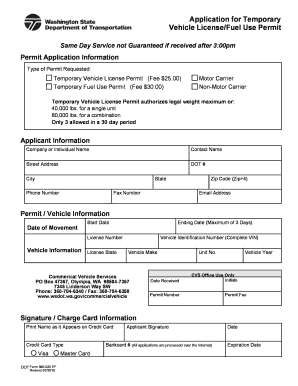

Dot Form 560 025 2010

What is the Dot Form 560 025

The dot form 560 025 is a specific document used primarily for tax purposes in the United States. It serves as a crucial form for individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). Understanding its purpose and requirements is essential for compliance with U.S. tax laws. This form may be required for various situations, including income reporting, deductions, and credits.

How to use the Dot Form 560 025

Using the dot form 560 025 involves several steps to ensure accurate completion. First, gather all necessary financial documents that pertain to the reporting period. This may include income statements, receipts for deductions, and any relevant tax documents. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. Finally, review the form for any errors before submission. Proper usage helps in avoiding delays or penalties from the IRS.

Steps to complete the Dot Form 560 025

Completing the dot form 560 025 requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents.

- Fill out personal identification information at the top of the form.

- Enter income details accurately, including wages, dividends, and other earnings.

- List any deductions you are eligible for, providing necessary documentation.

- Review all entries for accuracy before signing the form.

- Submit the completed form by the required deadline.

Legal use of the Dot Form 560 025

The legal use of the dot form 560 025 is defined by IRS regulations. It must be filled out accurately and submitted on time to avoid any legal repercussions. The form is legally binding, meaning that any false information can lead to penalties, including fines or audits. It is essential to ensure compliance with all IRS guidelines when using this form to maintain legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the dot form 560 025 are crucial for compliance. Typically, the form must be submitted by April 15 of the tax year, although extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, as these can vary based on specific tax situations or IRS announcements. Missing the deadline can result in penalties and interest on any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

The dot form 560 025 can be submitted through various methods, providing flexibility for users. Options include:

- Online Submission: Many users prefer to submit the form electronically through IRS-approved platforms.

- Mail: The form can be printed and mailed to the appropriate IRS address, ensuring that it is postmarked by the deadline.

- In-Person: Some individuals may choose to deliver the form in person at local IRS offices, although this method is less common.

Quick guide on how to complete dot form 560 025

Complete Dot Form 560 025 effortlessly on any gadget

Web-based document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly and without delays. Administer Dot Form 560 025 on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign Dot Form 560 025 with ease

- Locate Dot Form 560 025 and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to apply your changes.

- Choose your method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Dot Form 560 025 and maintain exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dot form 560 025

Create this form in 5 minutes!

How to create an eSignature for the dot form 560 025

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dot form 560 025?

The dot form 560 025 is a specific document used for reporting and managing certain regulatory requirements. Understanding this form is crucial for businesses that need to comply with related laws. With airSlate SignNow, you can easily eSign this form and streamline your documentation process.

-

How do I complete the dot form 560 025 using airSlate SignNow?

Completing the dot form 560 025 with airSlate SignNow is simple. You can upload the form, fill out the required fields, and add eSignatures securely. The platform guides you through the completion process to ensure you don't miss any important information.

-

Is airSlate SignNow cost-effective for handling dot form 560 025?

Yes, airSlate SignNow offers cost-effective solutions for managing documents like the dot form 560 025. Our pricing plans cater to various business sizes, ensuring you get the best value. Plus, the ease of use reduces the time spent on document handling, which further saves costs.

-

What features does airSlate SignNow offer for the dot form 560 025?

airSlate SignNow provides several features for handling the dot form 560 025, including eSignature capabilities, document tracking, and templates. These features help you manage your forms efficiently and ensure compliance. Additionally, you can integrate other apps for a seamless workflow.

-

Can I integrate airSlate SignNow with other software for the dot form 560 025?

Absolutely! airSlate SignNow supports numerous integrations with popular software, enhancing your ability to manage the dot form 560 025. Whether it's CRM systems or cloud storage, integration facilitates easy access and streamlined document flow.

-

What are the benefits of using airSlate SignNow for the dot form 560 025?

Using airSlate SignNow for the dot form 560 025 brings multiple benefits, including improved efficiency and faster turnaround times. The electronic signature feature ensures that documents are signed promptly, reducing delays. This solution also enhances security, keeping your sensitive information safe.

-

Is there customer support available for issues related to the dot form 560 025?

Yes, airSlate SignNow offers robust customer support to assist you with any issues related to the dot form 560 025. Whether you need help with document preparation or technical assistance, our team is ready to guide you through the process. Support is available via multiple channels to ensure quick resolution.

Get more for Dot Form 560 025

- Use voiceover with buttons checkboxes and more on mac form

- 2021 form il 1040login pages finder login faqcom

- How to use iphone keyboard like a mouse by holding cnbc form

- Quarterly report adjustment uitr 3 561179107 form

- Taxcoloradogovsales use tax formssales ampamp use taxforms ampamp instructions department of revenue

- Part year and nonresidentdepartment of revenue taxation form

- Colorado form dr 0145 power of attorney taxformfinder

- Colorado form dr 0204 estimated tax taxformfinder

Find out other Dot Form 560 025

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement