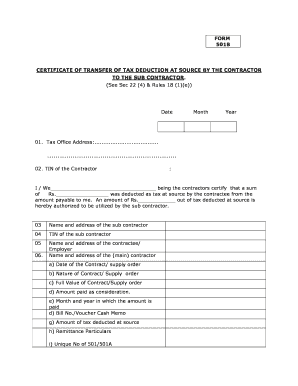

501b Form

What is the 501b form?

The 501b form is a tax document used primarily by organizations seeking tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This form is essential for non-profit organizations in the United States, as it helps them establish their eligibility for federal tax exemptions. By completing the 501b form, organizations can demonstrate their charitable purpose and gain the benefits associated with tax-exempt status, such as the ability to receive tax-deductible contributions.

Steps to complete the 501b form

Completing the 501b form involves several key steps to ensure accuracy and compliance with IRS requirements. Begin by gathering necessary information about your organization, including its mission statement, financial data, and details about its activities. Next, fill out the form carefully, ensuring all sections are complete. Pay special attention to the descriptions of your organization’s purpose and activities, as these will be critical in determining your eligibility for tax-exempt status. Finally, review the completed form for any errors or omissions before submitting it to the IRS.

Legal use of the 501b form

The legal use of the 501b form is crucial for organizations seeking to operate as tax-exempt entities. To ensure compliance, organizations must adhere to the guidelines set forth by the IRS. This includes maintaining accurate records, submitting the form on time, and operating within the scope of their stated charitable purposes. Failure to comply with these legal requirements can result in penalties, including the loss of tax-exempt status. Therefore, understanding the legal implications of the 501b form is essential for any organization pursuing tax-exempt status.

Who issues the 501b form?

The 501b form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax administration in the United States. Organizations must submit this form to the IRS to apply for tax-exempt status under section 501(c)(3). The IRS reviews the submitted forms to determine if the organization meets the necessary criteria for exemption, and they provide guidance on any additional information required during the application process.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 501b form is vital for organizations seeking timely approval of their tax-exempt status. Generally, the form must be submitted within 27 months from the end of the month in which the organization was formed to receive retroactive tax-exempt status. Organizations should also be aware of any changes in IRS regulations that may affect their filing timelines. Keeping track of these important dates helps ensure compliance and avoids potential penalties.

Examples of using the 501b form

The 501b form is commonly used by various types of organizations, including charities, educational institutions, and religious entities. For instance, a local charity aiming to provide food assistance to low-income families would complete the 501b form to establish its tax-exempt status. Similarly, a nonprofit organization focused on environmental conservation would use the form to gain the benefits associated with tax exemption, allowing it to receive donations that are tax-deductible for contributors. These examples illustrate the diverse applications of the 501b form in supporting charitable activities across the United States.

Quick guide on how to complete 501b

Complete 501b effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage 501b on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign 501b with ease

- Obtain 501b and then click Get Form to commence.

- Utilize the tools we offer to finalize your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your updates.

- Select your preferred method of sending your form—via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 501b to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 501b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 501b form?

A 501b form is utilized by organizations to provide essential information about their tax-exempt status. It is particularly important for nonprofits and ensures compliance with IRS regulations. Using airSlate SignNow, you can quickly eSign and manage your 501b form, making the process seamless and efficient.

-

How can airSlate SignNow help me with my 501b form?

With airSlate SignNow, you can easily prepare, send, and eSign your 501b form online. The platform offers intuitive features like templates and secure cloud storage, facilitating a smooth signing experience. This not only saves time but also ensures accuracy in your submissions.

-

Is airSlate SignNow cost-effective for managing 501b forms?

Yes, airSlate SignNow provides a cost-effective solution for managing 501b forms without sacrificing quality. The pricing plans are designed for various business sizes, ensuring you get the features needed for your organization. It helps reduce administrative costs while enhancing efficiency.

-

What features does airSlate SignNow offer for 501b form eSigning?

airSlate SignNow offers several features for 501b form eSigning, including customizable templates, multi-party signing, and in-app notifications. These features streamline the signing process and help keep all parties informed. This ensures that your document is signed promptly and securely.

-

Can I track the status of my 501b form with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your 501b form in real-time. You'll receive updates when your document is viewed, signed, or completed, ensuring you are always in the loop and can manage your documents efficiently.

-

Are there integrations available for the 501b form with airSlate SignNow?

Yes, airSlate SignNow offers integrations with popular tools and platforms that can aid in managing your 501b form. This includes CRM systems, cloud storage services, and productivity tools, allowing you to easily connect your workflow. These integrations enhance efficiency by keeping everything synchronized.

-

What are the benefits of using airSlate SignNow for my 501b form?

Using airSlate SignNow for your 501b form offers numerous benefits, including enhanced security, time savings, and ease of use. It increases workflow efficiency by simplifying the signing process while complying with legal requirements. Additionally, it helps reduce errors and ensures your documents are professionally handled.

Get more for 501b

- Cved form

- Bsa permission slip for campout form

- Pre service check in sheet form

- And murphy homes inc intake packet fairwinds group home form

- Framing material order form

- Puppy for sale dog for sale form

- Microsoft powerpoint kaizen event evaluation formkaizenfieldbook compatibility mode

- Online filmi form

Find out other 501b

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy