Ct1096 Drs Form 2020

What is the Ct1096 Drs Form

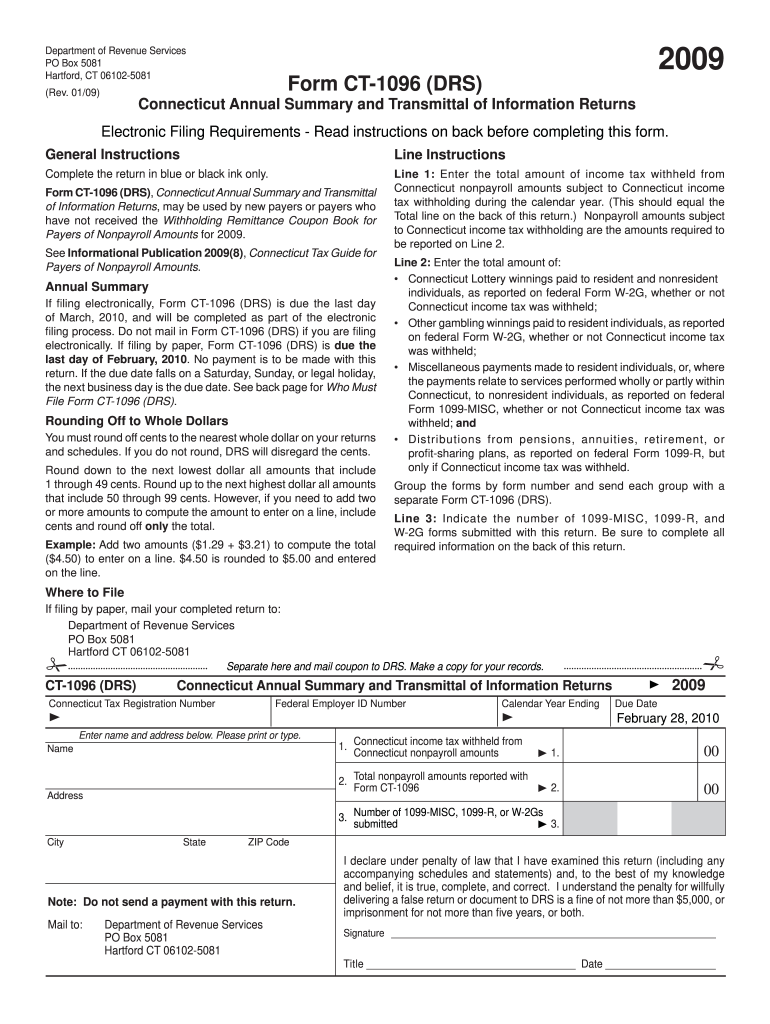

The Ct1096 Drs Form is a crucial document used in the state of Connecticut for specific tax-related purposes. It is primarily utilized by businesses and individuals to report certain financial information to the Connecticut Department of Revenue Services. This form helps ensure compliance with state tax regulations, allowing the state to accurately assess tax liabilities and maintain proper records.

How to use the Ct1096 Drs Form

Using the Ct1096 Drs Form involves several key steps. First, ensure that you have the correct version of the form, which can be obtained from the Connecticut Department of Revenue Services website. Next, carefully read the instructions provided with the form to understand the required information. Fill out the form accurately, ensuring all necessary details are included. Finally, submit the completed form according to the specified submission methods, whether online, by mail, or in person.

Steps to complete the Ct1096 Drs Form

Completing the Ct1096 Drs Form requires attention to detail. Follow these steps:

- Gather all necessary financial documents, including income statements and expense reports.

- Download the Ct1096 Drs Form from the official state website.

- Fill in your personal or business information as required.

- Provide accurate financial data, ensuring all calculations are correct.

- Review the form for completeness and accuracy before submission.

Legal use of the Ct1096 Drs Form

The legal use of the Ct1096 Drs Form is essential for compliance with Connecticut tax laws. When properly filled out and submitted, this form serves as an official record of your financial activities as they pertain to state taxes. It is important to ensure that all information is truthful and accurate, as discrepancies can lead to penalties or audits by the state.

Filing Deadlines / Important Dates

Filing deadlines for the Ct1096 Drs Form vary based on the type of taxpayer and the specific tax year. Generally, forms must be submitted by the end of the tax year or as specified by the Connecticut Department of Revenue Services. It is crucial to stay informed about these deadlines to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The Ct1096 Drs Form can be submitted through various methods. Taxpayers may choose to file online via the Connecticut Department of Revenue Services portal, which offers a streamlined process. Alternatively, forms can be mailed to the appropriate address provided in the instructions. In-person submissions are also accepted at designated state offices, allowing for direct interaction with tax officials if needed.

Quick guide on how to complete ct1096 drs 2009 form

Easily Prepare Ct1096 Drs Form on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly substitute for conventional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Ct1096 Drs Form on any platform through the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The Easiest Way to Edit and eSign Ct1096 Drs Form

- Locate Ct1096 Drs Form and select Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools available from airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Decide how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes requiring new printed copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Ct1096 Drs Form and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct1096 drs 2009 form

Create this form in 5 minutes!

How to create an eSignature for the ct1096 drs 2009 form

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Ct1096 Drs Form?

The Ct1096 Drs Form is a document used for reporting payments in the state of Connecticut. It is essential for businesses that need to disclose information about payments made to certain recipients. Understanding this form is crucial for ensuring compliance with state tax regulations.

-

How can I fill out the Ct1096 Drs Form using airSlate SignNow?

AirSlate SignNow offers an intuitive platform that makes it easy to fill out the Ct1096 Drs Form. Users can upload the document, input relevant information, and use our eSignature feature to finalize it quickly. This streamlines the process, ensuring your form is completed accurately and efficiently.

-

Is there a cost to use airSlate SignNow for the Ct1096 Drs Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including those who need to manage the Ct1096 Drs Form. You can choose a plan based on your usage level, making it a cost-effective solution for eSigning and managing documents.

-

What are the key features of airSlate SignNow relevant to the Ct1096 Drs Form?

AirSlate SignNow provides robust features such as document templates, team collaboration tools, and eSignature capabilities that are crucial when handling the Ct1096 Drs Form. These features enhance efficiency and ensure that all necessary compliance measures are met.

-

Can I integrate airSlate SignNow with other software for handling the Ct1096 Drs Form?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Salesforce, and others. This integration capability allows users to streamline their workflow while managing the Ct1096 Drs Form and other documents effectively.

-

What are the benefits of using airSlate SignNow for the Ct1096 Drs Form?

Using airSlate SignNow for the Ct1096 Drs Form offers several benefits, including time-saving features and enhanced document security. By eSigning and managing your forms within a single platform, you can improve compliance and accuracy in your reporting.

-

How can I ensure compliance when using the Ct1096 Drs Form with airSlate SignNow?

AirSlate SignNow helps ensure compliance when preparing the Ct1096 Drs Form by providing audit trails and secure storage for your documents. These features allow you to maintain records of signatures and submissions, essential for meeting regulatory requirements.

Get more for Ct1096 Drs Form

- Age of sigmar path to glory 3 0 pdf form

- South dakota property disclosure form

- T2151 39855872 form

- Tin id template download form

- Section 8 form to fill out pdf format printable

- Nf3 marsh artillery larval web monitoring form re

- Request for suspension of studies form leeds beckett university

- Cpf form 90 sample 40238584

Find out other Ct1096 Drs Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation