Ct 706 Nt Form 2020

What is the Ct 706 Nt Form

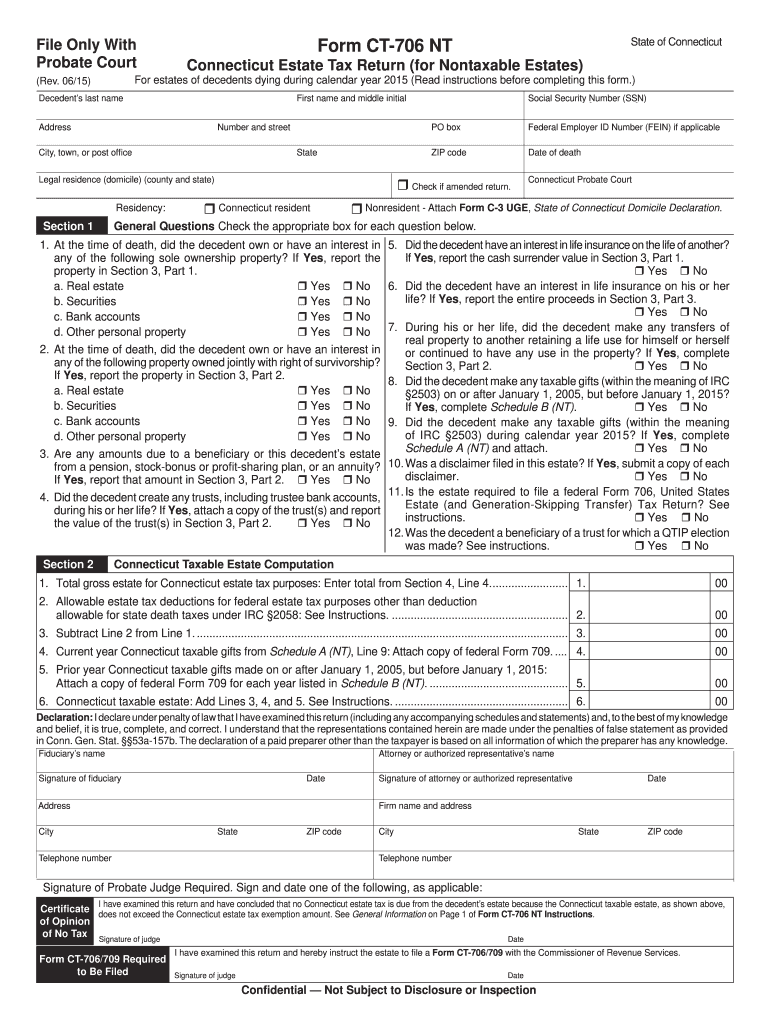

The Ct 706 Nt Form is a tax document used in the state of Connecticut for reporting the estate tax. This form is specifically designed for estates that exceed the exemption limit set by the state. The purpose of the Ct 706 Nt Form is to provide the Connecticut Department of Revenue Services with the necessary information to assess the estate tax owed. It includes details about the decedent, the value of the estate, and any deductions or credits that may apply. Understanding this form is essential for executors and administrators managing the estate, as it ensures compliance with state tax laws.

How to use the Ct 706 Nt Form

Using the Ct 706 Nt Form involves several steps to ensure accurate and complete submission. First, gather all necessary documentation related to the estate, including asset valuations, debts, and any relevant financial records. Next, fill out the form carefully, ensuring that all information is accurate and complete. Pay special attention to sections that require detailed descriptions of assets and liabilities. Once the form is completed, review it for any errors or omissions before submitting it to the Connecticut Department of Revenue Services. This careful approach helps avoid delays and potential penalties.

Steps to complete the Ct 706 Nt Form

Completing the Ct 706 Nt Form requires a systematic approach to ensure all necessary information is included. Follow these steps:

- Gather all relevant estate documents, including wills, asset valuations, and debts.

- Begin filling out the form with the decedent's information, including their name, date of death, and Social Security number.

- Provide a detailed list of all assets, including real estate, bank accounts, and personal property, along with their respective values.

- Document any debts or liabilities that the estate owes.

- Calculate any deductions or credits that may apply to the estate.

- Review the completed form for accuracy, ensuring all sections are filled out correctly.

- Submit the form to the appropriate state agency by the specified deadline.

Legal use of the Ct 706 Nt Form

The legal use of the Ct 706 Nt Form is crucial for compliance with Connecticut estate tax laws. This form must be filed by the executor or administrator of an estate when the total value exceeds the exemption threshold. Filing the form accurately and on time helps avoid legal penalties and ensures that the estate is settled according to state regulations. Additionally, the information provided on the form is used by the state to determine the estate tax liability, making it a key component of the estate settlement process.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 706 Nt Form are critical to ensure compliance with state tax laws. The form must typically be filed within six months of the decedent's date of death. However, extensions may be available under certain circumstances. It is important to check the Connecticut Department of Revenue Services website for specific dates and any updates to filing requirements. Meeting these deadlines helps prevent penalties and interest on unpaid taxes, making timely submission essential for estate administrators.

Who Issues the Form

The Ct 706 Nt Form is issued by the Connecticut Department of Revenue Services (DRS). This state agency is responsible for administering tax laws and collecting taxes in Connecticut. The DRS provides the form and accompanying instructions to assist executors and administrators in completing the estate tax filing process. It is advisable to refer to the DRS website for the most current version of the form and any updates to filing procedures or requirements.

Quick guide on how to complete ct 706 nt form 2015

Complete Ct 706 Nt Form seamlessly on any device

Online document organization has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without interruptions. Manage Ct 706 Nt Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The optimal method to modify and electronically sign Ct 706 Nt Form effortlessly

- Find Ct 706 Nt Form and click on Get Form to commence.

- Utilize the resources we provide to finish your form.

- Highlight pertinent sections of the documents or redact sensitive data with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to preserve your changes.

- Select your preferred method for delivering your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or mislaid documents, tiresome form searches, or mistakes requiring the printing of new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choosing. Edit and electronically sign Ct 706 Nt Form to ensure superb communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 706 nt form 2015

Create this form in 5 minutes!

How to create an eSignature for the ct 706 nt form 2015

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is the Ct 706 Nt Form?

The Ct 706 Nt Form is a Connecticut estate tax return that needs to be filed for estates exceeding a certain threshold. This form is crucial for handling estate taxes effectively and ensures compliance with state regulations. Understanding how to complete the Ct 706 Nt Form can help you navigate complex tax requirements.

-

How can airSlate SignNow help me with the Ct 706 Nt Form?

airSlate SignNow simplifies the process of completing and signing the Ct 706 Nt Form by allowing you to electronically fill out and send documents securely. With our easy-to-use tool, you can eSign the form and manage all your estate-related paperwork efficiently. This streamlines the process and minimizes potential errors.

-

What are the pricing options for using airSlate SignNow for the Ct 706 Nt Form?

We offer a variety of pricing plans tailored to meet your business needs when handling the Ct 706 Nt Form and other documents. Whether you're a small business or a large enterprise, you can find a plan that suits your budget while providing comprehensive features for document management. Check our website for current pricing and special offers.

-

Are there any specific features of airSlate SignNow that assist with the Ct 706 Nt Form?

Yes, airSlate SignNow provides features like customizable templates, bulk sending, and integration with cloud storage to assist with the Ct 706 Nt Form. These tools not only accelerate the completion process but also enhance collaboration among users. Our software is designed to ensure your document workflows are efficient and compliant.

-

Is airSlate SignNow compliant with regulations for the Ct 706 Nt Form?

Absolutely, airSlate SignNow is designed to comply with all relevant legal standards, including those required for the Ct 706 Nt Form. We prioritize security and compliance, ensuring that your data and electronic signatures are protected and legally binding. This allows users to focus on other important aspects of the estate process.

-

Can I integrate airSlate SignNow with other software for filing the Ct 706 Nt Form?

Yes, airSlate SignNow integrates seamlessly with popular software applications, making it easy to file the Ct 706 Nt Form alongside other financial and tax management tools. This integration helps increase productivity and ensures all documents remain organized. You can connect our platform with tools you already use to enhance workflow efficiency.

-

What are the benefits of using airSlate SignNow for the Ct 706 Nt Form?

Using airSlate SignNow for the Ct 706 Nt Form offers several benefits such as cost-effective solutions, improved accuracy, and time savings. Our platform allows you to manage all aspects of the document signing process from anywhere, providing flexibility and ease of use. By optimizing your document management with us, you will streamline the entire process.

Get more for Ct 706 Nt Form

Find out other Ct 706 Nt Form

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free