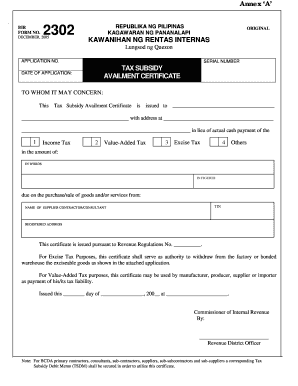

Bir 2302 2005

What is the Bir 2302

The Bir 2302 is a tax form used in the United States, primarily by businesses and self-employed individuals, to report specific income and tax information to the Internal Revenue Service (IRS). This form is essential for accurately documenting earnings and ensuring compliance with federal tax regulations. Understanding the Bir 2302 is crucial for anyone involved in financial reporting, as it helps to clarify tax liabilities and obligations.

How to use the Bir 2302

Using the Bir 2302 involves several steps to ensure accurate reporting of income. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form with the required information, including your business details and income sources. After completing the form, review it for accuracy. Finally, submit the Bir 2302 to the IRS by the designated deadline to avoid penalties.

Steps to complete the Bir 2302

Completing the Bir 2302 requires a systematic approach. Follow these steps for successful completion:

- Gather all relevant financial documentation.

- Enter your business name and identification number at the top of the form.

- Detail your income sources in the specified sections.

- Include any deductions or credits applicable to your situation.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Bir 2302

The Bir 2302 must be used in accordance with IRS regulations to ensure its legal validity. This includes submitting the form by established deadlines and providing accurate information. Failure to comply with these regulations can result in penalties or audits. It is important to understand the legal implications of the information reported on the Bir 2302 to maintain compliance and avoid potential issues.

Filing Deadlines / Important Dates

Filing deadlines for the Bir 2302 are crucial to adhere to in order to avoid penalties. Typically, the form must be submitted by the annual tax filing deadline, which is usually April fifteenth for most taxpayers. It is advisable to check for any specific state-related deadlines or extensions that may apply. Staying informed about these dates helps ensure timely compliance with tax obligations.

Who Issues the Form

The Bir 2302 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and updates regarding the use of the form, ensuring that taxpayers have access to the necessary information for accurate reporting. Understanding the issuing authority helps users stay informed about any changes or requirements related to the Bir 2302.

Quick guide on how to complete bir 2302 228204896

Effortlessly prepare Bir 2302 on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and without delays. Handle Bir 2302 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based process today.

The easiest way to modify and electronically sign Bir 2302 seamlessly

- Obtain Bir 2302 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential portions of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Decide how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any preferred device. Modify and electronically sign Bir 2302 and ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct bir 2302 228204896

Create this form in 5 minutes!

How to create an eSignature for the bir 2302 228204896

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the bir form 2302?

The bir form 2302 is a tax form used by businesses in the Philippines to report employee compensation for a specific period. It provides the necessary details for calculating withholding tax and is essential for compliance with tax regulations.

-

How can airSlate SignNow help with bir form 2302?

airSlate SignNow simplifies the process of completing and submitting your bir form 2302. With our user-friendly platform, you can easily fill out the form, add electronic signatures, and send it securely to relevant parties.

-

Is airSlate SignNow a cost-effective option for managing bir form 2302?

Yes, airSlate SignNow offers a cost-effective solution for managing your bir form 2302. Our competitive pricing ensures that businesses of all sizes can streamline their document processes without breaking the bank.

-

What features does airSlate SignNow provide for handling bir form 2302?

airSlate SignNow provides features like customizable templates, electronic signatures, and real-time tracking for your bir form 2302. These tools help expedite document workflows while ensuring compliance and accuracy.

-

Can I integrate airSlate SignNow with other software for managing bir form 2302?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, allowing you to manage your bir form 2302 more efficiently. Connect it with your accounting or HR software to streamline your workflow and data management.

-

What are the benefits of using airSlate SignNow for bir form 2302 submissions?

Using airSlate SignNow for bir form 2302 submissions offers several benefits, including enhanced security, reduced processing time, and easy access from any device. This means you can ensure timely reporting while maintaining compliance with tax regulations.

-

How secure is my information when using airSlate SignNow for bir form 2302?

Your information is highly secure when using airSlate SignNow for bir form 2302. We implement advanced encryption and security protocols to protect your sensitive data throughout the entire document management process.

Get more for Bir 2302

Find out other Bir 2302

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now