Dtf 280 Form

What is the DTF 280?

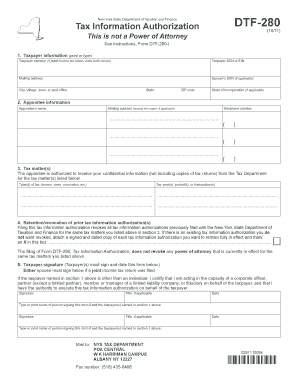

The DTF 280 is a tax information authorization form used in New York State. It allows taxpayers to authorize a third party, such as a tax preparer or accountant, to access their tax information and act on their behalf regarding specific tax matters. This form is particularly useful for individuals and businesses who require assistance with their tax filings, ensuring that their representatives have the necessary permissions to handle sensitive tax-related issues.

How to Obtain the DTF 280

To obtain the DTF 280 form, individuals can visit the New York State Department of Taxation and Finance website. The form is available for download in PDF format, making it easy to print and fill out. Additionally, it may be possible to request a physical copy through local tax offices or by contacting the Department directly. Ensuring that you have the most current version of the form is essential, as tax regulations can change frequently.

Steps to Complete the DTF 280

Completing the DTF 280 involves several straightforward steps:

- Download the DTF 280 form from the New York State Department of Taxation and Finance website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide the details of the individual or organization you are authorizing, including their name and contact information.

- Specify the tax matters for which the authorization is granted, ensuring clarity on the scope of access.

- Sign and date the form to validate your authorization.

After completing these steps, the form can be submitted to the relevant tax authority or shared with your authorized representative.

Legal Use of the DTF 280

The DTF 280 form is legally binding when properly completed and signed. It complies with New York State regulations regarding tax information authorization. For the authorization to be valid, both the taxpayer and the authorized representative must adhere to the stipulations outlined in the form. This includes ensuring that the authorization is not used for purposes outside of those specified, which helps maintain the integrity of the taxpayer's information.

Form Submission Methods

The DTF 280 can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the New York State Department of Taxation and Finance:

- Online: Some taxpayers may have the option to submit the DTF 280 electronically through secure online portals.

- Mail: The completed form can be mailed directly to the appropriate tax office. It is advisable to use certified mail for tracking purposes.

- In-Person: Taxpayers may also choose to deliver the form in person at designated tax offices, ensuring immediate receipt.

Key Elements of the DTF 280

The DTF 280 includes several key elements that are critical for its effectiveness:

- Taxpayer Information: Accurate identification of the taxpayer is crucial for processing.

- Authorized Representative Details: Clear identification of the individual or organization authorized to act on behalf of the taxpayer.

- Scope of Authorization: Specific details regarding the tax matters the representative is allowed to handle.

- Signature: The taxpayer's signature is required to validate the authorization.

Quick guide on how to complete dtf 280

Accomplish Dtf 280 easily on any device

Digital document management has gained popularity among both businesses and individuals. It offers an ideal eco-friendly replacement for conventional printed and signed documents, as you can discover the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without difficulties. Manage Dtf 280 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The optimal way to adjust and electronically sign Dtf 280 effortlessly

- Obtain Dtf 280 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with features that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about missing or mislaid files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow manages all your document handling needs in just a few clicks from any device you prefer. Modify and electronically sign Dtf 280 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtf 280

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DTF 280 and how does it work?

The DTF 280 is an advanced document signing tool that empowers businesses to manage and sign documents electronically. With a user-friendly interface, it simplifies the eSigning process by allowing users to send, track, and sign documents securely. This helps streamline workflows and improve overall efficiency.

-

What are the key features of the DTF 280?

The DTF 280 offers a range of features including customizable templates, real-time tracking, and advanced security options. Users can also integrate it seamlessly with various applications to enhance productivity. These features make it an ideal solution for businesses looking to optimize document management.

-

How much does the DTF 280 cost?

Pricing for the DTF 280 varies based on the subscription plan chosen. airSlate SignNow offers flexible pricing options to cater to businesses of all sizes. Additionally, there may be discounts available for annual subscriptions, providing even more value.

-

What benefits can businesses expect from using the DTF 280?

Utilizing the DTF 280 can lead to signNow time savings and improved accuracy in document processing. Businesses can expect enhanced collaboration as multiple users can sign and manage documents simultaneously. Furthermore, the eSigning feature ensures compliance with legal standards.

-

Is the DTF 280 secure for sensitive documents?

Absolutely! The DTF 280 incorporates top-tier encryption and security protocols to ensure that sensitive documents remain protected during the signing process. Additionally, it complies with various regulatory standards, giving users peace of mind when handling private information.

-

Can the DTF 280 integrate with other software?

Yes, the DTF 280 offers seamless integrations with a variety of popular applications such as Google Drive, Salesforce, and more. This allows businesses to enhance their existing workflows and ensure that document management is streamlined across different platforms.

-

How easy is it to use the DTF 280 for eSigning?

The DTF 280 is designed with user-friendliness in mind, making eSigning straightforward for everyone. Users can upload documents, add necessary fields, and send them for signatures in just a few clicks. The intuitive interface ensures a smooth experience even for first-time users.

Get more for Dtf 280

Find out other Dtf 280

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement