Empire State Child Credit Instructions Form

What is the Empire State Child Credit Instructions Form

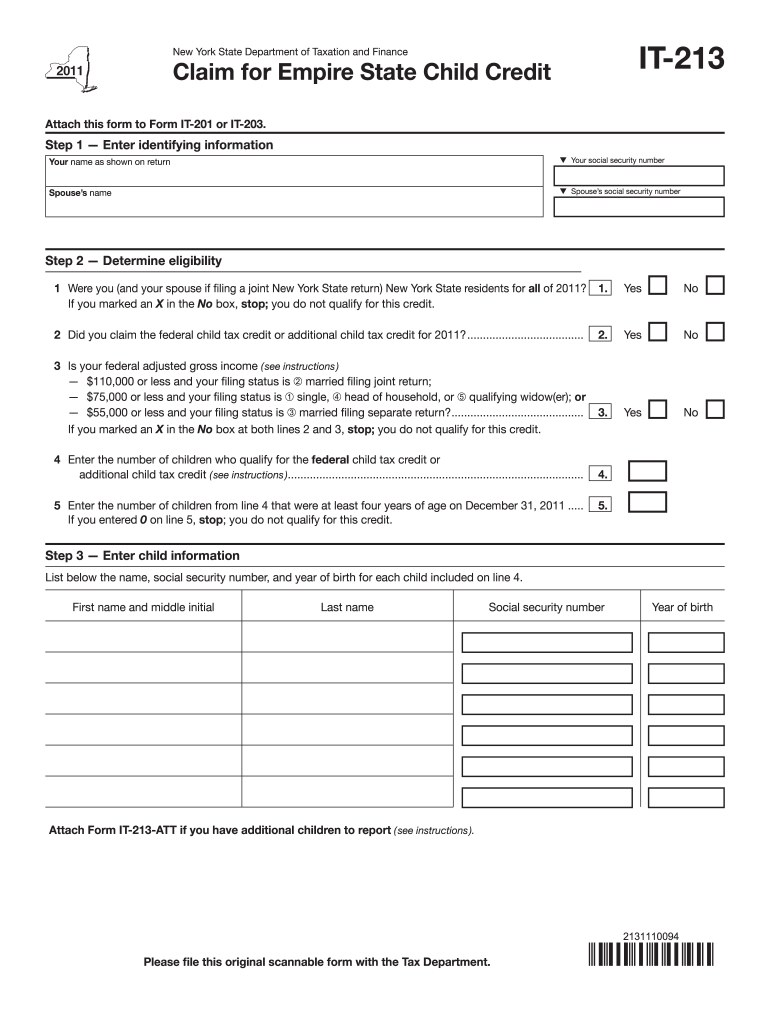

The Empire State Child Credit Instructions Form is a document designed to guide taxpayers in claiming the Empire State Child Credit, a tax benefit available to eligible families in New York. This credit aims to provide financial support to families with children, helping to alleviate some of the financial burdens associated with raising children. Understanding this form is essential for ensuring that you receive the maximum benefit available under New York state tax law.

How to use the Empire State Child Credit Instructions Form

Using the Empire State Child Credit Instructions Form involves several steps that ensure accurate completion and submission. First, familiarize yourself with the eligibility criteria for the credit. Next, gather all necessary documentation, such as proof of income and dependent information. Follow the instructions carefully, filling out the form with the required details. Make sure to review the completed form for accuracy before submitting it to the appropriate tax authority.

Steps to complete the Empire State Child Credit Instructions Form

Completing the Empire State Child Credit Instructions Form involves a series of detailed steps:

- Read the instructions thoroughly to understand the requirements.

- Gather necessary documents, including Social Security numbers and income statements.

- Fill in your personal information accurately, including your filing status.

- Provide information about your qualifying children, including their ages and relationship to you.

- Calculate the credit amount based on your income and the number of qualifying children.

- Review the form for any errors or omissions before submission.

Eligibility Criteria

To qualify for the Empire State Child Credit, certain eligibility criteria must be met. Generally, you must be a resident of New York State and have a qualifying child under the age of 17. Your income must fall below specific thresholds set by the state. Additionally, the child must be claimed as a dependent on your tax return. Understanding these criteria is crucial for determining your eligibility for the credit.

Required Documents

When completing the Empire State Child Credit Instructions Form, specific documents are required to support your claim. These typically include:

- Proof of identity, such as a driver's license or state ID.

- Social Security cards for you and your qualifying children.

- Income documentation, such as W-2 forms or 1099 forms.

- Any previous tax returns that may be relevant.

Form Submission Methods

The Empire State Child Credit Instructions Form can be submitted through various methods to accommodate different preferences. You can choose to file the form online through the New York State Department of Taxation and Finance website, which offers a streamlined electronic submission process. Alternatively, you may print the completed form and mail it to the designated address provided in the instructions. In-person submission may also be available at certain tax offices.

Quick guide on how to complete empire state child credit instructions form

Effortlessly Prepare Empire State Child Credit Instructions Form on Any Device

The management of documents online has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Empire State Child Credit Instructions Form on any device with the airSlate SignNow applications for Android or iOS and simplify your document-related tasks today.

How to Edit and Electronically Sign Empire State Child Credit Instructions Form with Ease

- Obtain Empire State Child Credit Instructions Form and click on Get Form to begin.

- Make use of the tools provided to complete your form.

- Highlight important sections of your documents or redact sensitive information with the specialized tools that airSlate SignNow offers for this purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device of your choice. Update and electronically sign Empire State Child Credit Instructions Form while ensuring clear communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the empire state child credit instructions form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Empire State Child Credit Instructions Form?

The Empire State Child Credit Instructions Form is a document designed to help taxpayers claim the child credit in New York State. By following the instructions outlined in this form, users can ensure they meet all eligibility requirements to maximize their credits and potential refunds.

-

How do I fill out the Empire State Child Credit Instructions Form?

Filling out the Empire State Child Credit Instructions Form involves providing detailed information about your children, including their ages and your income. Make sure to read the instructions carefully to avoid common mistakes that could delay your refund or disqualify you from receiving the credit.

-

Where can I access the Empire State Child Credit Instructions Form?

You can access the Empire State Child Credit Instructions Form online through the New York State Department of Taxation and Finance website. This ensures you have the most up-to-date version of the form and instructions for a smooth filing process.

-

Are there any fees associated with using the Empire State Child Credit Instructions Form?

There are no fees specifically associated with the Empire State Child Credit Instructions Form itself as it is provided free of charge by the state. However, if you opt for professional tax assistance or software, those services may incur costs.

-

What are the benefits of using the Empire State Child Credit Instructions Form?

The Empire State Child Credit Instructions Form allows eligible taxpayers to receive signNow tax credits for dependent children, which can reduce overall tax liability. This can lead to increased refunds, providing financial relief to families across New York State.

-

Can I submit the Empire State Child Credit Instructions Form electronically?

Yes, the Empire State Child Credit Instructions Form can often be submitted electronically if you're e-filing your tax return. Check with your chosen filing software or tax professional to ensure that the form is properly included and submitted.

-

What should I do if I make a mistake on my Empire State Child Credit Instructions Form?

If you realize you've made a mistake on your Empire State Child Credit Instructions Form, you can file an amendment with the appropriate New York State tax forms. It's crucial to correct any errors promptly to avoid potential issues or delays in processing your refund.

Get more for Empire State Child Credit Instructions Form

- Instructions for packet 11 change of venuetransfer of case form

- Oregon judicial department civil programs ampamp services form

- 22 02a 1113 name change packet adult rad care form

- Carbon monoxide disclosure form

- Change of name or sex oregongov form

- Present name of child last first middle form

- Order to give notice of name change hearing minor 4 form

- Writ of execution pennsylvania form

Find out other Empire State Child Credit Instructions Form

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free