Ct 706 Nt Form 2020

What is the Ct 706 Nt Form

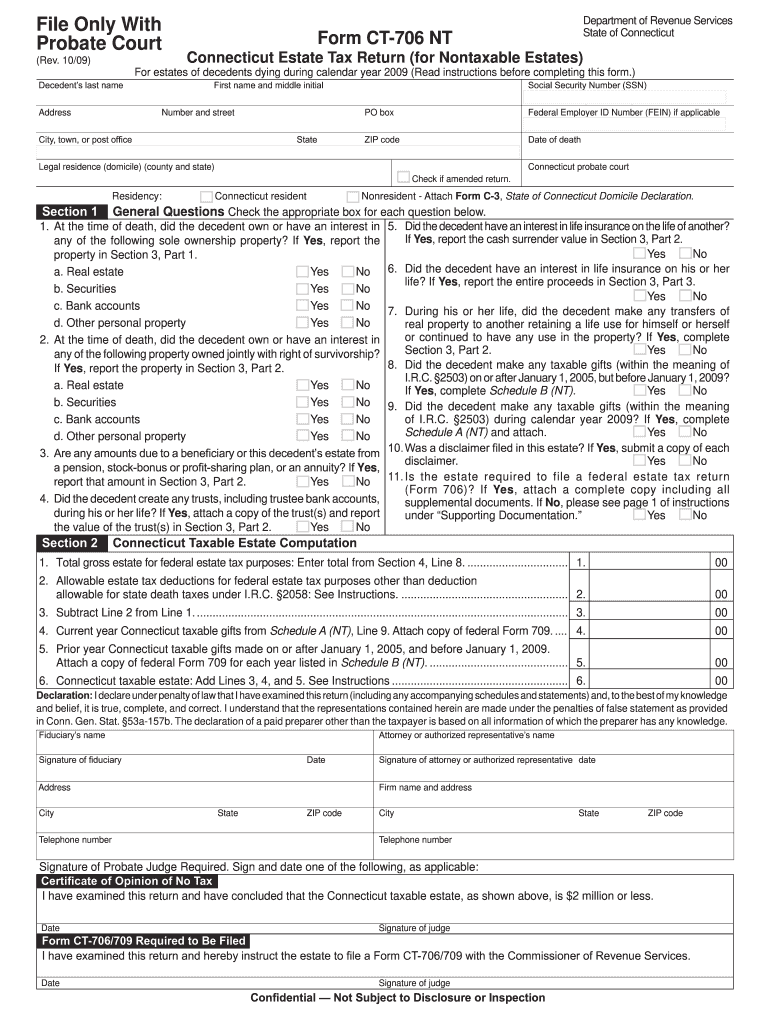

The Ct 706 Nt Form, also known as the Connecticut Estate Tax Return, is a legal document required for reporting and calculating estate taxes in the state of Connecticut. This form is typically necessary when the gross estate exceeds a specific threshold, which is subject to change based on state regulations. The form is essential for ensuring compliance with state tax laws and for the proper distribution of an estate's assets after the death of an individual.

How to use the Ct 706 Nt Form

Using the Ct 706 Nt Form involves several steps to ensure accurate reporting of an estate's value and tax liability. First, gather all necessary financial documents, including appraisals of property, bank statements, and investment records. Next, complete the form by providing detailed information about the decedent's assets, liabilities, and any deductions that may apply. Once filled out, the form must be signed by the executor or administrator of the estate before submission to the appropriate state authority.

Steps to complete the Ct 706 Nt Form

Completing the Ct 706 Nt Form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including property appraisals and account statements.

- Fill out the personal information section, including the decedent's name, date of birth, and date of death.

- List all assets owned by the decedent, including real estate, bank accounts, and investments.

- Detail any debts or liabilities that the estate must settle.

- Calculate the total value of the estate and any applicable deductions.

- Review the completed form for accuracy and ensure all required signatures are included.

Legal use of the Ct 706 Nt Form

The Ct 706 Nt Form serves a crucial legal function in the estate settlement process. It is required by Connecticut law for estates that meet the specified value threshold. Filing this form accurately and on time is essential to avoid penalties and ensure that the estate is administered according to state regulations. Failure to file can lead to significant legal complications and financial liabilities for the estate and the executor.

Filing Deadlines / Important Dates

Filing the Ct 706 Nt Form must be done within a specific timeframe to comply with state law. Generally, the form is due within nine months of the decedent's date of death. However, extensions may be available under certain circumstances. It is important to be aware of these deadlines to avoid late fees and penalties that can arise from delayed submissions.

Required Documents

When preparing to file the Ct 706 Nt Form, several documents are necessary to support the information provided. These documents typically include:

- Death certificate of the decedent.

- Appraisals for real estate and other significant assets.

- Bank statements and investment account summaries.

- Documentation of debts, such as mortgages and loans.

- Any previous tax returns that may affect the estate's tax liability.

Quick guide on how to complete 2009 ct 706 nt form

Complete Ct 706 Nt Form seamlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It offers an optimal eco-friendly substitute for conventional hardcopy paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Ct 706 Nt Form across any platform with the airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

The easiest way to alter and eSign Ct 706 Nt Form effortlessly

- Obtain Ct 706 Nt Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, monotonous form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ct 706 Nt Form while ensuring excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 ct 706 nt form

Create this form in 5 minutes!

How to create an eSignature for the 2009 ct 706 nt form

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is the Ct 706 Nt Form and why is it important?

The Ct 706 Nt Form is a state tax form used in Connecticut to report the estate tax for estates over a certain threshold. It's crucial for ensuring compliance with state tax laws and can help avoid penalties. Properly completing the Ct 706 Nt Form can simplify the estate settlement process and support transparency.

-

How can airSlate SignNow help with the Ct 706 Nt Form?

airSlate SignNow provides an intuitive platform for eSigning and sending your Ct 706 Nt Form securely. Our electronic signature solution ensures that the document is legally binding and compliant with state regulations. This streamlines the process, saving you time and reducing paperwork.

-

What features does airSlate SignNow offer for managing the Ct 706 Nt Form?

With airSlate SignNow, you get features like document templates, cloud storage, and team collaboration tools specifically designed for forms like the Ct 706 Nt Form. You can easily track document status, set reminders, and manage multiple signers. These features enhance efficiency and organization when dealing with important tax documents.

-

Is airSlate SignNow cost-effective for handling tax forms like the Ct 706 Nt Form?

Yes, airSlate SignNow is known for its competitive pricing, making it a cost-effective solution for managing the Ct 706 Nt Form and other documents. Our flexible subscription plans allow businesses of all sizes to access powerful eSigning features without breaking the bank. This affordability supports businesses in staying compliant without compromising efficiency.

-

Can I integrate airSlate SignNow with other applications for the Ct 706 Nt Form?

Absolutely! airSlate SignNow offers integrations with popular applications such as Google Drive, Dropbox, and various CRM systems. This facilitates seamless document management for your Ct 706 Nt Form by allowing easy access and sharing across platforms. Integrating these tools can enhance your workflow and improve overall productivity.

-

What are the security features of airSlate SignNow when handling the Ct 706 Nt Form?

airSlate SignNow prioritizes security with advanced encryption protocols to protect sensitive information in the Ct 706 Nt Form. Our platform also includes features such as password protection and audit trails to ensure that your documents remain secure throughout the signing process. This commitment to security gives users peace of mind while handling important tax forms.

-

How do I get started with airSlate SignNow for the Ct 706 Nt Form?

Getting started with airSlate SignNow is simple! You can sign up for a free trial to explore our platform and its features tailored for the Ct 706 Nt Form. Once registered, you can easily upload your document, customize it as needed, and start sending it for eSignature.

Get more for Ct 706 Nt Form

- Atto notorio pdf 322419722 form

- Night work permit for construction site form

- Plumbing inspection report pdf form

- Tsp 1 form fillable

- Patient prescriber agreement form

- Baptism certificate african methodist episcopal church baptism certificate african methodist episcopal church form

- Business tax missouri department of revenue mo gov form

- Pa 8879 form

Find out other Ct 706 Nt Form

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template