Form Il 1120 St 2020

What is the Form IL 1120 ST

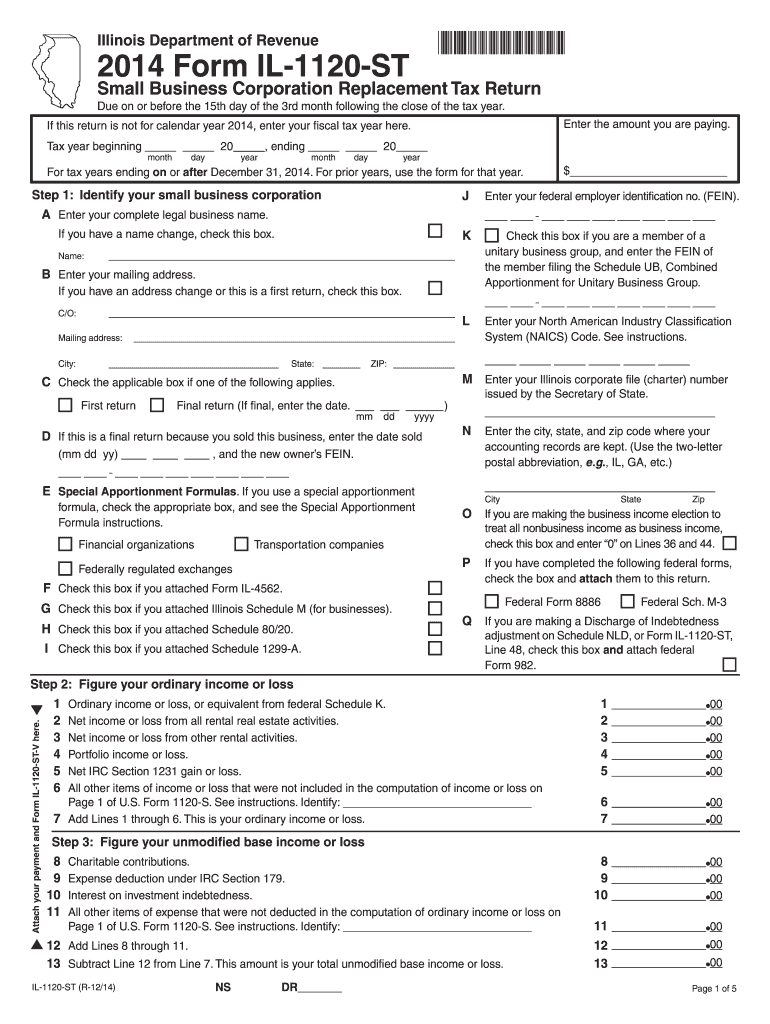

The Form IL 1120 ST is a state tax return form used by corporations in Illinois. This form is specifically designed for S corporations to report their income, deductions, and credits to the Illinois Department of Revenue. It is essential for S corporations operating in Illinois to file this form annually, as it helps determine the state tax liability based on the corporation's earnings.

How to use the Form IL 1120 ST

To use the Form IL 1120 ST effectively, corporations must gather relevant financial information, including income statements, balance sheets, and any applicable deductions. The form requires detailed reporting of income, expenses, and tax credits. Accurate completion ensures compliance with state tax laws and helps avoid penalties. It is advisable to consult a tax professional for assistance in filling out the form correctly.

Steps to complete the Form IL 1120 ST

Completing the Form IL 1120 ST involves several key steps:

- Gather all necessary financial documents, including income statements and prior year tax returns.

- Fill out the identification section with the corporation's name, address, and federal employer identification number (EIN).

- Report total income and allowable deductions in the appropriate sections of the form.

- Calculate the corporation's tax liability based on the reported income.

- Sign and date the form, ensuring that it is submitted by the filing deadline.

Filing Deadlines / Important Dates

The filing deadline for the Form IL 1120 ST is typically the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year basis, this means the form is due on March 15. Corporations should also be aware of any extensions that may be available and ensure they meet all deadlines to avoid late fees or penalties.

Legal use of the Form IL 1120 ST

The Form IL 1120 ST is legally binding and must be completed accurately to ensure compliance with Illinois tax laws. Failure to file the form or submitting incorrect information can lead to penalties, interest on unpaid taxes, and potential audits. It is crucial for corporations to maintain accurate records and ensure that all information reported on the form is truthful and complete.

Key elements of the Form IL 1120 ST

Key elements of the Form IL 1120 ST include:

- Identification Information: This section requires the corporation's name, address, and EIN.

- Income Reporting: Corporations must report total income from all sources.

- Deductions: Specific deductions allowed by Illinois law can be claimed to reduce taxable income.

- Tax Calculation: The form includes a section for calculating the total tax due based on reported income.

Quick guide on how to complete form il 1120 st 2014

Complete Form Il 1120 St effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly and without delays. Manage Form Il 1120 St on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Form Il 1120 St with ease

- Find Form Il 1120 St and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you want to distribute your form: via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Form Il 1120 St and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form il 1120 st 2014

Create this form in 5 minutes!

How to create an eSignature for the form il 1120 st 2014

How to generate an eSignature for your PDF document in the online mode

How to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is Form IL 1120 ST and who needs it?

Form IL 1120 ST is a simplified income tax return for S corporations operating in Illinois. Businesses with S corporation status, which meet specific criteria, are required to file this form to report their income, deductions, and credits. It's essential for S corporations to stay compliant and properly submit Form IL 1120 ST to avoid any penalties.

-

How can airSlate SignNow help with Form IL 1120 ST filing?

airSlate SignNow simplifies the process of completing and eSigning your Form IL 1120 ST by providing an intuitive digital platform. Users can easily upload, fill out, and send their documents for electronic signature, streamlining the entire filing process. This allows businesses to save time and ensure accuracy when filing their Form IL 1120 ST.

-

What features does airSlate SignNow offer for tax form eSigning?

airSlate SignNow offers a range of features for tax form eSigning, including customizable templates and audit trails for accountability. Users can quickly create and send Form IL 1120 ST for signature, while also benefiting from real-time notifications and reminders. These features enhance the efficiency and reliability of document management.

-

Is there a cost associated with using airSlate SignNow for Form IL 1120 ST?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. You can choose a plan that fits your requirements for managing documents like Form IL 1120 ST. The cost is competitive, and the platform provides signNow time savings, making it a cost-effective solution for businesses.

-

Can airSlate SignNow integrate with accounting software for Form IL 1120 ST?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to streamline your workflow when managing Form IL 1120 ST. These integrations ensure that your documents synchronize smoothly with your accounting tools, enhancing accuracy and efficiency in the filing process.

-

How secure is my data when using airSlate SignNow for Form IL 1120 ST?

Security is a top priority at airSlate SignNow. When managing your Form IL 1120 ST or any other documents, your data is protected with industry-standard encryption and secure access controls. This ensures that your sensitive information remains confidential and safe from unauthorized access.

-

What are the benefits of eSigning my Form IL 1120 ST with airSlate SignNow?

eSigning your Form IL 1120 ST with airSlate SignNow offers numerous benefits, including faster processing times and reduced paperwork. It allows for instant verification of signatures and provides a user-friendly experience. Additionally, you can access your signed documents anytime, anywhere, ensuring greater flexibility.

Get more for Form Il 1120 St

Find out other Form Il 1120 St

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure