CT 1041, Connecticut Income Tax Return for Trusts CT Gov 2019

What is the CT 1041, Connecticut Income Tax Return For Trusts

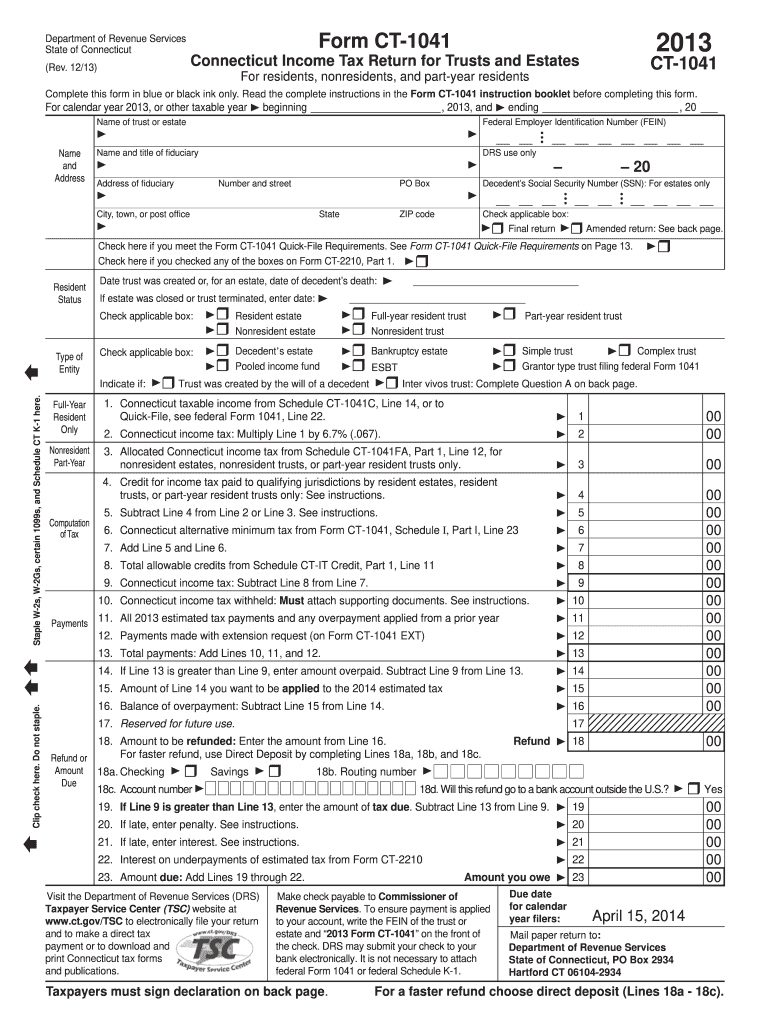

The CT 1041 is the official form used for filing the Connecticut income tax return for trusts. This form is specifically designed for fiduciaries managing trusts that generate income. It allows for the reporting of income, deductions, and credits associated with the trust's financial activities. Trusts must file this return if they have taxable income or if they have any Connecticut source income. Understanding the purpose of the CT 1041 is essential for compliance with state tax laws.

Steps to complete the CT 1041, Connecticut Income Tax Return For Trusts

Completing the CT 1041 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements, deductions, and any relevant tax forms. Next, accurately fill out each section of the CT 1041, providing detailed information about the trust's income and expenses. It is important to review all entries for correctness before finalizing the form. After completion, the form can be submitted either electronically or via mail, depending on the preferred submission method.

Filing Deadlines / Important Dates

Trusts must adhere to specific filing deadlines for the CT 1041. Generally, the return is due on the fifteenth day of the fourth month following the close of the trust's taxable year. For trusts operating on a calendar year basis, this typically means the due date is April 15. It is crucial to be aware of these deadlines to avoid penalties and ensure timely compliance with state tax regulations.

Required Documents

When preparing to file the CT 1041, certain documents are required to support the information reported on the form. These documents may include:

- Income statements from all sources

- Records of deductions and credits

- Previous year’s tax return for reference

- Any supporting documentation for special circumstances, such as distributions or expenses

Having these documents readily available will facilitate a smoother filing process and help ensure that all necessary information is accurately reported.

Legal use of the CT 1041, Connecticut Income Tax Return For Trusts

The CT 1041 serves a legal purpose as it is required by Connecticut tax law for trusts that meet specific criteria. Filing this form correctly is essential for the legal recognition of the trust's income and tax obligations. Failure to file or inaccuracies in the form can lead to penalties, interest, and potential legal issues. Therefore, understanding the legal implications of the CT 1041 is vital for fiduciaries managing trusts.

Who Issues the Form

The CT 1041 is issued by the Connecticut Department of Revenue Services (DRS). This state agency is responsible for administering tax laws and ensuring compliance among taxpayers, including trusts. The DRS provides guidance and resources for completing the CT 1041, making it easier for fiduciaries to understand their obligations and the filing process.

Quick guide on how to complete ct 1041 2013 connecticut income tax return for trusts ctgov

Complete CT 1041, Connecticut Income Tax Return For Trusts CT gov effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents swiftly without delays. Manage CT 1041, Connecticut Income Tax Return For Trusts CT gov on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign CT 1041, Connecticut Income Tax Return For Trusts CT gov without hassle

- Locate CT 1041, Connecticut Income Tax Return For Trusts CT gov and click Get Form to begin.

- Utilize the tools we provide to submit your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign CT 1041, Connecticut Income Tax Return For Trusts CT gov and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 1041 2013 connecticut income tax return for trusts ctgov

Create this form in 5 minutes!

How to create an eSignature for the ct 1041 2013 connecticut income tax return for trusts ctgov

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is the CT 1041, Connecticut Income Tax Return For Trusts CT gov.?

The CT 1041, Connecticut Income Tax Return For Trusts CT gov., is a tax form that trusts must file with the state of Connecticut to report income and calculate the amount of tax owed. It is crucial for trusts generating income in Connecticut to comply with state tax laws. Utilizing platforms like airSlate SignNow can streamline the eSigning and submission process for these forms.

-

How can airSlate SignNow assist with filing the CT 1041, Connecticut Income Tax Return For Trusts CT gov.?

airSlate SignNow provides an efficient platform to send and eSign necessary documents required for filing the CT 1041, Connecticut Income Tax Return For Trusts CT gov. Our easy-to-use interface simplifies the document management process, making it easier for trustees to ensure timely and accurate filing.

-

What are the pricing options for airSlate SignNow when filing the CT 1041, Connecticut Income Tax Return For Trusts CT gov.?

airSlate SignNow offers affordable pricing plans designed to meet the needs of both individuals and businesses preparing the CT 1041, Connecticut Income Tax Return For Trusts CT gov. Our plans include various features, ensuring you have everything you need for efficient document handling without breaking the bank.

-

Are there any features specific to managing the CT 1041, Connecticut Income Tax Return For Trusts CT gov. on airSlate SignNow?

Yes, airSlate SignNow includes features like document templates, automated reminders for deadlines, and secure eSigning. These tools specifically cater to the needs of trustees and accountants handling the CT 1041, Connecticut Income Tax Return For Trusts CT gov., ensuring compliance and smooth processing.

-

Can I integrate airSlate SignNow with other accounting software for the CT 1041, Connecticut Income Tax Return For Trusts CT gov.?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and finance software, making it easier to prepare and submit the CT 1041, Connecticut Income Tax Return For Trusts CT gov. These integrations help keep your financial data synchronized and organized.

-

What are the benefits of using airSlate SignNow for the CT 1041, Connecticut Income Tax Return For Trusts CT gov.?

Using airSlate SignNow for the CT 1041, Connecticut Income Tax Return For Trusts CT gov. streamlines the document processing workflow. You benefit from enhanced security, improved efficiency in signing documents, and the ability to track the status of submissions, making tax compliance easier for trustees.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning documents for the CT 1041, Connecticut Income Tax Return For Trusts CT gov.?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those not tech-savvy. Our intuitive interface allows users to easily navigate the eSigning process for the CT 1041, Connecticut Income Tax Return For Trusts CT gov. without any prior experience.

Get more for CT 1041, Connecticut Income Tax Return For Trusts CT gov

Find out other CT 1041, Connecticut Income Tax Return For Trusts CT gov

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement