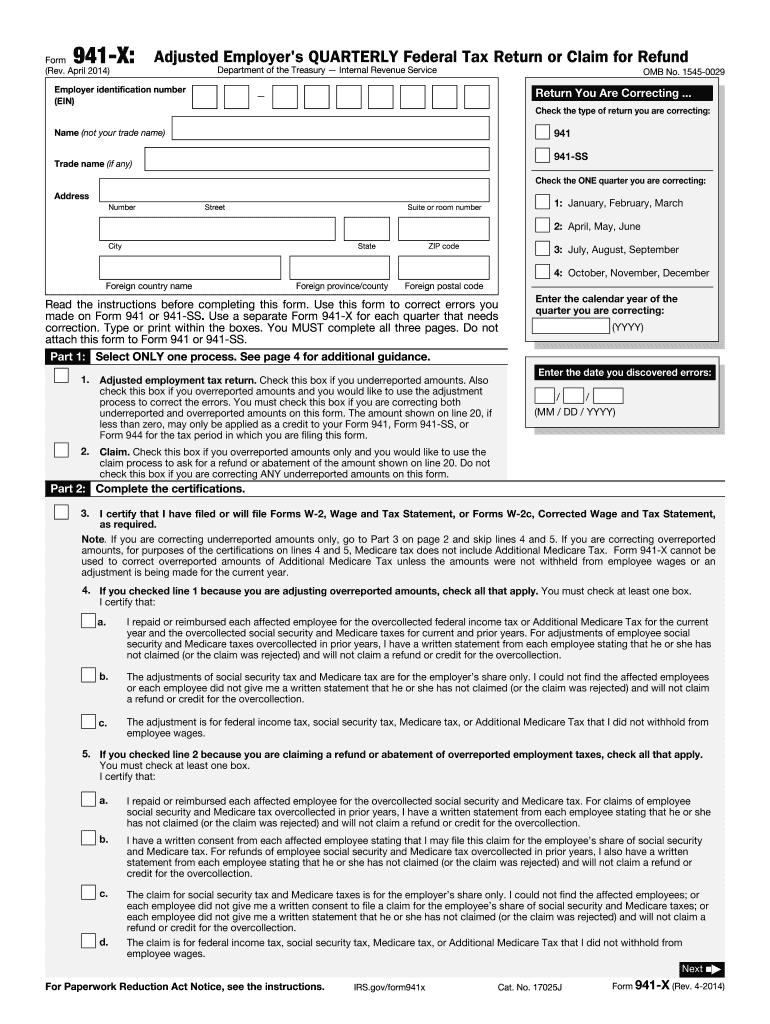

The 941x Form is an essential document used by employers in the United States to amend their previously filed Form 941, which reports payroll taxes. This form allows businesses to correct errors related to income, tax withholdings, or credits claimed on their original filings. It is particularly important for ensuring compliance with federal tax regulations and maintaining accurate records with the Internal Revenue Service (IRS).

How to use the 941x Form

Using the 941x Form involves several key steps. First, employers must obtain the correct version of the form from the IRS website or other authorized sources. Next, they should carefully review their original Form 941 to identify any discrepancies or errors that need correction. Once the necessary changes are determined, the employer fills out the 941x Form, providing detailed explanations for each amendment. Finally, the completed form must be submitted to the IRS, ensuring that it is filed within the appropriate time frame to avoid penalties.

Steps to complete the 941x Form

Completing the 941x Form requires attention to detail. Here are the steps to follow:

- Review the original Form 941 to identify errors.

- Obtain the latest version of the 941x Form from the IRS.

- Fill out the form, ensuring to indicate the tax period being amended.

- Provide accurate information for each line item that requires correction.

- Include a detailed explanation of the changes made.

- Sign and date the form before submission.

Legal use of the 941x Form

The 941x Form is legally binding when completed accurately and submitted to the IRS. It serves as a formal request to amend previously reported payroll tax information. To ensure its legal validity, employers must comply with IRS guidelines and maintain proper documentation supporting the amendments. Failure to do so may result in penalties or additional scrutiny from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the 941x Form are crucial for compliance. Generally, it must be filed within three years from the date the original Form 941 was due. Employers should be aware of specific deadlines related to the tax year and ensure timely submission to avoid penalties. Keeping track of these dates is essential for maintaining good standing with the IRS.

Form Submission Methods (Online / Mail / In-Person)

The 941x Form can be submitted through various methods. Employers have the option to file electronically or send a paper version via mail. Electronic filing is often preferred for its speed and efficiency, while mailing the form requires careful attention to ensure it is sent to the correct IRS address. Employers should choose the submission method that best suits their operational needs and compliance requirements.

Quick guide on how to complete 2014 941x form

Prepare 941x Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to formulate, modify, and electronically sign your documents promptly with minimal wait time. Manage 941x Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign 941x Form seamlessly

- Obtain 941x Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or obscure sensitive information with features specifically designed for that function by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign 941x Form to maintain outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 941x form

Create this form in 5 minutes!

How to create an eSignature for the 2014 941x form

How to create an electronic signature for your PDF file in the online mode

How to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is the 941x Form and when should I use it?

The 941x Form is an adjusted version of the IRS Form 941, used to correct overreported or underreported employment taxes. You should use the 941x Form when you discover discrepancies in your previously filed forms, ensuring compliance with tax regulations.

-

How can airSlate SignNow assist with the 941x Form?

airSlate SignNow simplifies the process of preparing and sending the 941x Form by allowing users to eSign and manage documents securely online. Our platform makes it easy to fill out, edit, and submit your 941x Form quickly and efficiently.

-

Is there a cost for using airSlate SignNow to eSign the 941x Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. With our cost-effective solutions, you can eSign the 941x Form without incurring excessive expenses associated with traditional document signing methods.

-

What features does airSlate SignNow provide for managing the 941x Form?

airSlate SignNow provides features like document templates, customizable workflows, and real-time status tracking specifically designed for the 941x Form. These features enhance document management, making it easier to prepare during tax season.

-

Can I integrate airSlate SignNow with other software for handling the 941x Form?

Absolutely! airSlate SignNow integrates with various software solutions, including accounting and payroll systems, to streamline the process of managing the 941x Form. This allows for a more cohesive experience, reducing errors and saving time.

-

What are the benefits of eSigning the 941x Form with airSlate SignNow?

Using airSlate SignNow for eSigning the 941x Form offers numerous benefits, such as improved efficiency, enhanced security, and simplified tracking of your document statuses. This leads to faster corrections and peace of mind during tax reporting.

-

How secure is an eSigned 941x Form on airSlate SignNow?

airSlate SignNow prioritizes security, employing advanced encryption and compliance protocols to protect your eSigned 941x Form and sensitive data. You can trust that your documents are safe and compliant with industry standards.

Get more for 941x Form

- Form 656 b 2011

- 2011 form withholding

- Form 8822 2011

- Schedule r form 940 rev december 2017 allocation schedule for aggregate form 940 filers irs

- 944 2011 form

- Form 944 x rev february 2011 adjusted employers annual federal tax return or claim for refund

- Gen instr for certain info returns 2011 form

- Can i file 943 online 2011 form

Find out other 941x Form

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed