Ct 1040es Form 2020

What is the Ct 1040es Form

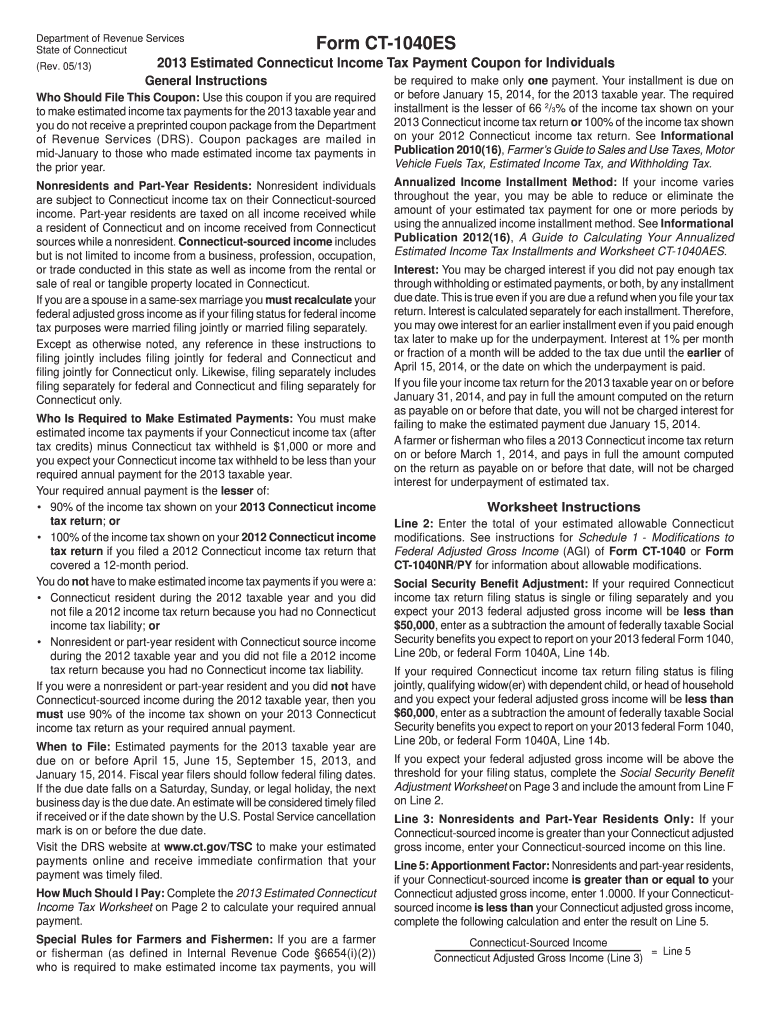

The Ct 1040es Form is a tax document used by individuals and businesses in Connecticut to make estimated income tax payments. It is essential for those who expect to owe tax of $1,000 or more when filing their annual return. This form allows taxpayers to pay their estimated taxes in four quarterly installments, helping to avoid penalties for underpayment. Understanding the purpose and function of the Ct 1040es Form is crucial for effective tax planning and compliance.

How to use the Ct 1040es Form

Using the Ct 1040es Form involves several steps to ensure accurate completion and timely submission. Taxpayers should first calculate their estimated tax liability based on expected income, deductions, and credits for the year. Once the estimated amount is determined, the taxpayer can fill out the form with personal information and the calculated payment amounts for each quarter. It is important to submit the form and payment by the due dates to avoid penalties.

Steps to complete the Ct 1040es Form

Completing the Ct 1040es Form requires careful attention to detail. Here are the key steps:

- Gather necessary financial documents, including previous tax returns and income statements.

- Calculate your estimated annual income and tax liability.

- Fill out the form with your personal information, including your name, address, and Social Security number.

- Enter the estimated tax amounts for each of the four quarters.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

Timely filing of the Ct 1040es Form is crucial to avoid penalties. The deadlines for submitting estimated tax payments typically fall on the fifteenth day of April, June, September, and January of the following year. It is important to mark these dates on your calendar to ensure compliance and avoid interest charges on unpaid taxes.

Legal use of the Ct 1040es Form

The Ct 1040es Form is legally recognized for the purpose of making estimated tax payments in Connecticut. To ensure its validity, taxpayers must adhere to state tax laws and regulations regarding estimated payments. Proper use of the form can help avoid legal issues related to tax compliance and potential penalties for underpayment.

Who Issues the Form

The Ct 1040es Form is issued by the Connecticut Department of Revenue Services. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. By following the guidelines provided by the Department, individuals can ensure they are using the form correctly and fulfilling their tax obligations.

Quick guide on how to complete ct 1040es 2013 form

Complete Ct 1040es Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers a superb environmentally friendly substitute for traditional printed and signed paperwork, as you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources you need to generate, alter, and eSign your documents swiftly without delays. Manage Ct 1040es Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to modify and eSign Ct 1040es Form with ease

- Obtain Ct 1040es Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Alter and eSign Ct 1040es Form and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 1040es 2013 form

Create this form in 5 minutes!

How to create an eSignature for the ct 1040es 2013 form

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the Ct 1040es Form?

The Ct 1040es Form is a payment voucher used by taxpayers in Connecticut to make estimated income tax payments. It allows individuals and businesses to remit taxes that are expected to be owed for the year. Utilizing tools like airSlate SignNow can simplify the eSigning process for this form.

-

How can I complete a Ct 1040es Form using airSlate SignNow?

To complete a Ct 1040es Form with airSlate SignNow, simply upload your document and utilize our intuitive editing features. You can add necessary signature fields, fill in your payment details, and securely send it to be signed electronically. This streamlines the entire tax payment process.

-

Is there a fee associated with using airSlate SignNow for the Ct 1040es Form?

airSlate SignNow offers a cost-effective solution for eSigning documents, including the Ct 1040es Form. While there may be subscription costs, many find that the value it provides in terms of efficiency and savings on paper and mailing makes it worth the investment.

-

What features does airSlate SignNow offer for handling the Ct 1040es Form?

airSlate SignNow includes features such as document templates, custom fields, and real-time status tracking. These tools are designed to enhance the completion and submission experience for the Ct 1040es Form. You can also access audit trails and reminders to stay on top of your payments.

-

Can I integrate airSlate SignNow with other platforms for the Ct 1040es Form?

Yes, airSlate SignNow offers robust integrations with various platforms, such as Google Drive and Dropbox. This allows users to easily access and manage the Ct 1040es Form alongside their existing workflows, making it an ideal choice for busy professionals.

-

What are the benefits of using airSlate SignNow for the Ct 1040es Form?

Using airSlate SignNow for the Ct 1040es Form offers benefits such as quick document turnaround times, enhanced security features, and the ability to track document status. By streamlining the eSignature process, you can focus more on your business and less on paperwork.

-

Is it safe to sign the Ct 1040es Form electronically?

Yes, signing the Ct 1040es Form electronically through airSlate SignNow is completely safe. We utilize advanced encryption methods and comply with legal standards to ensure your information remains secure. This allows you to eSign with confidence.

Get more for Ct 1040es Form

Find out other Ct 1040es Form

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free