Ct Form 2020

What is the Ct Form

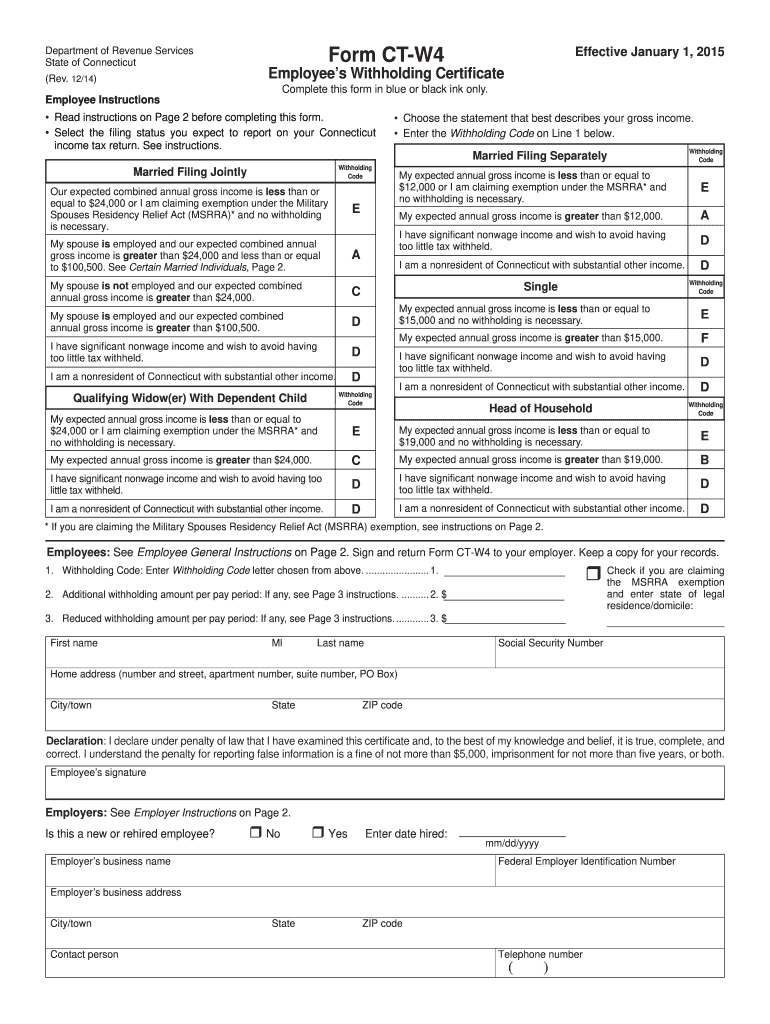

The Ct Form is a specific document used primarily for tax purposes in the United States. It is essential for individuals and businesses to report income, deductions, and other relevant financial information to the Internal Revenue Service (IRS). Understanding the purpose of the Ct Form is crucial for compliance with federal tax regulations. This form helps streamline the tax filing process, ensuring that all necessary information is accurately reported.

How to use the Ct Form

Using the Ct Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, receipts, and previous tax returns. Next, fill out the form carefully, ensuring that all information is complete and accurate. It is advisable to review the form for any errors before submission. Once completed, the Ct Form can be submitted electronically or via traditional mail, depending on the specific requirements of the IRS.

Steps to complete the Ct Form

Completing the Ct Form involves a series of methodical steps:

- Gather all relevant financial documents.

- Fill in personal information, including name, address, and Social Security number.

- Report income from various sources, such as wages, dividends, and interest.

- Claim deductions and credits applicable to your situation.

- Review the form for accuracy and completeness.

- Submit the form according to IRS guidelines.

Legal use of the Ct Form

The Ct Form is legally recognized by the IRS as a valid means of reporting tax information. To ensure its legal standing, it must be filled out accurately and submitted within the designated deadlines. Compliance with IRS regulations is crucial, as improper use of the form can lead to penalties or legal issues. Additionally, eSignatures can be applied to the form when submitted electronically, as long as they meet the requirements set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN).

Filing Deadlines / Important Dates

Filing deadlines for the Ct Form are critical to avoid penalties. Typically, the deadline for submission is April fifteenth of each year, although this may vary based on weekends or holidays. Extensions may be available, but they must be requested before the original deadline. It is essential to stay informed about any changes to filing dates, as these can impact your tax obligations.

Required Documents

To complete the Ct Form accurately, certain documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Receipts for deductible expenses.

- Previous year's tax return for reference.

Having these documents on hand will facilitate a smoother filing process and help ensure that all necessary information is reported.

Quick guide on how to complete 2015 ct form 100453931

Effortlessly prepare Ct Form on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to quickly create, modify, and eSign your documents without delays. Manage Ct Form across any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The simplest way to alter and eSign Ct Form with ease

- Obtain Ct Form and select Get Form to begin.

- Utilize the resources we provide to fill out your document.

- Mark important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to share your form: via email, SMS, invite link, or download it onto your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow addresses your document management needs with just a few clicks from your preferred device. Edit and eSign Ct Form to ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 ct form 100453931

Create this form in 5 minutes!

How to create an eSignature for the 2015 ct form 100453931

The way to generate an electronic signature for a PDF in the online mode

The way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is a Ct Form and how is it used in airSlate SignNow?

A Ct Form is a crucial document used in businesses for various purposes, including legal, financial, and operational transactions. With airSlate SignNow, you can easily create, sign, and manage your Ct Forms electronically, ensuring a streamlined workflow and enhanced efficiency.

-

How does airSlate SignNow support the completion of Ct Forms?

airSlate SignNow provides users with intuitive tools to create, edit, and track Ct Forms. Features such as templates, eSigning, and real-time collaboration make it easy to handle Ct Forms from start to finish, reducing the time and effort involved in traditional paper methods.

-

Is there a cost to use the Ct Form feature in airSlate SignNow?

Using the Ct Form feature in airSlate SignNow is part of our subscription plans, which are designed to be cost-effective for businesses of all sizes. We offer various pricing tiers to fit your needs, ensuring that you get the best value for managing your Ct Forms and other documents.

-

Can I customize my Ct Form within airSlate SignNow?

Absolutely! airSlate SignNow allows you to fully customize your Ct Form to meet your specific requirements. You can add fields, adjust layouts, and incorporate your branding to ensure your Ct Forms reflect your business’s unique identity.

-

What are the benefits of using airSlate SignNow for Ct Forms?

Using airSlate SignNow for your Ct Forms offers numerous benefits, including faster document turnaround, reduced paper use, and improved organization. The electronic signing process enhances security and ensures that all signed Ct Forms are easily accessible and accountable.

-

Does airSlate SignNow integrate with other tools for managing Ct Forms?

Yes, airSlate SignNow integrates seamlessly with various business applications, enabling you to manage your Ct Forms alongside other critical workflows. This integration saves time and improves efficiency by allowing for real-time updates and data synchronization across platforms.

-

Is it easy to track the status of my Ct Form in airSlate SignNow?

Tracking the status of your Ct Form in airSlate SignNow is simple and efficient. You can receive real-time notifications and view the document's signing progress, ensuring that you are always informed about where your Ct Form stands in the workflow.

Get more for Ct Form

- Amoeba sisters video recap of meiosis answer key pdf form

- Cw8a form

- Dpss mental health assessment form

- Einladungsschreiben besuchervisum muster form

- Form 1113

- Fs 240 form pdf

- Nutrition screening form 24405710

- Pennsylvania e file signature authorization for pa s corporationpartnership information return pa 20spa 65 directory of 496341449

Find out other Ct Form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template